Can Popeyes take on KFC in India?

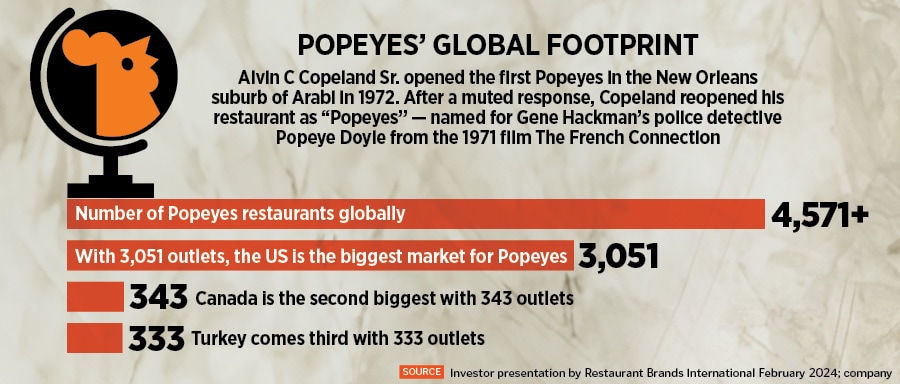

Last October, Popeyes overtook KFC to become the second-biggest chicken chain in the US. Back home in India, the fried chicken upstart has aggressively ramped its footprint over the last two quarters. Can it challenge the might of Colonel Sanders in India?

Gaurav Pande, Executive Vice President, Jubilant Foodworks Ltd and Business head, Popeyes India.

Image: Madhu Kapparath

Gaurav Pande, Executive Vice President, Jubilant Foodworks Ltd and Business head, Popeyes India.

Image: Madhu Kapparath

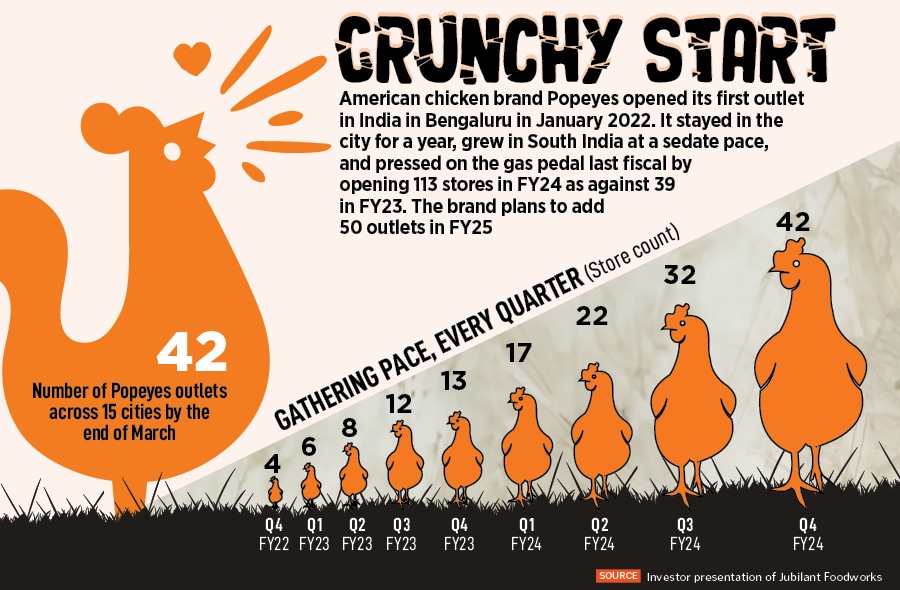

Gaurav Pande starts the ‘crunchy’ conversation by underlining an elementary rule: Don’t count your chickens before they are hatched. Interestingly, the executive vice president and business head of Popeyes India counted his chickens for 12 months before deciding to step out of Bengaluru. Launched by Domino’s Jubilant FoodWorks—the master franchise of Domino’s and Dunkin in India—in January 2022, the Louisiana fried chicken brand remained confined in the QSR capital of India for over a year and then moved into Chennai in February 2023.

Sixteen months later, the second-biggest chicken chain in the US has galloped to 42 outlets across 15 cities. “It takes time to win consumer experience,” reckons Pande, who shares a not-so-secret formula behind the crunchiness of the Louisiana chicken brand. “We marinate chicken for 12 hours,” he claims. Chicken, Pande lets on, is marinated in Cajun seasoning, hand-battered, and breaded for the perfect shatter crunch. “We offer antibiotic-free chicken and fresh chicken,” he claims. “The chicken is marinated for 12 long hours,” he reiterates.

Twelve months is what it took for Popeyes to step out of its first city. The sedate innings, however, has gathered pace over the last three quarters, and the brand plans to open 50 more stores in FY25. Interestingly, the medium-term target for store expansion is 250, according to the latest investor presentation by Jubilant FoodWorks. Pande decodes the sense of urgency by explaining why the brand took an inordinate time to expand. “The first year was focussed on perfecting the product,” he says, adding that despite being the second biggest in the US—Popeyes overtook KFC to become the second-biggest fried chicken chain in America last October—the brand was entering a new country.

Twelve months is what it took for Popeyes to step out of its first city. The sedate innings, however, has gathered pace over the last three quarters, and the brand plans to open 50 more stores in FY25. Interestingly, the medium-term target for store expansion is 250, according to the latest investor presentation by Jubilant FoodWorks. Pande decodes the sense of urgency by explaining why the brand took an inordinate time to expand. “The first year was focussed on perfecting the product,” he says, adding that despite being the second biggest in the US—Popeyes overtook KFC to become the second-biggest fried chicken chain in America last October—the brand was entering a new country.

A new country and a new brand needed a fresh approach. Sameer Khetarpal explains the differentiated strategy. “There were broadly four parameters to frame the expansion plan,” says Khetarpal, who joined Jubilant FoodWorks as chief executive officer and managing director in September 2022. The first factor is demand. “We need to find if there is a chicken-eating market in that city,” he underlined in the Q3FY23 earnings call in January. “So, 70 percent of Indians eat chicken. The proportion is larger in the South as compared to the western parts of India. So, we are aware of how big the market is,” he said, alluding to the big opportunity in the fried chicken space. Bengaluru, interestingly, happens to be the biggest market for KFC, Domino’s, and a battery of QSR players, including Popeyes, which has 18 outlets in the city. The second factor for Khetarpal was the store economics. Return on investment (RoI), the payback period, the discipline of finding a store, and the rental negotiations stepped into the picture.