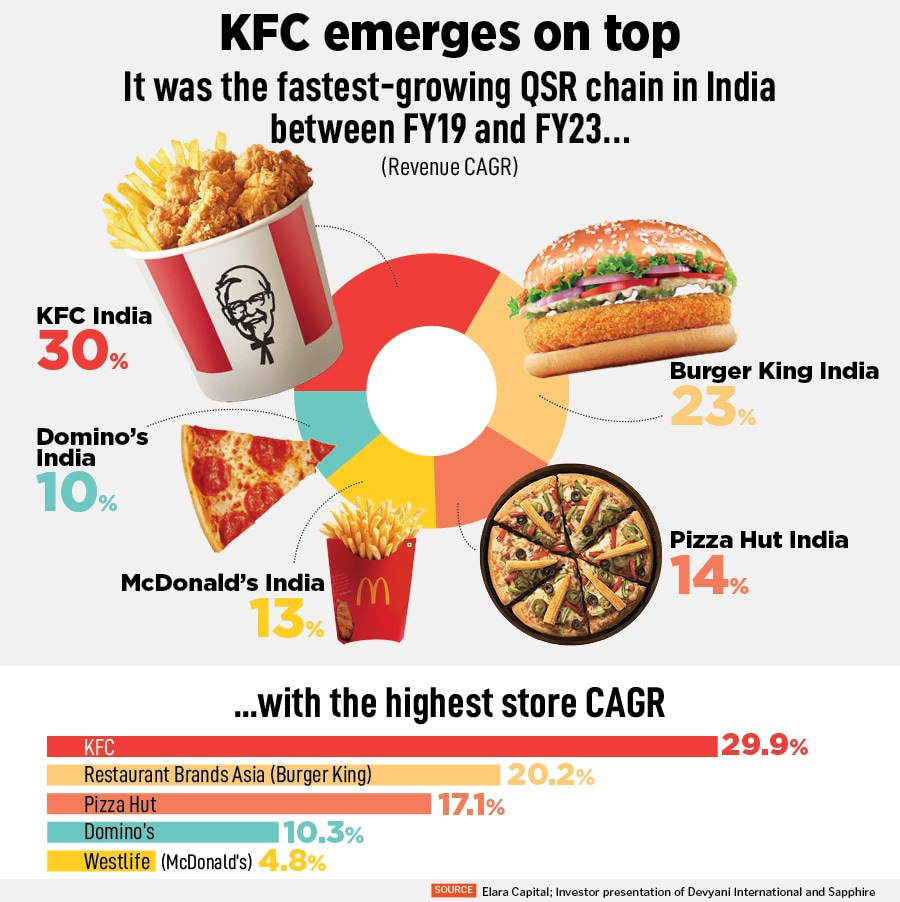

Fried & tested: KFC tops the pecking order

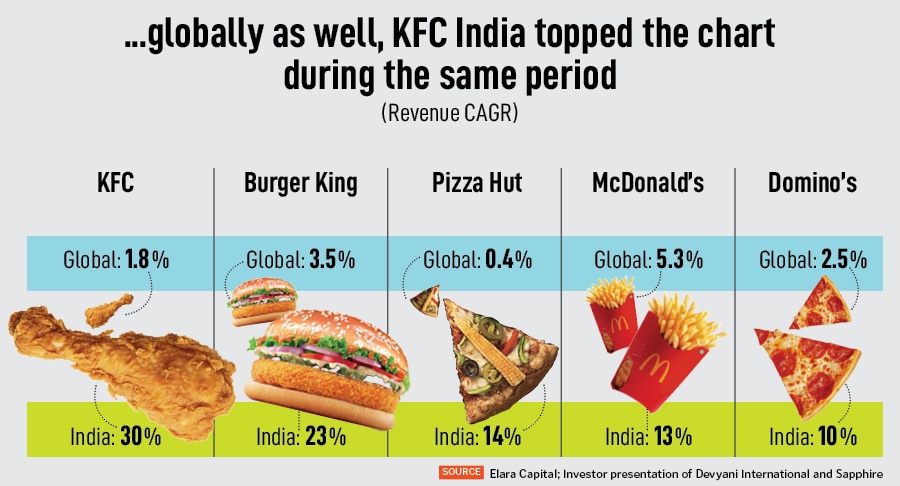

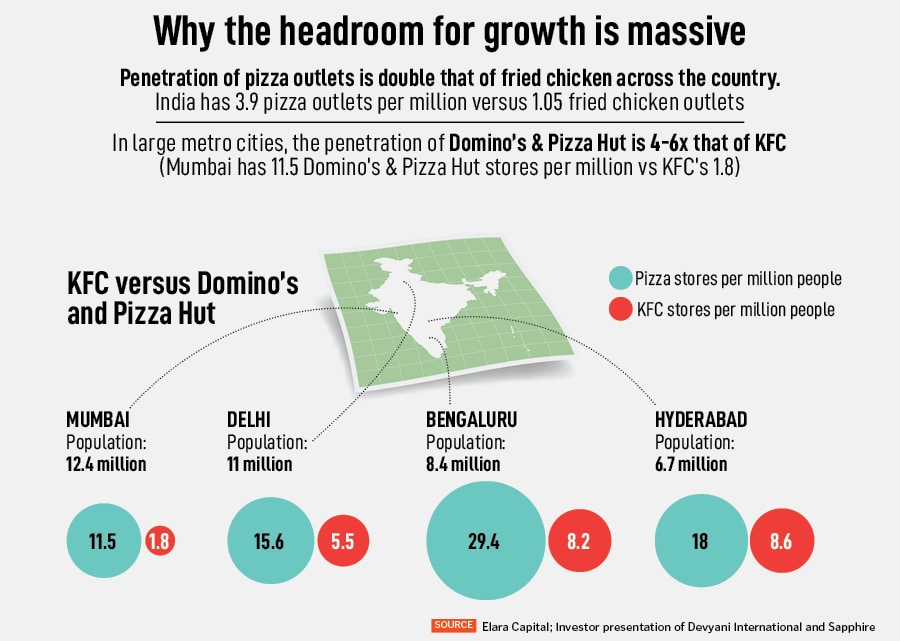

A boom in the fried chicken market post-Covid, the absence of formidable rivals and an insatiable appetite of Indian consumers for meat have unfurled the chicken wings of KFC and put it on the top of the QSR pyramid. Can it continue with its dream run?

KFC Restaurant at Atta market in Noida, Uttar Pradesh, India. Image: Ravi S Sahani/The The India Today Group via Getty Images

KFC Restaurant at Atta market in Noida, Uttar Pradesh, India. Image: Ravi S Sahani/The The India Today Group via Getty Images

New Delhi. It was 2011. Though McDonald’s and KFC were no longer spring chickens, the former topped the pecking order in India and, therefore, earned the bragging and bullying rights. “Even if KFC comes right next to us,” Vikram Bakshi reportedly took a jibe at his rival brand and commented on the purported strategy of KFC to open outlets in proximity to the Golden Arches, “they gain nothing.” “To their Zinger, we've had our Spicy Burger,” the then-managing director of Connaught Plaza Restaurants, which used to run McDonald's franchises in north and east India, continued to flaunt their superiority. “They were worried... they had to call their Zinger Hot Zinger,” he reportedly added.

