Edelweiss Alternatives: Tapping the credit opportunity

While taking the early-mover advantage in private credit, Edelweiss Alternatives, a market leader, has been providing adequate returns in various product lines for investors. Due diligence, governance and a conservative approach to risk taking are its mantras

Venkat Ramaswamy, Co-founder and Vice Chairman, Edelweiss Financial Services.

Image: Bajirao Pawar for Forbes India

Venkat Ramaswamy, Co-founder and Vice Chairman, Edelweiss Financial Services.

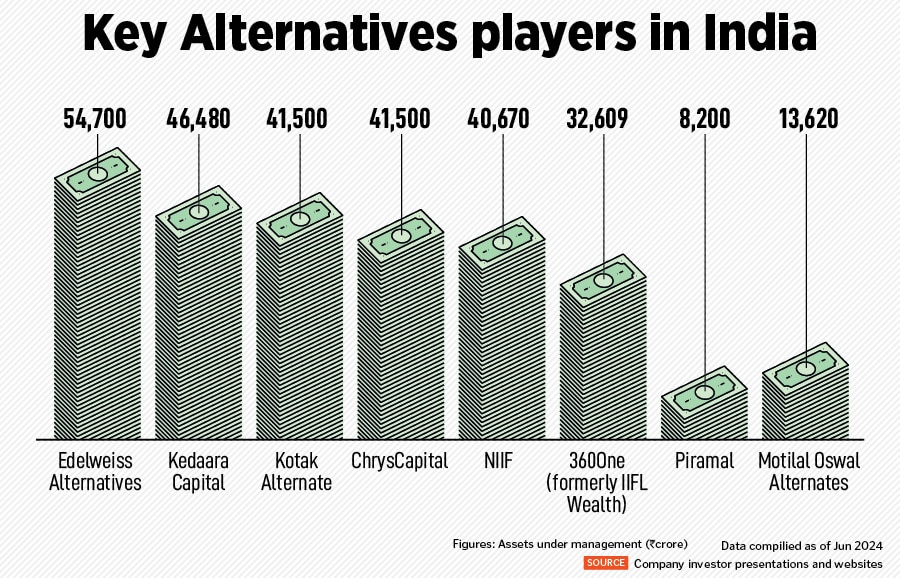

Image: Bajirao Pawar for Forbes IndiaAt a time when some of the Edelweiss group companies had come under scrutiny of the regulator, Edelweiss Alternative Asset Advisors, one of its fastest growing businesses—with assets under management of $6.8 billion (Rs 57,120 crore)—has outpaced growth in retail lending and mutual funds businesses in recent years.

The multi-strategy private alternatives business, headed by Edelweiss group’s vice chairman Venkatchalam Ramaswamy, contributed over 8 percent to the consolidated revenue from operations of Edelweiss’s financial services businesses (excluding insurance premium) in FY24, and has emerged as a powerful varied investment tool for onshore and offshore clients.

There is little opportunity for corporates below AA ratings level to raise debt, publicly, considering that banks are not interested in dealing with them. “We look at the A to BBB, which is an untapped market. We have the expertise even when we go to below A rated companies. We have been buying debt of companies close to liquidation value and sell at replacement value at good return or make outsized returns when we sell at enterprise value,” Ramaswamy says.

Over the past five years, the alternatives business has grown by 35 percent in India, according to PMS bazaar data. Geographically, private capital AUM in North America is at 24 percent while it is just 4 percent in Asia. “The headroom for growth is enormous in Asia,” says Ramaswamy, “for the ultra-rich who are looking to get wealthier beyond the traditional investments.”

Over the past five years, the alternatives business has grown by 35 percent in India, according to PMS bazaar data. Geographically, private capital AUM in North America is at 24 percent while it is just 4 percent in Asia. “The headroom for growth is enormous in Asia,” says Ramaswamy, “for the ultra-rich who are looking to get wealthier beyond the traditional investments.” About a third of the Alternatives’ business AUM is currently from clients in India (and Asia), a third is from North America; the balance from Europe, Middle-East and Africa.

