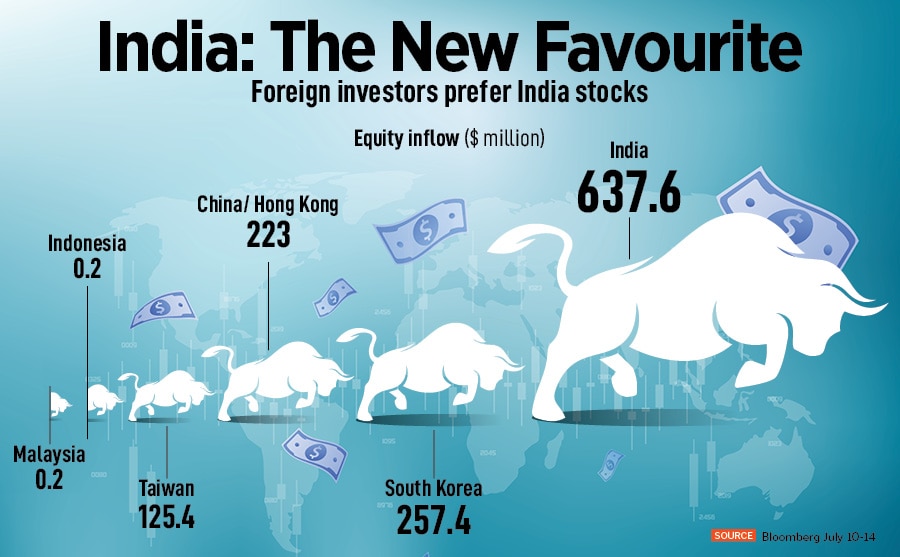

How, after years of cynicism, foreign investors are favouring India over China

The tide of foreign investments has turned as investors pull out of China stocks and turn to India and global emerging market ETFs, excluding China, for better long-term returns, finally

Many domestic investment managers have traditionally—for nearly three deacdes—faced unfounded scepticism as foreign investors fancied China over India for big-ticket investments despite the stark underperformance of Chinese equities. But, one year later, the tide has turned and the big change in perception is noteworthy.

Image: Shutterstock

Many domestic investment managers have traditionally—for nearly three deacdes—faced unfounded scepticism as foreign investors fancied China over India for big-ticket investments despite the stark underperformance of Chinese equities. But, one year later, the tide has turned and the big change in perception is noteworthy.

Image: Shutterstock

Last year, in a freewheeling conversation, Saurabh Mukherjea, founder and CIO, Marcellus Investment Managers, told the author, based on global fund-raising roadshows, the portfolio allocation of most global family houses and endowment funds towards Chinese stock markets is four-five times that of India, although returns from China have been dismal over the past decade in relation to India.

“In New York or London, you will not hear a word about the Indian stock market. Most investors, for decades, have had a cynical view of India. They had this wildly bizarrely positive notion about China, which is neither founded on fact, nor on investment returns. I think that anomaly has begun to correct,” Mukherjea had said.

Many domestic investment managers have traditionally—for nearly three deacdes—faced unfounded scepticism as foreign investors fancied China over India for big-ticket investments despite the stark underperformance of Chinese equities. A case in point: Since its inception in October 1995, the MSCI China Index has delivered no returns to investors. In contrast, the MSCI India Index returned a whopping 2,000 percent and the MSCI Emerging Market Index rose over 160 percent.

But, one year later, the tide has turned and the big change in perception is noteworthy.

Washington-based global emerging financial markets investment firm Kleiman International’s managing partner Elizabeth Morrissey tells Forbes India, “China has seriously disappointed investors. The reopening trade was wildly enthusiastic in January, but since then has totally turned around.”

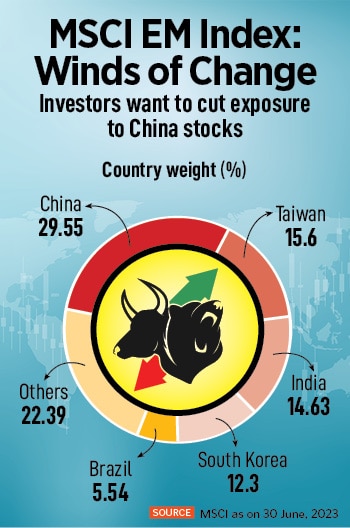

Moreover, China’s weight on the MSCI EM Index has reduced to 29.55 percent from 38.7 percent in 2020 whereas exposure to India stocks has increased from 8.3 percent in 2020 to 14.63 percent currently. Clearly, investors are looking to reduce exposure to China stocks for better returns. Global brokerages, including Goldman Sachs and Morgan Stanley, cut their targets for Chinese stock indices. For example, Morgan Stanley trimmed its MSCI China Index target to 70 from 80 and reduced its target for the Hang Seng China Enterprises Index to 7320 from 8250.

Moreover, China’s weight on the MSCI EM Index has reduced to 29.55 percent from 38.7 percent in 2020 whereas exposure to India stocks has increased from 8.3 percent in 2020 to 14.63 percent currently. Clearly, investors are looking to reduce exposure to China stocks for better returns. Global brokerages, including Goldman Sachs and Morgan Stanley, cut their targets for Chinese stock indices. For example, Morgan Stanley trimmed its MSCI China Index target to 70 from 80 and reduced its target for the Hang Seng China Enterprises Index to 7320 from 8250.