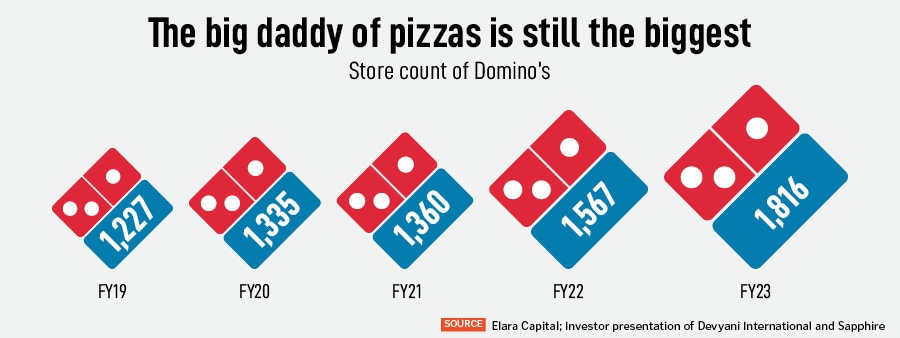

Back in 2011, the world’s biggest burger brand had nothing to worry about. McDonald’s, which started its India innings in 1996, was in the middle of a dream run in India. Over the next one-and-a-half decade, the Golden Arches emerged as the biggest burger brand. KFC, in contrast, had a disastrous debut. Despite being the first foreign QSR chain to storm into the country in 1995, Colonel Sanders was soon forced to exit as it got embroiled in regulatory controversies and violent protests by farmer activists. A few years later, the brand staged a comeback in 1999. Despite playing catch-up for over a decade, which resulted in KFC overtaking Pizza Hut to become the biggest bet of the Yum! Brands—the owner of KFC, Pizza Hut and Taco Bells—in India, it couldn’t topple the burger biggie McDonald’s.

The failure to do so was largely to do with KFC’s depleted armoury. A former senior McDonald’s executive explains what McDonald’s had, and what KFC lacked in India. “I mean the biggest gap was the name itself. McDonald’s stood for an unambiguous burger, but KFC had fried chicken in its name,” says the veteran QSR analyst who worked with McDonald’s for over a decade. Back in the 90s, Indians were developing a taste for two alien QSR products—pizzas and burgers. In burgers, McDonald’s had a clear edge with a long list of India-specific localised products, especially vegetarian items such as McAloo Tikki Burger, panner burger, and, yes, Maharaja Mac, the Indian variant of the Big Mac. “KFC’s bucket list only had fried chicken, which was not a rage back then,” says the industry observer, declining to be named. “We used to taunt them by saying: You will get fried in India,” he recalls, adding that KFC was getting grilled between Domino’s on one side, and McDonald’s on the other.

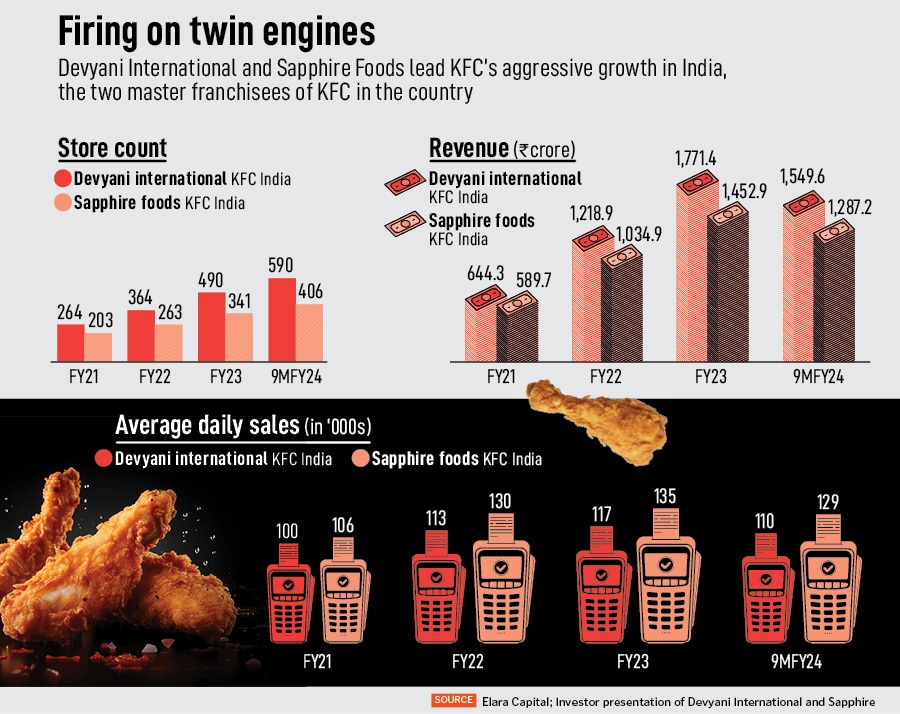

What also hampered KFC’s prospects in India were multiple franchisees running the chicken show. After years of a flawed approach, Yum! Brands started to rejig its India operations from 2014 onwards, decided to settle for well-capitalised players, and towards the fag end of 2015, Sapphire Foods and Ravi Jaipuria-owned Devyani International emerged as the two big franchise partners to drive growth. Both were expected to ace the game of chicken.