Fear index shows complacency about risks as markets scale new heights

India is not the only country where the VIX or fear gauge/index has plunged with investors betting on a downside risk as a distant possibility. But are there really no risks with rising inflation, elections and a weak rupee?

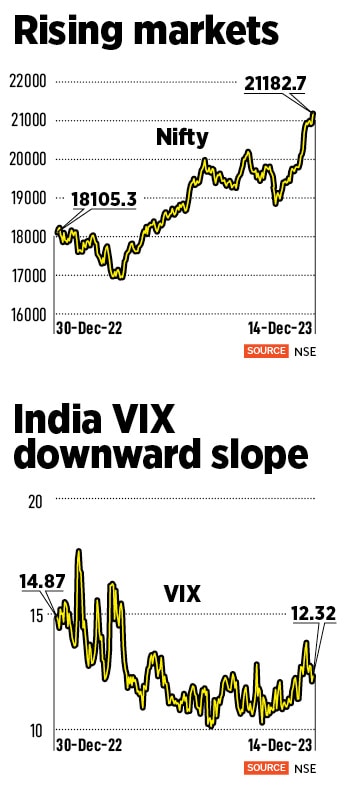

The India volatility index (VIX), often referred to as a fear gauge or fear index, is tumbling, an indication that investors are increasingly betting that a downside risk is a distant possibility.

Image: Shutterstock

The India volatility index (VIX), often referred to as a fear gauge or fear index, is tumbling, an indication that investors are increasingly betting that a downside risk is a distant possibility.

Image: Shutterstock

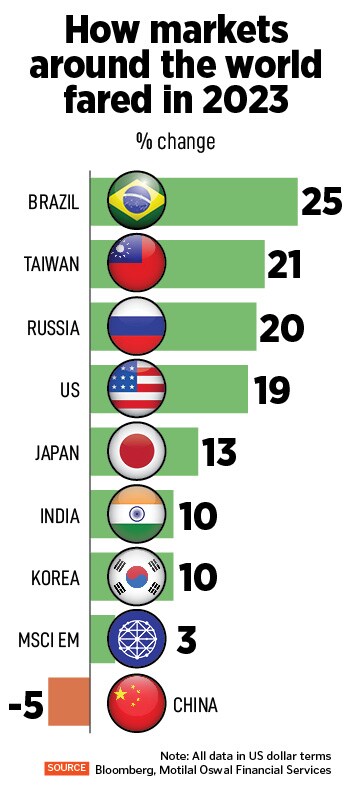

As markets in India continue to spearhead, scaling new record highs, there seems to be a sense of complacency creeping in among investors who are either overconfident or choosing to ignore risks ahead. State election results boosted markets sentiment which was already peaking as investors remained convinced about the end of the US Federal Reserve’s rate hike cycle which triggered strong institutional flows into equities.

The India volatility index (VIX), often referred to as a fear gauge or fear index, is tumbling, an indication that investors are increasingly betting that a downside risk is a distant possibility. The volatility index typically has an inverse correlation with the benchmark index. The India VIX has slipped 17 percent from the beginning of January to 12.32 levels.

“Tumbling VIX should be interpreted as an increase in confidence by the market participants for the equity markets,” Jay Thakkar, head-alternate research, capital market strategy, Sharekhan by BNP Paribas, says. He feels that as of now there are no major domestic risks apart from performance risk.

Thakkar explains that low VIX means market participants are ready to take risks in equity. ““It’s a ‘risk-on’ approach as of now. So, where the VIX is falling it means less uncertainties in near term. A very sharp rise in VIX is considered risk-off mode and small bounces are just due to profit booking,” he adds.,” he adds.

The India VIX, which gauges the anticipated volatility in Nifty over the next 30 days, has been trading considerably low over the last several quarters, ranging between 8 and 14 during the previous few months. With the expectation that there is not much likelihood of any big negative surprises in the markets in the foreseeable future, investors' overall positive and bullish sentiments are reflected in the sharp decline in the India VIX, says Aamar Deo Singh, Senior VP Research, Angel One.