- Home

- UpFront

- Take One: Big story of the day

- How Brand WPL will be built over the long term

How Brand WPL will be built over the long term

The early years would be loss-making, yet the league is expected to create phenomenal value for franchises and aspiring cricketers

Kathakali has been a journalist for a decade and a half, working previously with The Telegraph and Times of India. An MA in political science and a Chevening Fellow, she writes on various themes--the business of sports, pop culture, startups, innovation--and co-produces the video series, From the Field. She is also part of the desk, editing, rewriting and putting the print edition to bed. Kathakali is a sports nut and collects autographs as a hobby. She enjoys travelling and music, and you'll often find her humming completely out of tune.

- Inside the Rajasthan Royals high-performance centre that groomed Sanju Samson, Yashasvi Jaiswal, Dhruv Jurel

- In 10 years, RCB should be a global brand beyond just cricket: Rajesh V Menon

- Beyond cricket: How brand RCB is being built

- Why Adidas is betting big on Indian cricket

- In tough times, stay positive: Pawan Sehrawat

Delhi Capitals cricketers Aparna Mondal, Alice Capsey, Meg Lanning, Jemimah Rodrigues and Minnu Mani at a press conference ahead of the inaugural Women's Premier League (WPL), in Mumbai on March 2. 2023.

Image: Indranil Mukherjee / AFP

Delhi Capitals cricketers Aparna Mondal, Alice Capsey, Meg Lanning, Jemimah Rodrigues and Minnu Mani at a press conference ahead of the inaugural Women's Premier League (WPL), in Mumbai on March 2. 2023.

Image: Indranil Mukherjee / AFP

When she was around eight, a cricket academy in Mumbai refused to admit Jemimah Rodrigues. “One of the reasons was I was a girl,” the 22-year-old told Forbes India in an earlier interview. “That hurt me a lot because, till then, I didn’t know you had to be a boy to play cricket.”

Related stories

It’s a story that’s unlikely to repeat itself ever again. Because, if you cut to 2023, Rodrigues, the second-fastest Indian woman to reach 1,000 runs in T20Is, is not only a household name, but has been signed by the Delhi Capitals for a whopping Rs 2.2 crore to play in the inaugural edition of the Women’s Premier League (WPL), India’s first franchise cricket league for women.

Not just Rodrigues, but her colleagues from the national team have also commanded a premium at the recently-concluded players auction for the WPL. Opening batter Smriti Mandhana has emerged as the most expensive pick, earning a Rs 3.4 crore bid from Royal Challengers Bangalore, teenage opener Shafali Verma will play alongside Rodrigues for the Delhi Capitals for Rs 2 crore, while national captain Harmanpreet Kaur will turn out for Mumbai Indians for Rs 1.8 crore. Rodrigues, Mandhana and Kaur have all played in franchise cricket in the UK and Australia, but this is likely the biggest purse they would be carrying home.

Mandhana’s fees may pale in comparison to the Rs 15.25 crore that the Mumbai Indians paid for keeper-batter Ishan Kishan, the most expensive Indian pick in the 2022 mega auction of the men’s tournament, the Indian Premier League (IPL), but given the late blossoming of women’s cricket in the country–that gained wider recognition only in 2017, when India finished runners-up in the ODI World Cup–the figures are astounding. Especially since, till about six months ago, India’s centrally contracted players would earn Rs 1 lakh for an ODI and a T20I and Rs 2.5 lakh for a Test match. It was only in October the Board of Control for Cricket in India (BCCI) brought in pay parity among the men and women and hiked the salaries to Rs 15 lakh for a Test, Rs 6 lakh for an ODI and Rs 3 lakh for a T20I.

Also read: Disney+Hotstar has lost the lucrative IPL deal. Is it now a fight for survival?

