- Home

- UpFront

- Take One: Big story of the day

- Bitcoin gets a massive shot in the arm, thanks to Elon Musk and Tesla. What's next?

Bitcoin gets a massive shot in the arm, thanks to Elon Musk and Tesla. What's next?

Tesla's $1.5 billion investment in the cryptocurrency will encourage more corporates to take a gamble with it. Experts say India needs to join the party before it's too late

Manu Balachandran is a writer for Forbes India, based in Bengaluru. At Forbes India, Manu writes on automobiles, aviation, pharmaceuticals, banking, infrastructure, economy and long profiles among many others. He also moderates many of Forbes India's CEO and CXO events and hosts Capital Ideas, a podcast on the most riveting success stories from the business world. He has previously worked with Quartz, The Economic Times and Business Standard in Mumbai and New Delhi. Manu has a master's degree in journalism from Cardiff University and a degree in economics from the Loyola College. When not chasing stories, he is most likely obsessing over Formula 1 (Read: Lewis Hamilton), historical events and people, or planning long weekend drives from Bengaluru

Image: Shutterstock

Image: Shutterstock

For long, it had only remained the talk of the town.

Of course, there were those who jumped the bandwagon and invested in them, making millions over the past few years. Yet, for many others, bitcoins and cryptocurrencies have remained something of an enigma. Even as prices of bitcoin prices surged to record highs, lack of a central agency and government regulations meant that the digital currency remained somewhat undesirable to many.

Related stories

All that might change this year. On February 8, Tesla, the world's most valuable automaker, said the company has invested $1.5 billion in bitcoins — something that sent the prices of bitcoin up by as much as 15 percent to rise above $44,000. Tesla’s CEO Elon Musk, who was once believed to be the man who invented bitcoins, has been rooting for digital currencies to become mainstream for a while.

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximise returns on our cash that is not required to maintain adequate operating liquidity,” Tesla said in a statement on February 8. “As part of the policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.5 billion in bitcoin under this policy.”

The automaker, whose valuation far exceeds the combined valuation of the nine largest car companies globally, is also planning to accept bitcoin as a form of payment for its products in the near future.

“Tesla’s purchase of bitcoins is approximately 0.2 percent of the market capitalisation of bitcoins,” says Sumit Gupta, chief executive officer and co-founder at CoinDCX, a Mumbai-based cryptocurrency exchange. “Tesla’s investment, particularly when it comes from Musk, gives confidence to many in investing in this new asset class. While bitcoins may not be used for trading immediately, they offer an investment opportunity.”

Essentially, bitcoins are digital tokens that are not backed by any physical instruments. They can be sent electronically from one user to another. As of February 9, the market capitalisation of bitcoins stands at $873 billion. Unlike traditional banking and payment systems, the bitcoin network isn’t carried out by a single company or a central authority.

The system is run by a decentralised network of computers around the world, keeping track of every transaction to avoid double-spending. The records of all bitcoin transactions are stored using blockchain technology, a shared public ledger where all the confirmed transactions are included. The integrity and the chronological order of the blockchain are enforced with cryptography.

“Tesla's purchase of bitcoins appears to be primarily an investment,” says Param Vir Singh, Carnegie Bosch professor of business technologies and marketing at the Carnegie Mellon University. “The objective of Tesla is to diversity and maximise returns on its cash as Tesla revealed in its statement to the Securities and Exchange Commission. This investment does legitimise cryptocurrencies and bitcoin, in particular, as a store of value.”

Tesla is among the few companies across the world that have added bitcoin to their treasury, after Square, the payments company led by Twitter CEO Jack Dorsey and software firm MicroStrategy Inc. “Tesla has de-risked the acquisition of bitcoin by public companies and accelerated the digital transformation of corporate balance sheets,” Michael Saylor, chairman and CEO of MicroStrategy, said on Twitter. “Treasurers are now thinking about how to convert a non-performing asset into the best performing asset.”

While Tesla’s move is likely to see more corporates take a gamble with bitcoins and other cryptocurrencies, companies, including Microsoft, AT&T, Burger King, Rakuten and BMW, have already begun to accept bitcoin as a payment tool. “Last year, PayPal, the largest payment company by market cap in the world, allowed users to buy, hold and sell cryptocurrency directly from their PayPal account.

“The impact of the purchase by Tesla is not the important legitimising factor… it is the effective endorsement by Elon Musk,” says James R Barth, the Lowder Eminent Scholar in Finance at Auburn University, a senior fellow at the Milken Institute and a fellow at the Wharton Financial Institution Center. “He has taken substantial risks in growing PayPal, Tesla, SpaceX and SolarCity into successful companies. He has taken risks in new business endeavours and has been very successful. This may suggest to others that once again he is onto another successful venture.”

