Groww took the growth out of Zerodha. But can it really take it on?

The seven-year-old financial services platform usurped the bootstrapped startup to become the largest brokerage in India in terms of the number of active investors. The change in pecking order is significant, but Zerodha is still miles ahead when it comes to revenues

(From left) Neeraj Singh, Harsh Jain, Lalit Keshre, Ishan Bansal, co-founders, Groww.

(From left) Neeraj Singh, Harsh Jain, Lalit Keshre, Ishan Bansal, co-founders, Groww.

Last week, India’s investing community was in for a surprise.

Not because of the turmoil caused by the ongoing Israel-Hamas war, or due to tax demands by the Indian government on certain companies. This time, it was for an entirely different reason. Groww, a seven-year-old financial services platform, usurped Bengaluru-headquartered Zerodha to become the largest brokerage in India in terms of the number of active investors.

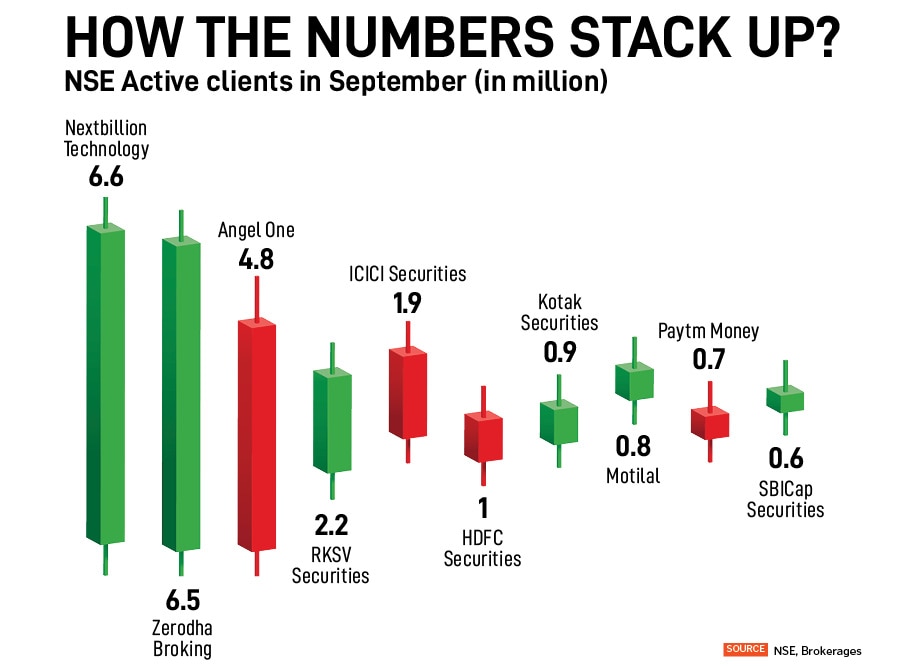

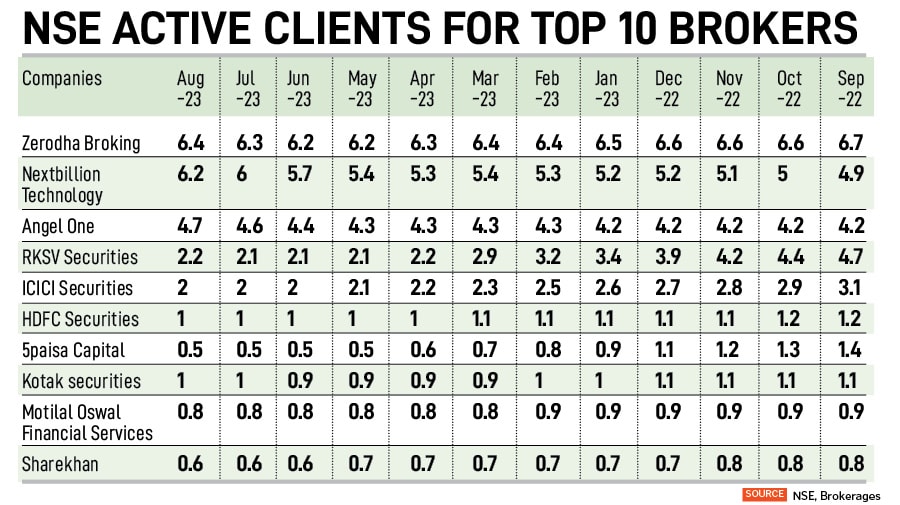

An active investor is someone who performs at least one trade in a year. Zerodha, founded by brothers Nithin and Nikhil Kamath, had long remained India’s poster boy for bootstrapped startups and is credited with revolutionising discount broking in India. At last count, according to data from the NSE, Groww had 6.63 million active investors on its platform, the highest number of users on any stock broking platform in the country. Zerodha had 6.48 million active users as of September.