Ramaswamy’s optimism also stems from the fact that corporate sponsors will want to start new companies as well as they need capital for providing exit to private equity investors. Similarly, the growing opportunities for creating new infrastructure is leading to construction companies selling their existing operating assets and the increased interest in global organisations creating GCCs in India is leading to higher demand for quality commercial office assets.

The alternatives space is not too crowded but it has companies which are starting to find their niche strengths. Both Edelweiss Alternative Asset Advisors and Kotak Alternate Asset Managers have a track record in private credit, real assets and building domestic teams (see size chart). Other players such as Kedaara Capital and ChrysCapital have a strong track record in raising private equity.

The early mover advantage

Edelweiss has taken advantage of being one of the early movers in the alternatives space. “A decade ago, we saw huge potential and pioneered the private credit business in India offering flexible financing solutions to clients which were not available with commercial banks, that were increasingly getting focussed on retail lending,” Ramaswamy says.Edelweiss’s real estate vertical—as part of the alternatives business—found a market gap, which it has exploited well. India has a range of corporates who are building assets but few who manage them. Edelweiss owns and operates assets similar to what Brookfield does.

Edelweiss provides structured credit to residential real estate projects within the top six cities in India against collateral of project and receivables. This strategy focuses on providing capital for construction and completion of mid-income and affordable homes. It reflects in the fact that their operational team is 10x the size of the investment team (200 compared to 20). Their strategy focuses on providing capital for construction and completion of mid-income and affordable homes.

“Over the past six years, we have built a portfolio valued at approximately $2.7 billion across highways, energy transition and commercial offices,” says Subahoo Chordia, president and head of real asset funds at Edelweiss Alternatives.

In this period, Edelweiss has developed in-house data analytics tools including high-end central control and monitoring centre, which it believes is the differentiator to peers leading to superior asset management: Reflected in better grid availability, increased generation, and Platinum LEED-certified office refurbishments.

Private credit is one of the fastest growing verticals in Edelweiss Alternatives, which banks and non-banking financial companies (NBFCs) are unable to provide to corporates who need it, while offering the attraction of superior returns.

“Private Credit in 2012 was largely collateral based funding (loan against property (LAP) or loan against securities (LAS) and the market size was closer to $500-600 million per annum of deals. Today across core credit, performing credit, real estate credit and special situations, we see annual deals of $5-7 billion which is more than 10x growth in the market size,” says Amit Agarwal, head and president, private credit at Edelweiss Alternatives.