The Big Opportunity

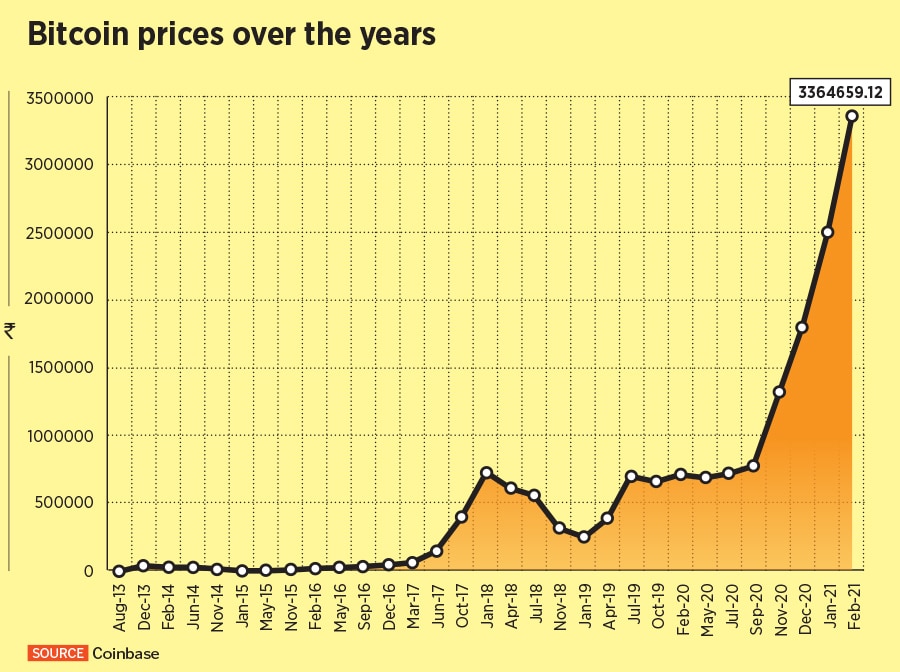

Tesla’s decision to invest in bitcoins comes at a time when the prices of bitcoin have surged to record levels. Between February 2020 and February 2021, they have surged over 380 percent—from Rs 725,009 to Rs 34 lakh, according to Coinbase, a digital currency exchange headquartered in San Francisco.

“I think Tesla's move opens it up for every company to hold bitcoin,” Balaji Srinivasan, former CTO of Coinbase and general partner at Andreessen Horowitz tells Forbes India. “And, eventually, every country.”

“I think Tesla's move opens it up for every company to hold bitcoin,” Balaji Srinivasan, former CTO of Coinbase and general partner at Andreessen Horowitz tells Forbes India. “And, eventually, every country.”

Since it was introduced in 2008, the cryptocurrency has seen several highs and lows, making it a largely volatile currency. Yet, it is over the past year that bitcoin’s popularity saw a massive uptick largely as a result of the pandemic-infused economic slowdown and market volatility.

“Some countries like China are introducing central bank digital currencies that can be used as a substitute for physical currencies,” adds Barth. “However, these are not substitutes for cryptocurrencies like bitcoin. An advantage of bitcoin to most other means of payment is that transactions are anonymous. Furthermore, unlike government-issued money, the total supply of bitcoins is limited to 21 million, which is expected to be reached in 2140. This means bitcoins can serve as an inflation hedge when too much government-issued money is injected into an economy.”

That should be reason enough for corporates to jump the bandwagon. In an early-February interview on Clubhouse, the audio chat app, Elon Musk said he had turned into a bitcoin supporter and was already “late to the party”.

“Cryptocurrencies like bitcoin will continue to be a store of value,” says Singh of Carnegie Mellon University. “With Tesla's purchase of bitcoin, I expect a lot more people will feel comfortable investing in bitcoin.” That’s something Monark Modi, founder and CEO of Bitex, a UAE-based cryptocurrency exchange, agrees with.

“Tesla is the most recent example of mainstreaming of cryptocurrencies,” says Modi. “The industry has also seen strong endorsements coming from the likes of PayPal and JP MorganChase, each of which has added significant momentum to the adoption of cryptocurrencies in general and bitcoin in particular. In fact, even governments across the globe working on framing regulations is seen as a positive move in the industry.”

Then there are also impending talks about Visa planning to help banks roll out bitcoin and cryptocurrency buying and trading services with a Visa crypto software program, which may launch later this year. “The pending adoption ofbitcoin by the Visa credit card network is the real watershed moment, if it occurs, as seems likely,” David Yermack, Albert Fingerhut Professor of Finance and Business Transformation at New York University Stern School of Businesstells Forbes India. “If a consumer can use the Visa credit card, which is accepted almost everywhere, to pay for things indirectly using BTC, then it would greatly expand the consumer footprint of cryptocurrency.”

Yet, slow transaction speeds, high transaction fees for low-value transactions, and the high volatility in prices could act as a dampener in cryptocurrencies emerging as a tool for daily use. “Even if Starbucks were to accept bitcoin as a payment, most people would not use bitcoin for their coffee simply because they will have to wait almost an hour to be certain that the transaction was verified and made it to the main chain,” adds Singh of Carnegie Mellon.

Over the years, bitcoin’s growing popularity had led to the creation of many more alternatives that offer greater speed or anonymity. Among these are ethereum, dogecoin and namecoin. “Large value transaction can be done at low transaction costs via bitcoin,” says Singh. “In that way, Tesla allowing for transactions appears to be a good idea. However, the volatility of bitcoin prices makes it not an ideal currency for transactions.”

