Budget 2024: Electronics manufacturing seeks incentives to build a robust component ecosystem

For India to be globally competitive, it needs to localise components, strengthen design capabilities through R&D investments, and forge strategic partnerships with global technology leaders

Production has nearly doubled from $48 billion in FY17 to $101 billion in FY23—driven primarily by mobile phones, which constitutes 43 percent of total electronics production; Image: Shutterstock

Production has nearly doubled from $48 billion in FY17 to $101 billion in FY23—driven primarily by mobile phones, which constitutes 43 percent of total electronics production; Image: Shutterstock

India’s share of electronics in merchandise exports has surged to 6.6 percent in FY24, up from 2.7 percent in FY19, according to the Economic Survey 2023-24. This significant increase highlights the country’s growing role in the global electronics market.

The survey stated that there is a focus on smartphone manufacturing and assembly, and the production linked incentive (PLI) scheme, including tax breaks and subsidies, plays a significant role in attracting companies. “The rise in India's domestic smartphone demand is also a key factor in companies' decisions to invest there. For instance, Apple assembled $14 billion worth of iPhones in India during FY24, constituting 14% of its global iPhone production,” the survey said.

India should aim to touch $500 billion in electronics manufacturing, in terms of value, by FY30, stated a recent report by the NITI Aayog. The size of the sector in FY23 was at $155 billion. Production has nearly doubled from $48 billion in FY17 to $101 billion in FY23—driven primarily by mobile phones, which constitutes 43 percent of total electronics production. The report further stated that India is now manufacturing almost 99 percent domestically, reducing reliance on smartphone imports significantly.

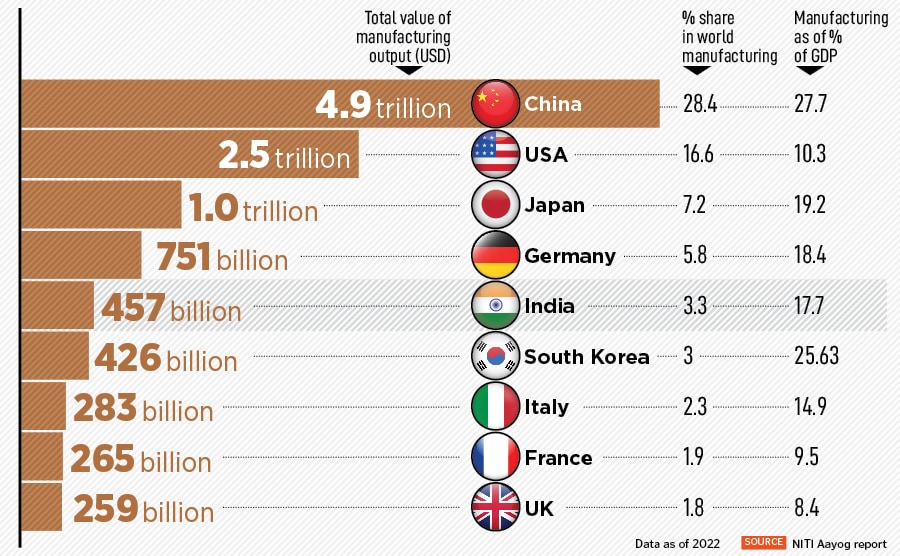

Globally, the electronics manufacturing market is valued at $4.3 trillion, dominated primarily by countries like China, Taiwan, USA, South Korea, Vietnam and Malaysia. Currently, India exports approximately $25 billion annually, representing less than one percent of the global share despite the four percent share in global demand.

“Leading electronics manufacturers expect policies [from Budget 2024] that will increase domestic production and exports, enhance R&D capacity, and encourage innovation to produce globally competitive products from India,” says Kathir Thandavarayan, partner, consulting, Deloitte India. Increased focus on the electronics value chain, especially critical components such as semiconductors that are completely import dependent, is the key to driving domestic manufacturing, enhancing exports and sustaining sector growth.