The RBI is doing the right stuff: Oliver Prill

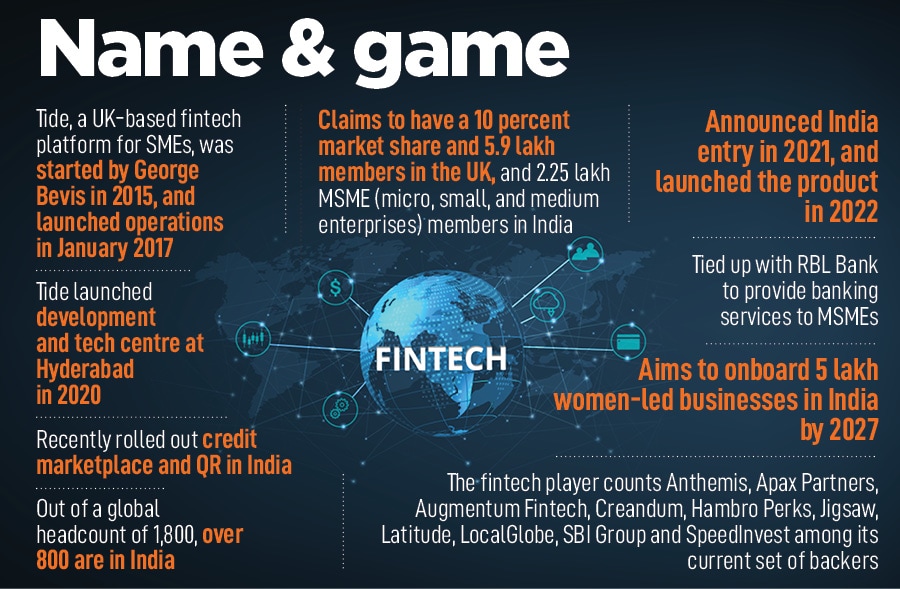

It's rare to spot a fintech honcho who roots for the work done by RBI. It's rare to meet a chief executive officer who brutally admits that a section of old and new players, across the world and in India, didn't play by the book. And it's rare to meet a foreigner who confesses that 'Indian Chinese' is way better than authentic Chinese food. Meet the global CEO of Tide, a UK-based fintech platform for SMEs

Oliver Prill, Global chief executive officer (CEO), Tide

Image: Madhu Kapparath

Oliver Prill, Global chief executive officer (CEO), Tide

Image: Madhu Kapparath

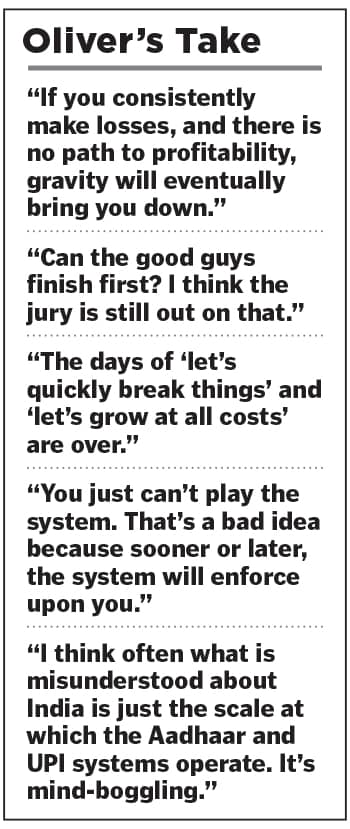

The timing of the comment is fortuitous. “You need to realise that regulators are there for a reason,” underlines Oliver Prill, the global chief executive officer (CEO)of Tide, a UK-based fintech platform for SMEs. A lot of people, reckons the top honcho of the fintech major, don't realise that the risk profile of regulators is asymmetric. “They don’t have an upside. There is only a downside,” says Prill, who was in India early this week to take stock of the operations of his startup, which announced its India launch in 2021, and rolled out operations a year later. “Most of them [regulators] are benevolent,” he underlines.

A little over 24 hours after Prill’s free-wheeling interview with Forbes India came the news that the banking regulator in India, the Reserve Bank of India (RBI), has barred Kotak Mahindra Bank from issuing new credit cards and onboarding new customers via online and mobile channels. The move is set to stoke the fire to a simmering debate on the purported high-handedness of the regulator, which has faced flak for its ‘tough’ action against Paytm Payments Bank, IIFL Finance, Visa and Mastercard earlier this year. A clutch of fintech founders, investors, analysts, industry experts and seasoned banking professionals was quick to denounce the regulator for its ‘harsh’ stand and alleged that the regulator’s overbearing attitude might do more harm than good.

Meanwhile, at Tide India’s office in Gurugram, Prill tells us why the Indian financial regulator must be commended for staying vigilant. “I don't think the whole notion in the press that regulators are trying to stifle growth is correct,” says the CEO, who spent over 20 years in global leadership roles across financial services, including banking and insurance, had worked with regulators across countries, and joined Tide in 2018. “But what about a loud chorus of disapproval of the way the Indian financial markets are regulated?” I try to evoke a blunt reply from the CEO who is known to speak his mind. “Is the Indian financial system highly regulated?” I tried to draw the fintech boss deep into a discussion pivoting around compliance and governance.

Prill stays true to his reputation of calling a spade a spade. Some of the fintech players, including established international players, the CEO reckons, may have thought they could get away with de-facto non-compliance. As a business leader, Prill continues to explain his point, one must realise that there is a democratically elected system that has empowered a regulator with asymmetric risk-return profiles to ensure that a sound financial system of protecting consumers is adhered to. “If you try to play the system, that's a bad idea. It’s bad because sooner or later, the system will enforce upon you,” he underscores, trying to put RBI’s actions in perspective. India had an old financial system that was quite heavily regulated. “And then the fintech world arrived. And not all played by the book,” he says. Consequently, the regulator had to adjust rapidly, and put a good framework around it. “We think that's a good thing,” he says.