Are buy now pay later offers worth it?

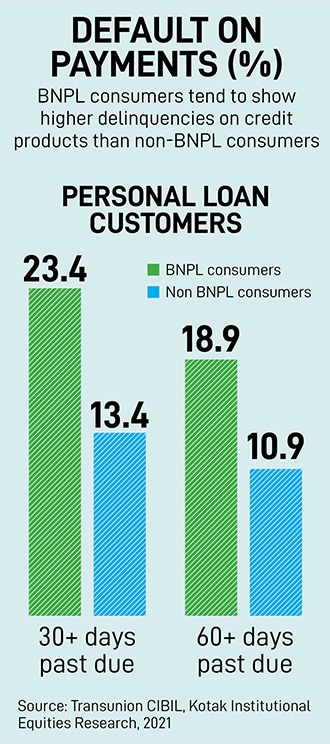

They are tempting and often result in impulsive purchases beyond budgets. Experts say BNPL and buy now travel later options are double-edged swords that can impact credit score and lead people into a debt trap

On the face of it, BNPL is an attractive financial model. A short-term financing option that lets consumers buy at a point and pay in deferred repayment tenure, including the option of EMIs after the end of an interest-free period.

Imaging: Chaitanya Dinesh Surpur

On the face of it, BNPL is an attractive financial model. A short-term financing option that lets consumers buy at a point and pay in deferred repayment tenure, including the option of EMIs after the end of an interest-free period.

Imaging: Chaitanya Dinesh Surpur

For Shreya Sharma, 20, a college student in Mumbai, being able to make online purchases without paying that moment has been an interesting leverage. “Many a time, especially by the end of a month, I’d run out of liquid money… it is then that I bank on platforms like LazyPay and Simpl the most,” says Sharma, naming two of the widely-used buy now pay later (BNPL) platforms in India.

When the first few times Sharma chose the BNPL feature—offered by most online B2C aggregators today—she was able to repay in time. The confidence of purchasing first and paying later made Sharma opt for BNPL services for almost every alternative online transactions. “Initially I had a smooth experience because I used to pay back on time, which increased the limit of my spending offered by LazyPay, my most-actively-used platform. My credit limit went from 1,500 to 10,000,” she says, adding that she considered this equivalent to earning. “When my credit limit increased, it felt like I was being rewarded for paying back on time.”

Once using the pay-later option became a habit, Sharma started running into problems. “I made a purchase of around Rs5,000 and missed paying back in 15 days, which is generally the specified time by most BNPL players. The amount I had to pay back ballooned to somewhere around Rs6,200,” she says. This took a hit on her credit score. “From being offered Rs10,000 to spend, my credit limit dropped down to Rs1,500,” she says.

“That’s when I thought of reducing my dependence on paying later as an option until iPhone 14 was launched and LazyPay offered easy loans up to Rs5 lakh,” says Sharma, who took a loan of Rs1.5 lakh to buy the gadget is now repaying through EMI. “In retrospect, I feel it was an impulse decision… a major chunk of my monthly spend goes into repaying the loan which further brings down my buying capacity.”

This put Sharma in a vicious cycle of depending on pay later platforms for immediate requirements. “I still bank on BNPL platforms and my expenditure now is much more than what I would have been spending otherwise,” she says.

_20220316022208_102x77.jpg)

LazyPay witnessed a 400 percent growth in the last two years, with 296 merchant partners choosing it as a payment alternative, the company claimed in August. The other major BNPL brands in India include Amazon Pay Later, Simpl, ZestMoney and Flipkart Pay Later. Launched in April 2020, Amazon Pay Later has over 3.7 million registered users, driven by a faster customer sign-up process, and its wider use cases for goods purchases and utility payments, Amazon said in a statement. BNPL transactions on ZestMoney surged by 300 percent in 2021 compared to 2020, according to the platform's 'The India Buy Now, Pay Later Report 2021'. Most of ZestMoney's customers median was in the 23 to 26 years group, the report said.

LazyPay witnessed a 400 percent growth in the last two years, with 296 merchant partners choosing it as a payment alternative, the company claimed in August. The other major BNPL brands in India include Amazon Pay Later, Simpl, ZestMoney and Flipkart Pay Later. Launched in April 2020, Amazon Pay Later has over 3.7 million registered users, driven by a faster customer sign-up process, and its wider use cases for goods purchases and utility payments, Amazon said in a statement. BNPL transactions on ZestMoney surged by 300 percent in 2021 compared to 2020, according to the platform's 'The India Buy Now, Pay Later Report 2021'. Most of ZestMoney's customers median was in the 23 to 26 years group, the report said.