From January to February 2018, the price of bitcoin fell by over 65 percent, in what many had considered a bubble burst. By November 2018, the total market capitalisation for bitcoin fell below $100 billion for the first time, with the price of bitcoin falling below $4,000.

“I would point to the recent American experience with GameStop,” says John C Coffee, Jr, the Adolf A Berle Professor of Law at Columbia Law School and director of the Center on Corporate Governance at Columbia University Law School. “What goes up quickly can come down even more quickly. Although Musk's support will clearly be an adrenaline shot for bitcoin (and PayPal's adoption is even more important), this kind of support by celebrities can produce a bubble, and it has happened to cryptocurrencies before.”

But that shouldn’t keep corporates from holding cryptocurrencies on their balance sheet. “Bitcoin brings breakthrough innovations including triple-entry accounting, which eliminates third parties and reduces costs and corruption,” says Vikram Rangala, chief marketing officer at ZebPay. “Its built-in scarcity makes it inflation-proof. And transactions on the blockchain are visible to everyone, bringing unprecedented transparency and accountability. Those are real and valuable technologies that anybody should be investing in, whether it's a company, individual or even a reserve bank.”

Then, there is also the worry about the government’s interference in cryptocurrencies, particularly since they could be used towards tax evasions and illegal activities. Last year, the Mexican government had said that cryptocurrency was being used by drug lords and human traffickers to launder money. India too had conducted surveys on brokers of bitcoin amid suspicion of tax evasion.

“There are some concerns about potentially nefarious uses of cryptocurrencies due to the transactional anonymity offered by many cryptocurrencies,” explains Abhishek Jain, an assistant professor at John Hopkins University. “The recent events will not help subside such concerns. But, the potential for constructive uses—especially if you look at the underlying technology of blockchains—is significant. Blockchains provide censorship-resistance, a remarkable property.” In 2019, India too had conducted surveys on brokers of bitcoin amid suspicion of tax evasion.

“There are three basic characteristics of money—a unit of account, a means of payment and a store of value,” says Barth. “As of now, cryptocurrencies do not possess all three characteristics. Not all goods and services are priced in terms of a cryptocurrency… cryptocurrencies are not universally accepted as a means of payment, and the substantial swings in the prices of cryptocurrencies do not render them stores of value.”

The India Conundrum

Despite the growing acceptance of cryptocurrencies globally, India remains rather averse to their use.

“While developed countries across the world are embracing the opportunity in cryptocurrencies, India is moving in the opposite direction,” adds Gupta of CoinDCX. “India has over seven million users who are in some way exposed to the asset class. We don’t have taxation guidelines or exchange guidelines which makes it uncomfortable for people to invest in.”

In 2018, the Reserve Bank of India had directed that entities regulated by it shouldn’t deal in virtual currencies or provide services for facilitating any entity in dealing with them. That rule was overturned by the Supreme Court in 2020.

“The current environment of uncertainty in India owing to the consideration of a bill on cryptocurrency has created some nervous moments for investors and industry players alike,” adds Modi of Bitex. “Cryptocurrency exchanges have been voicing the need for a positive regulation for a long time now since the lack of it is the biggest challenge that needs to be addressed.”

Now, the government is looking to introduce a law to ban private cryptocurrencies such as bitcoin in the country and provide a framework for the creation of an official digital currency during the Budget session of Parliament. The new bill seeks to “prohibit all private cryptocurrencies in India”, but allow “for certain exceptions to promote the underlying technology [blockchain] of cryptocurrency and its uses”.

“I cannot understand the attitude of the government of India,” adds Yermack. “Crypto assets are becoming important not only in payments, but also in corporate finance and risk management. India has a comparative advantage in technology and software engineering, and this should be an area of strength for the country. By suppressing crypto, the government is creating the possibility of a huge opportunity cost. I think this is being done to protect the weak banking sector and protect the banks from consumer outflows, as has already happened in China due to the success of mobile payments technology there.”

Already, countries such as Ecuador, China, Singapore, Venezuela Tunisia and Senegal have issued their own cryptocurrencies, while others like Estonia, Japan, Palestine, Russia and Sweden are considering plans to launch their own digital assets.

“Governments and regulators, specifically in emerging markets, would prefer to exercise greater control over currency demand-supply for effective implementation of both, fiscal and monetary policy,” says Vikram Pandya, director of the fintech programme at the SP Jain School of Global Management. “The proposed ‘Cryptocurrency and Regulation Of Official Digital Currency Bill, 2021’ is a step towards creating an official Central Bank Digital Currency and banning private cryptocurrencies. However, it is better to regulate them instead of banning them because banning them completely may result in India having a shadow economy for crypto.”

A blanket ban is only likely to put India’s companies and the ecosystem at a disadvantage in the coming years. “Regulators should take a more progressive stand towards cryptocurrencies and create a framework that enables that,” says Pranav Sharma, co-founder and managing partner at Woodstock Fund, a multi-asset investment fund. “But any delay will take Asia time towards wealth creation.”

Perhaps, like Musk, it’s time for India to join the party too.