From India's ONDC bet to the diminishing wealth of UHNIs, here are our most-read stories of the week

Wolves of Dalal Street, Spinny as the dark horse of the used-car market, Sunny Leone at Cannes Film Festival are some of the stories that piqued the interest of our readers this week

Image: Shutterstock

Image: Shutterstock

1) India's next big bet

1) India's next big bet

The ecommerce sector may have got a much-needed boom thanks to the pandemic, but not a lot is spoken about its meagre penetration at five to seven percent. India may be on the e-bandwagon, but Bharat is still not reaping the benefits of digital platforms. Open Network for Digital Commerce or ONDC is looking to bring in that 93 to 95 percent of the country that has never purchased anything online. T Koshy, CEO of ONDC, says that they are going after the undigitised population and aim to improve the ecommerce penetration to 25 percent in the next two years. This is not a new claim. Ecommerce giants Amazon, Walmart-owned Flipkart have invested billions, ploughed through the nation to bring more people into the fold. Then what is ONDC doing differently? Will this change consumers as UPI did? Let's find out. Read more

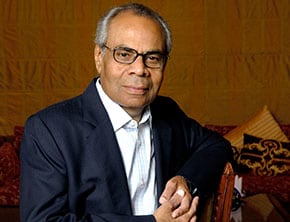

2) Sharks of the Indian bourses

2) Sharks of the Indian bourses

Portfolios of ultra-high net worth individuals (UHNI) in India have, in the past, weathered steep inflation, a long unwinding cycle of interest rates, abrupt geo-political factors wrecking capital markets and a global financial crisis with an anticipated recession. They remained persistent even when unprecedented changes and behavioural bias forced investors to pivot last year. Forbes India's analysis of these super-rich investors shows that some masters of the game remained on the field even when overall markets were barrelling downwards. If we look at the combined portfolio of these wolves of Dalal Street, they appear to have combined holdings of more than Rs250 crore as on March 2023. From Radhakishan Damani of Avenue Supermart to Kamla Vachani of Dixon Technologies, here are some of the big sharks of the Indian stock markets. Read more

3) Dark horse

3) Dark horse

2) Sunny Leone at Cannes 2023

2) Sunny Leone at Cannes 2023 3) Why do airlines fail?

3) Why do airlines fail? 4) Money matters

4) Money matters