What does the Modi 3.0 government need to do to scale India's electronics manufacturing industry?

Experts anticipate a greater thrust on creating a component ecosystem and enabling a skilled workforce to further scale the industry

Workers on the assembly line at electronics manufacturing services company Dixon Technologies’ Noida facility; Image: Madhu Kapparath

Workers on the assembly line at electronics manufacturing services company Dixon Technologies’ Noida facility; Image: Madhu Kapparath

In his speech at the BJP headquarters in New Delhi after the general election results on Tuesday, Prime Minister Narendra Modi said India is the second-largest mobile manufacturing country, and the focus will now be on electronics and semiconductors. The last 10 years of the Modi-led government have focussed on improving the electronics manufacturing ecosystem, particularly via the Production Linked Incentive (PLI) scheme. “The last 10 years have ensured Indian companies revitalise themselves; the prime minister’s call for ‘Aatmanirbharta’ has been met with much appreciation together with on-the-ground action,” says Ajai Chowdhry, co-founder, HCL; founder & chairman, EPIC Foundation, and chairman-Mission Governing Board, National Quantum Mission.

Now as Modi is set for his third term as prime minister, will the new coalition dynamics slow down what has been going on in the electronics manufacturing industry for the past 10 years? Experts don’t think so. In fact, they expect the newly formed government to double down on investments in this sector and turn India into an electronics manufacturing powerhouse over the next decade. This will mainly be driven by increasing domestic demand and improving export competitiveness. Domestic production has nearly doubled from $41 billion in FY17 to $81 billion in FY22, and is expected to further increase at a CAGR of 24 percent between FY22 and FY27, as per an EY report.

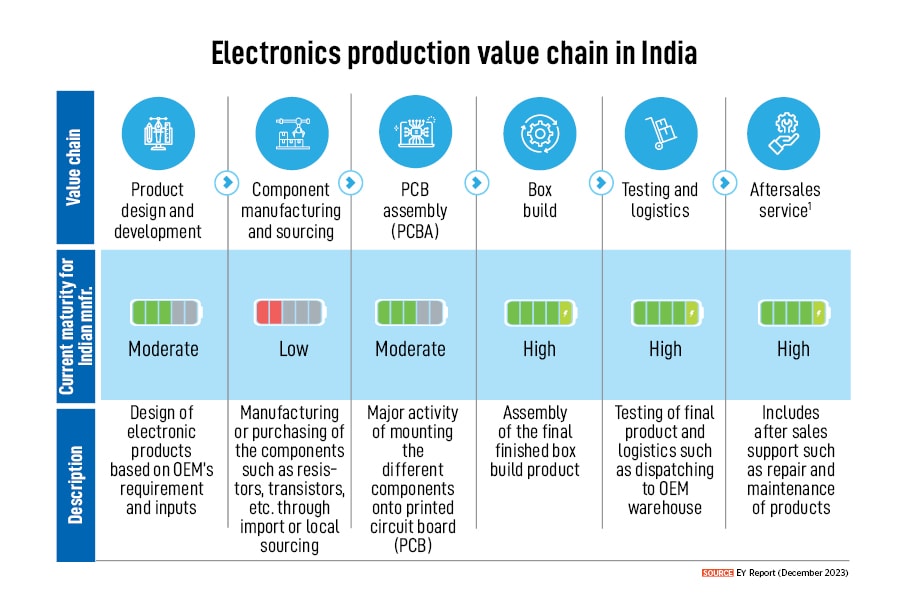

Yet, there are various key drivers that the new government will need to address in the electronics production value chain.

Component Manufacturing

India imports electronic components from China (62 percent), Vietnam (2 percent), South Korea (10 percent), Japan (2 percent) and other Southeast Asian countries, resulting in increased lead time and costs, as per an EY report from December 2023. Of the total components, India can only source 12 to 13 percent of the components locally, in terms of value. Whereas countries like China can source close to 50 to 55 percent locally, and Vietnam, about 30 percent, as per Counterpoint Research.