The debt trap for Indian businesses

Before the 2008 downturn, several Indian companies leveraged their balance sheets to aggressively pursue growth. For some, the move turned out to be a double-edged sword

The noun ‘leverage’ refers to the action of a lever, a bar that rests on a pivot at one point and is used to move an object at a second point by a force applied at a third. With capital structure, debt is the bar used to move returns on equity (RoE) upwards. As long as the rate of return on capital is higher than the post-tax cost of debt, RoE will be superior compared to an unleveraged business.

The trouble begins in a sustained downturn: When toplines stagnate, margins decline, cash flows dry up, and yet, debt has to be serviced, RoE slides precipitously. This makes financial leverage a double-edged sword.

After the 2008 financial crisis, some Indian businesses that had heavily leveraged their balance sheets to pursue acquisitions and brownfield/greenfield projects suffered a decline. As creditworthiness slipped, the cost of funding, too, went up in some cases.

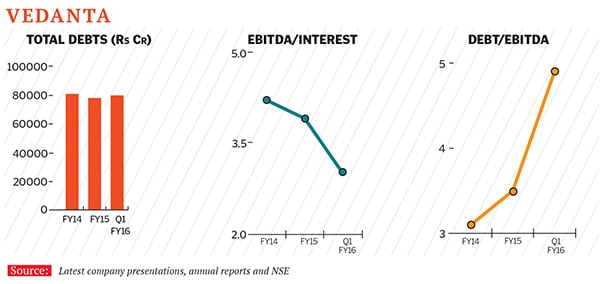

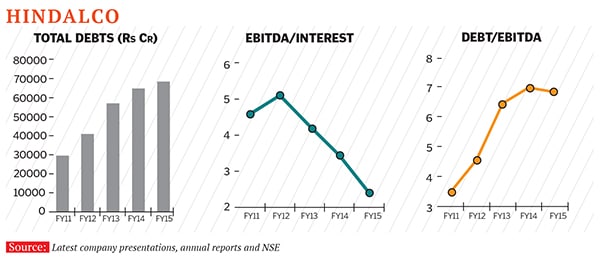

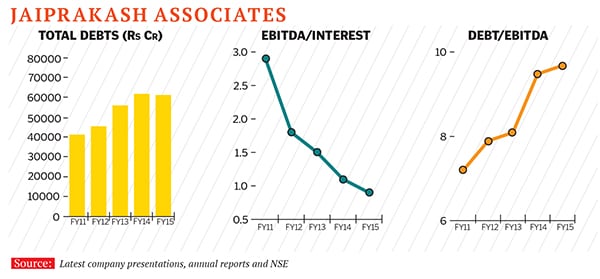

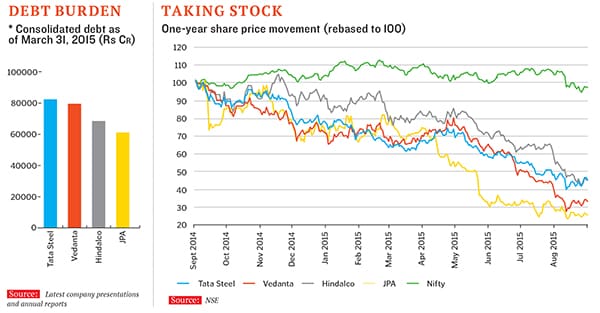

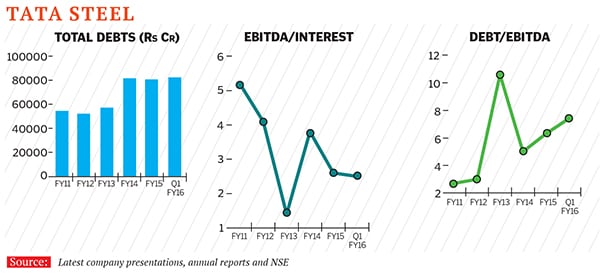

We take a look at some of the most indebted listed companies, profiled on the size of their debt, above Rs 50,000 crore as of March 31, 2015, and a steady decline in debt serviceability. Banks have been left out from the list as debt, for them, is raised in the normal course of business and assumes a different context than corporate debt; so have been PSUs since aspects such as subsidy burdens, government guarantees and social obligations come into play.

Tata Steel

Most of Tata Steel’s debt pertains to the $12.9 billion leveraged buyout of Anglo-Dutch steelmaker Corus in 2007; $6.1 billion of debt was raised in Corus’s books while a large portion of Tata Steel’s equity contribution was paid for by using foreign currency debt raised in its Indian books. Corus has required ongoing funding support since acquisition.

The foreign currency debt has continued to swell due to inadequate returns on the Corus investment as well as adverse exchange rates. In FY15 alone, increase in the value of borrowings due to rupee depreciation amounted to Rs 933 crore (Rs 828 crore in FY14).