Asia: Looking the US recession in the eye?

The US Federal Reserve is widely expected to hike rates by 75 to 100 basis points next week after the most telling indicator of a US recession—the inverted yield curve—is now blinking red. But economies like India and China, driven by domestic demand, might be able to weather the storm

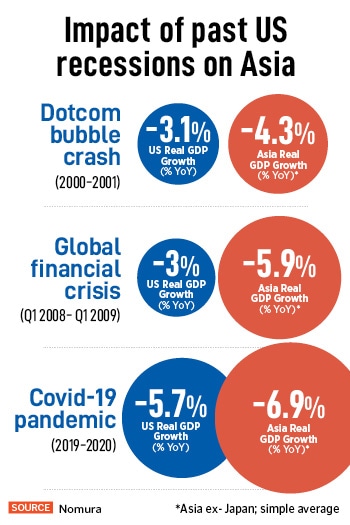

Illustartion: Chaitanaya Dinesh Surpur In the past recessions, Asian economies contracted much more than the US economy. However, in the current situation, emerging economies are estimated to contract by 1.5 percent as against the US economy’s 2.8 percent

In the past recessions, Asian economies contracted much more than the US economy. However, in the current situation, emerging economies are estimated to contract by 1.5 percent as against the US economy’s 2.8 percent

When the US sneezes, the world catches a cold. So goes the saying. There has been chatter about a slowdown in the world’s largest economy. But now the most telling indicator of an economic recession in the US—the inverted yield curve—is blinking red. The inversion of the bond market’s yield curve has foretold past US recessions: The dotcom bubble crash in 2000 and the global financial crisis that began in December 2007. This has amplified growth concerns across emerging economies.

US: Battling record inflation

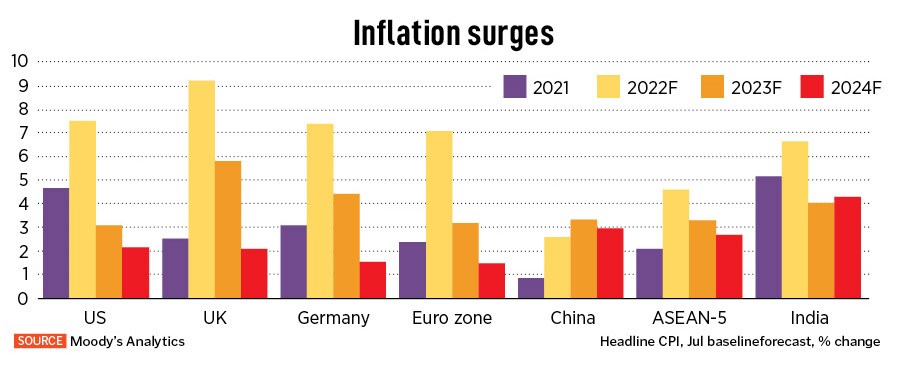

US Inflation raced to a multi-decade high of 9.1 percent last month and the US Federal Reserve is expected to hike rates by 75 to 100 basis points in its meeting next week to rein in rising prices. “Commodity prices are rolling over quickly; they correlate very highly with inflation. Add that to the base effect of a high rate of inflation in the second half of last year. We think inflation can come down quickly but it will settle closer to 3 percent than 2 percent,” says Mark Matthews, head of Asia Research at Julius Baer. Evidently, the inverted or negative yield curve—formed when short-term rates rise above long-term rates—is currently at levels not seen since 2007. Brokerage firm Nomura expects a shallow but long recession of five quarters in the US. “We believe the US will enter a mild recession in the fourth quarter of this calendar year. But unlike previous recessions, household balance sheet conditions are relatively healthy,” says Aurodeep Nandi, VP and India economist, Nomura.

By definition, a recession generally indicates two consecutive quarters of a decline in real GDP. But during 2008 and 2009 the US economy contracted by 4 percent over four quarters and 10.1 percent in the first six months of 2020. So, this definition can’t be taken as a rule of thumb. Moreover, the National Bureau of Economic Research depends on a variety of economic activity indicators to call out a recession in the US.

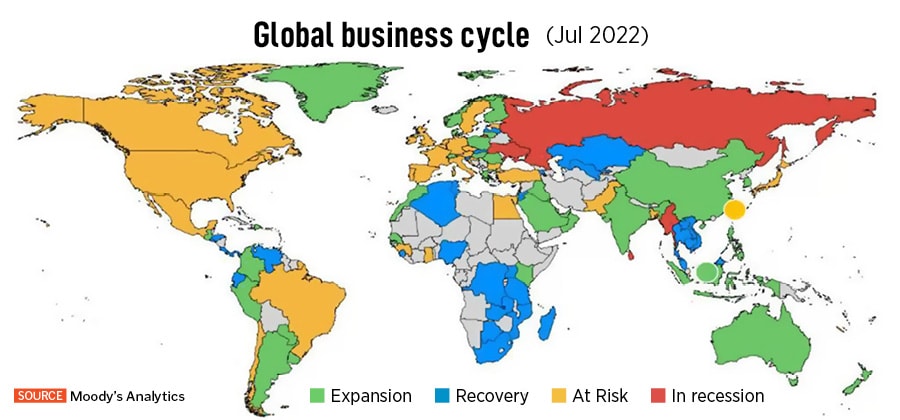

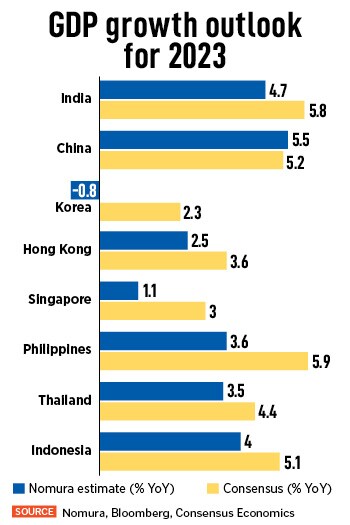

Economists believe countries cannot depend on exports to drive growth. Europe, UK, Japan, South Korea, Australia and Canada are likely to be more impacted than others, and could slip into a recession over the next 12 months. Domestic-demand-driven economies like India, China, Indonesia and the Philippines are expected to be more resilient to the downdraft.

Economists believe countries cannot depend on exports to drive growth. Europe, UK, Japan, South Korea, Australia and Canada are likely to be more impacted than others, and could slip into a recession over the next 12 months. Domestic-demand-driven economies like India, China, Indonesia and the Philippines are expected to be more resilient to the downdraft.