From DTH to streaming, Tata's OTT Play

For the past two years, Tata Sky has been making strategic moves to offer not just a bouquet of TV channels but also streaming services. Now with its aggregator app and a rebranding, it is all set to capture new customers

“We are retailers of content, we buy the content in bulk and we sell it in small packets. The difference in bargain and arbitrage is how we make money. So, basically we are content grocers," says Harit Nagpal, MD and CEO, Tata Play; Image: Nayan Shah for Forbes India

“We are retailers of content, we buy the content in bulk and we sell it in small packets. The difference in bargain and arbitrage is how we make money. So, basically we are content grocers," says Harit Nagpal, MD and CEO, Tata Play; Image: Nayan Shah for Forbes India

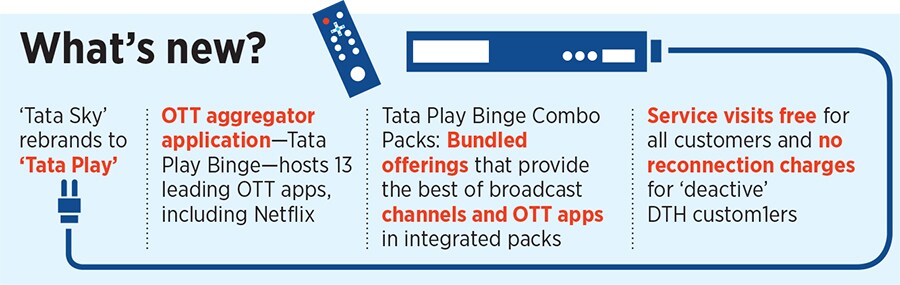

In the last week of January, India’s largest Direct-to-Home (DTH) operator Tata Sky, announced its rebranding to Tata Play, as part of its change in strategy. “Our core has shifted from being only a DTH operator to being a distributor of content,” says Harit Nagpal, MD and CEO, Tata Play.

In addition to being a DTH operator, two years back Tata Sky also launched an Over The Top (OTT) aggregator application, now Tata Play Binge. The application has a unified front end that currently hosts 12 leading OTT applications, plus Amazon Prime Video, and offers the flexibility of single subscription and single payment. They have also added Netflix as an add-on bundled service to its vast bouquet of offerings.

Along with the rebranding, the company also announced ‘Binge Combo Packs’ – it’s the first ever Live TV and OTT packs that offer the best of broadcast channels and OTT applications in integrated pack, thereby removing the headache of maintaining multiple billing cycles for each of the subscriptions. Its broadband business, which was launched in 2015, has also been rebranded to Tata Play Fiber.

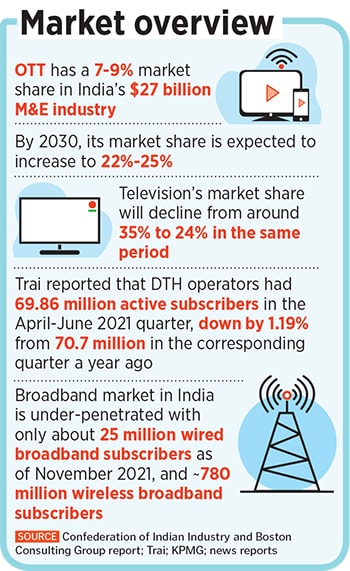

Evidently, this change in strategy means convergence is the way forward. “While TV in India is not going away anytime soon, OTT video is likely to grow by leaps and bounds, with 90 percent of all internet users being video viewers in the next decade,” says Girish Menon, partner and head, media and entertainment, KPMG in India.

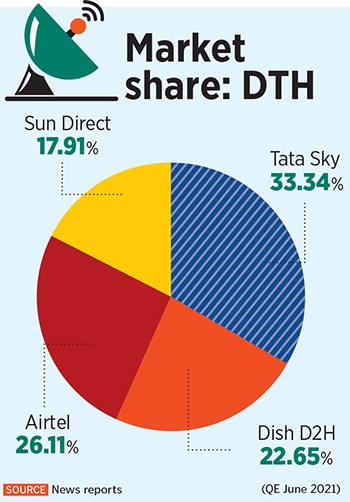

Though there are other players in this space, including Airtel Xtream, Nagpal believes there is enough space for multiple players.

Though there are other players in this space, including Airtel Xtream, Nagpal believes there is enough space for multiple players.

According to experts, the confluence of OTT and broadband is likely to lead to immense opportunities, as large screen consumption of OTT is picking up pace. The broadband market in India has traditionally been under-penetrated with only about 25 million wired broadband subscribers as on November 2021, and ~780 million wireless broadband subscribers, as per KPMG’s estimates.

According to experts, the confluence of OTT and broadband is likely to lead to immense opportunities, as large screen consumption of OTT is picking up pace. The broadband market in India has traditionally been under-penetrated with only about 25 million wired broadband subscribers as on November 2021, and ~780 million wireless broadband subscribers, as per KPMG’s estimates.