Cement's big boys get bigger

The cement business has witnessed rapid consolidation over the past five years. However, the next wave of acquisitions would be slower due to the paucity of assets available and promoters' unwillingness to sell

Ambuja Cements Limited plant owned by Adani Group is seen from a nearby village in Darlaghat, Solan district in the state of Himachal Pradesh, India, February 15, 2023.

Image: Anushree Fadnavis / Reuters

Ambuja Cements Limited plant owned by Adani Group is seen from a nearby village in Darlaghat, Solan district in the state of Himachal Pradesh, India, February 15, 2023.

Image: Anushree Fadnavis / Reuters

A little over a year ago the Adani Group had no cement business. It is now the second largest player.

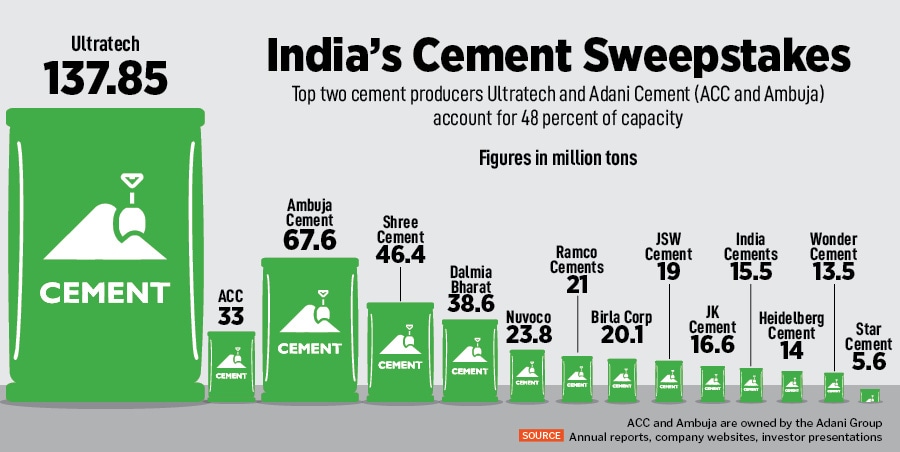

Not to be left behind larger rival Ultratech has set its sights on 200 million tons of capacity, up 45 percent from its present 137 million tons. While Chairman Kumaramangalam Birla didn’t specify a timeframe at the company’s annual general meeting, he said, “The scorching pace of expansion is unprecedented in the sector.” With the business consolidating and the top 4-5 players accounting for over two-thirds of India’s installed capacity of 510 million tons Birla knows he has his task cut out to maintain Ultratech’s lead.

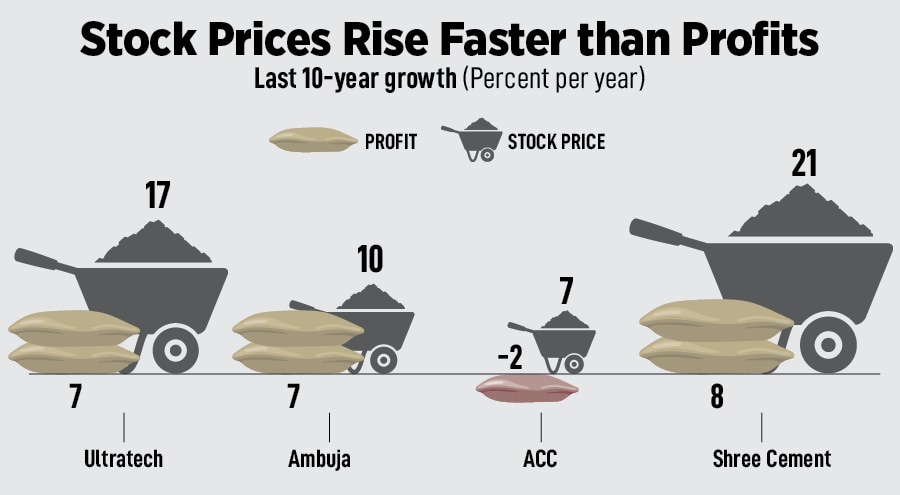

Ultratech’s rapid ascent and stay at the top also provides an insight into why promoters are after expanding the scope of their operations. First, growth is not hard to come by. The business usually grows at 1.2 times nominal GDP growth and over the last decade Ultratech has grown sales by 12 percent a year (this number includes acquisitions). Profitability has grown slower at 7 percent a year.

In the last five years Ultratech has generated Rs 28,468 crore in free cash flow. Shree Cement generated Rs 6,632 crore of free cash flow in the same period and Dalmia Bharat made Rs 4,182 crore. It is this easy conversion of profits into cash that makes the industry such a sought-after one. It is also why promoters of smaller plants (2-10 million tons) are loath to sell. Making money in this business is not that hard.

The last five years the industry has seen an unprecedented wave of mergers and acquisitions where larger players have sold to the top five cement companies. Some, like the sale of the Jaypee and Binani Cements’ assets, have come out of insolvency proceedings while others like the recent sale of Holcim’s India arms or Sanghi Industries to the Adani Group have been simple buyouts. Cement companies contacted by Forbes India declined to comment saying they couldn’t speculate on future developments.

The last five years the industry has seen an unprecedented wave of mergers and acquisitions where larger players have sold to the top five cement companies. Some, like the sale of the Jaypee and Binani Cements’ assets, have come out of insolvency proceedings while others like the recent sale of Holcim’s India arms or Sanghi Industries to the Adani Group have been simple buyouts. Cement companies contacted by Forbes India declined to comment saying they couldn’t speculate on future developments.