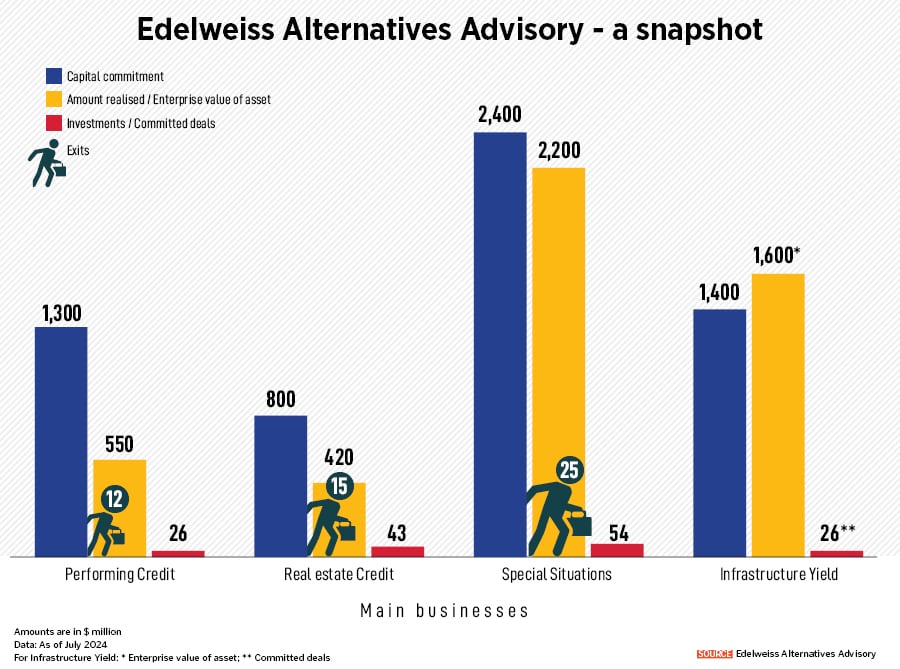

A business which has seen a pick-up in the last decade in a major way is Special Situations, reflected in the fact that Edelweiss Alternatives has made 54 investments, 25 exits and realising $2.2 billion from portfolio companies through three special solution funds in 2011, 2018 and 2022.

Also read: India (and Edelweiss') long-term opportunity is bright, but the short term can be messy

Turning businesses around

Special solutions is a strategy that Edelweiss utilises to invest into asset heavy companies with potential to create value, by helping a turnaround in business and management. “In India, such financing carries heavy covenants and is usually secured lending, thereby have very limited downside risk,” Ramaswamy says.Kolkata-based debt-laden Kesoram Industries—now acquired by Aditya Birla group’s cement giant UltraTech Cement—was, in 2020, struggling to pay back banks the principal amount of loans taken. The pandemic, a year later, only worsened the financials for the BK Birla group firm, whose main businesses were cement, textiles, rayon and chemicals. The company raised around Rs 2,100 crore through a consortium of Edelweiss Alternatives (Special Situations II fund), Goldman Sachs India AIF, a Cerberus Capital managed fund and ECL Finance. The funds helped the company pay back banks through a one-time settlement and infuse working capital. Kesoram has now finalised the plan to pay back the debt to the consortium, which according to Agarwal will mean “reasonably good exit” to its fund.

In another case earlier, Edelweiss Alternatives, along with Goldman Sachs, invested into the debt-impacted BILT Graphic, a subsidiary of Ballarpur Industries, owned by the Avantha Group. They bought debt from the banks and ring-fenced the business, providing them with working capital and did cash flow monitoring. BILT’s debt came down from around Rs 8,000 crore to around Rs 4,500 in FY23. It has led to record Ebitda levels of Rs 1,641 crore in FY23 and margins improving.

Edelweiss Alternatives is strong on sustainability and, in 2023, launched its first $500 million climate fund, which is investing in viable and growing climate mitigation, climate adoption, green and EV infrastructure businesses in themes of decarbonisation, digitisation and circular economy.

New solutions and products

Edelweiss’s focus on the 3Cs—counterparty, collateral and cash flows—has held the fund house in good stead over the last decade. “We believe partnering with right borrowers is key in India, and being a local player here allows us significant edge in market reference checks as well as due diligence of collateral being offered,” say Agarwal. As with other private credit players, Edelweiss Alternatives will be well placed in this space in coming years. “We believe that, as India moves from a $4 trillion to $8 trillion economy, the requirement of credit will be significant and private credit will play an important role in the same,” Agarwal adds.

As with other private credit players, Edelweiss Alternatives will be well placed in this space in coming years. “We believe that, as India moves from a $4 trillion to $8 trillion economy, the requirement of credit will be significant and private credit will play an important role in the same,” Agarwal adds.In the quest to build size and introduce new products, Edelweiss Alternatives is currently missing in the private equity space. “There will be more products here in next 3-5 years. It will depend on perception of opportunity and capability. We have to find our own secret sauce,” Agarwal said.

India, as a country, is however, still a negligible part of allocations of global institutions in alternatives assets.

Ramaswamy has a simple but clear message for his young team, whose average age is just 36. “Take the job—and not yourself seriously. Culturally—and using a cricket analogy—it does not help, especially in credit and real assets investment strategies, for investment folks to only look to bat aggressively, aiming to hit fours and sixes.”

“Clients give us capital with the expectation that we will be conservative in taking risks and always keep an eye on capital preservation. The chance of losing money rises when one takes undue risks (trying to hit a six),” Ramaswamy says.