The change in pecking order is significant, considering how Groww built up its business seven years after Zerodha started operations, and particularly over the past two years. In just a year, Groww’s active user clientele jumped 35 percent from 4.9 million to 6.63 million in September. The Peak XV-backed startup ventured into stock broking in 2020 at a time when Zerodha had already been leading the race.

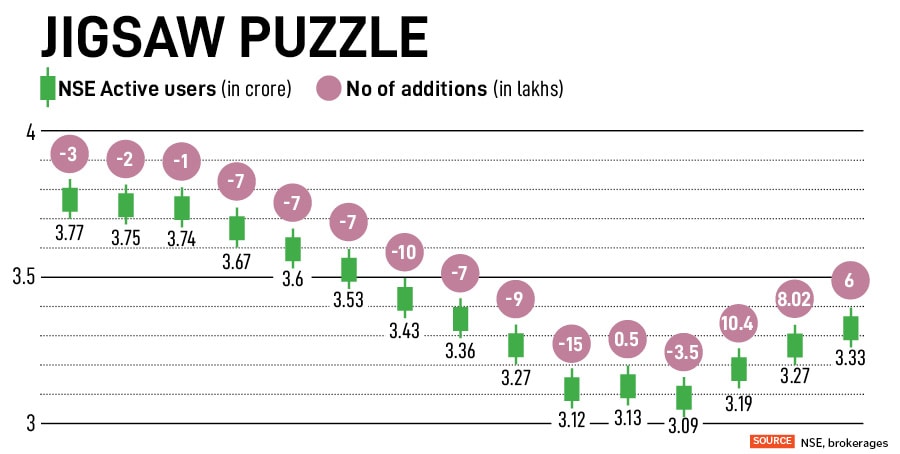

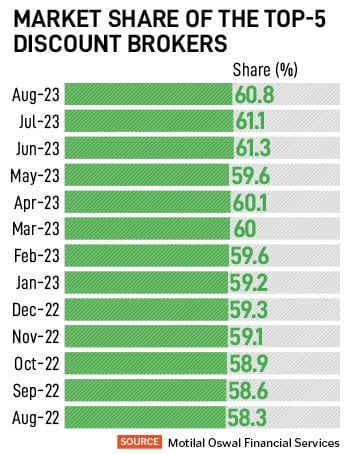

Together, the two companies control almost 40 percent of the Indian stock broking industry, dominated by discount broking firms. Discount brokers carry out buy and sell orders at reduced commission rates compared to a full-service broker. The race to the top also assumes significance as India remains an under-penetrated stock market and everybody from banks to financial institutions are looking to fill that gap.

All that means is that the stage is set for some intense competition as financial markets become more accessible to millions. That has also meant following each other rather closely, and in some cases, even replicating them. For instance, Zerodha is already ramping up on video content, much like Groww.

All that means is that the stage is set for some intense competition as financial markets become more accessible to millions. That has also meant following each other rather closely, and in some cases, even replicating them. For instance, Zerodha is already ramping up on video content, much like Groww.