A ‘Good Business’ Decision Framework

Systematic management approach is necessary in both bad times and in good

The current economic downturn has focused managerial attention on and fostered a spate of articles about how to manage effectively in difficult economic circumstances. A recent and particularly good -- possibly iconic -- example of advice about managing in a downturn is provided by David Rhodes and Daniel Stelter in a recent Harvard Business Review article. Their approach is positive, comprehensive and considers both the immediate exigencies and future potential. Their key recommendations include immediately focusing on:

• Monitoring and maximizing cash

• Optimizing financial structure

• Reducing cost and increasing efficiency

• Aggressively managing the top line

• Rethinking product mix and pricing strategies

• Shedding unproductive assets and divesting non-core businesses.

Reviewing these recommendations reveals three fundamental truths:

1. Each of these recommendations applies equally well in good times and in bad. The only difference may be that in bad times, managers facing the prospect of ruin bring a renewed intensity and focus to these basic and essential business practices.

2. There is no magic bullet or single answer to effecting a turnaround or improving declining business performance. A comprehensive, systemic approach is necessary to improve subpar business performance. This truth has been known, though often overlooked, for a long time.

3. It is important to pay attention to both immediate operational concerns and enduring strategic issues.

So, if the same focused but systematic management approach is necessary in both bad times and in good, what role does ethics or ‘good business’ have to play? The answer, I believe, is that ‘good business’ criteria are the key to identifying and prioritizing the actions to be taken. These criteria also serve as the basis of a framework for ensuring systematic comprehensiveness and strategic consistency in the actions being taken, and they are especially valuable in the context of a downturn.

The question remains, how do managers identify priorities and also ensure systematic, comprehensive and synergistic decisions and actions?

Rhodes and Stelter offer clues in their article. The “snags of implementation” they identify include:

• Failure to see how individual initiatives are part of a comprehensive plan; and

• Lack of attention to the human element.

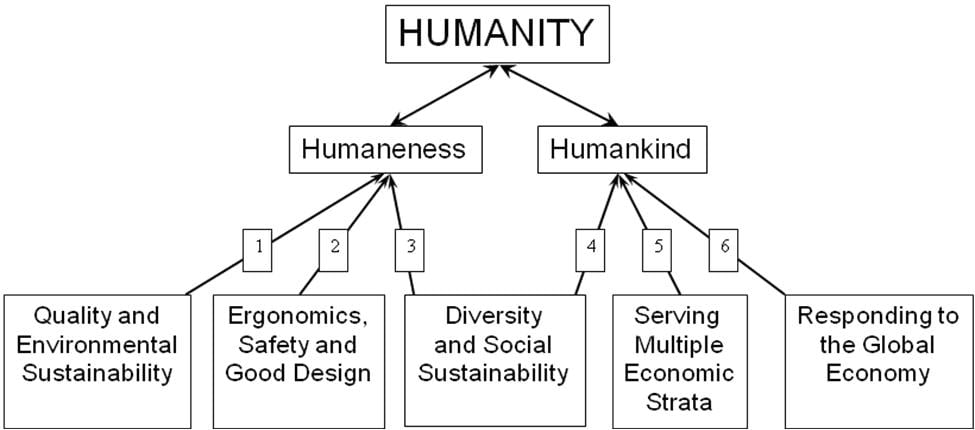

By using the ‘human element’ as a guiding principle, I will present a framework that promotes the development of both comprehensiveness and consistency of managerial decisions.

There are three bases and motivations for the framework for ethical or ‘good business’ decision making in a downturn that is being proposed here:

1. The dysfunctionality of accounting profits for managerial decision making in crises or when innovating strategy.

2. The short- and long-term economic and strategic advantages of ‘humaneness’ in managerial decision making.

3. The imperative of recognizing ‘humankind’ in innovating strategy.

I will examine each in turn.

1. The Dysfunctionality of Accounting Profits

The dysfunctionality of accounting profits as a basis for guiding managerial decision making is quite evident, but is largely ignored. The use of accounting profits for decision making can be likened to searching for a lost object at a street corner because of the street lamp being located there, rather than searching for the object in the nearby dark alley where it was lost. Some of the fundamental failings of accounting profits are: