Is it time for markets to settle down?

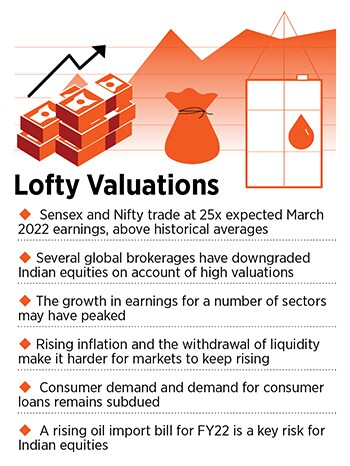

A sharp run up over the last 18 months may have priced in too much; Indian indices have been trading at far above historical valuations, with the Sensex and Nifty commanding a 24x multiple based on expected March 2022 earnings

Indian indices trading at far above historical valuations, with the Sensex and Nifty commanding a 24x multiple based on expected March 2022 earnings

Indian indices trading at far above historical valuations, with the Sensex and Nifty commanding a 24x multiple based on expected March 2022 earnings

Image: Chaitanya Dinesh Surpur

A sharp run up over the last 18 months may have priced in too much When Indian markets registered their first bounceback post the March 2020 dip, investors voiced a fair amount of caution. After all, Covid-19 cases were still climbing, business activity was low and balance sheets, both corporate and personal, had been broken.

But, as the rally matured, those voices were consistently proven wrong. Globally, there was $25 trillion of new money sloshing around and some of it found its way to the Indian market. The result: More and more participants being sucked in at ever increasing valuations.

The net result has been Indian indices trading at far above historical valuations, with the Sensex and Nifty commanding a 24x multiple based on expected March 2022 earnings. Over the last three months, global brokerages, with JP Morgan being the latest, have downgraded Indian stocks primarily based on the lofty valuations they trade at. A recent sell-off in the mid and small cap indices suggests that it may finally become time to get more cautious.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

In November, the

In November, the