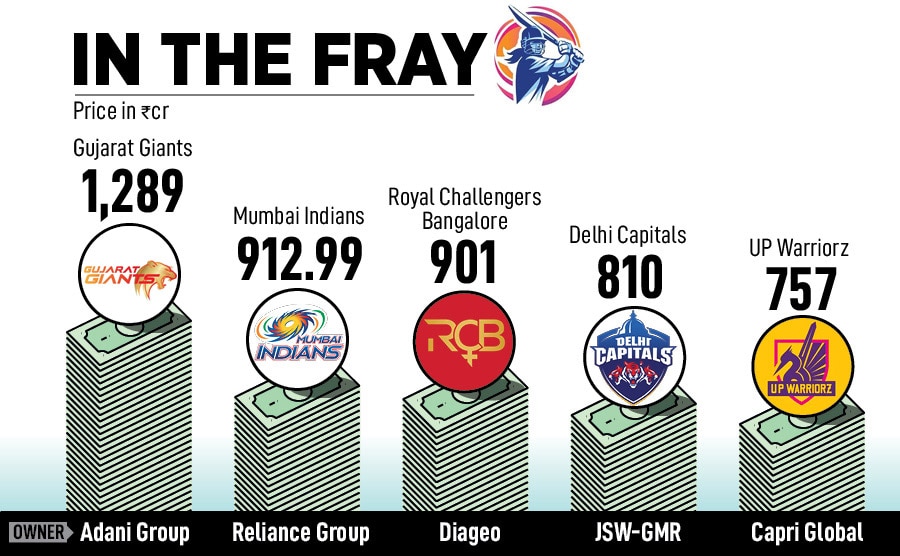

Aside from the players, the BCCI, too, has raked in staggering digits in the WPL, selling the five franchises for a cumulative Rs 4,669.99 crore (see box). Its honorary secretary Jay Shah claimed it had broken the records of the IPL bids in 2008.

Its broadcasting rights, won by Viacom 18, have exceeded expectations as well, earning the BCCI Rs 951 crore in five years, with a per match value of Rs 7.09 crore. Says Anil Jayaraj, CEO, Viacom18 Sports: “Recent bilateral women's series and ICC tournaments like the U19 World Cup and T20 World Cup have fired up conversations among fans. There's a very strong business case here to build the league as the biggest women’s sporting property in the world and deliver significant value to the sporting ecosystem.” Despite macro-economic headwinds, and talks of an advertising slowdown, the broadcaster has signed on 10 sponsors for the inaugural season, including the likes of Tata Motors, Bank of Baroda, Noise, H&M and JSW Paints.

While Viacom18 believes the WPL's principal consumers will be the core fans of the game, it has taken certain steps to ensure that it digs deep into the untapped female cohort of the audience. “We are broadcasting the league on TV and streaming it on JioCinema in 4K (English & Hindi) for free, so this expands our audience base tremendously, making the WPL available to 700 million+ internet users,” adds Jayaraj.

VALUE CREATORS

While the astronomical numbers make for great headlines, what sort of business rationale are the franchises driven by? Not the near-term, say most. “It isn’t exactly a business decision, as much as it is a conscious decision. We knew there would be losses,” says Dhiraj Malhotra, CEO, Delhi Capitals. “I think it will take at least 5-10 years for the women’s franchises to turn profitable.”

It’s not an anomaly given that’s how the financials of the IPL teams had panned out in the early years as well. According to media reports, the eight franchises had reported a cumulative loss of Rs 315 crore in FY10. Kolkata Knight Riders (KKR) was the first team to register a profit, and the first time all franchises went in the black was in 2018, buoyed by a steep rise in the media rights.

A large part of the annual costs of a WPL franchise for the first 10 years will go towards paying a tenth of the franchise fee, as was the case with IPL too. Which means for Delhi Capitals, for instance, a fixed annual cost of Rs 81 crore, having bought the team for Rs 810 crore. “Add to that the fixed player purses–Rs 12 crore for the first year with an increase of Rs 1.5 crore thereon each season. These two would constitute over 75 percent of the costs,” says Bhairav Shanth, co-founder of ITW Consulting, a leading sports management and consulting company.

Once that’s paid out, the franchises will only have to share 20 percent of their revenues with the BCCI. “That’s when your outflow reduces and inflow rises,” says Malhotra of DC.

The franchises, on the other hand, are entitled to a share from the central pool of media and sponsorship rights–80 percent in the first five years, 60 percent in the next five, and 50 percent thereafter. But the fixed costs are expected to be higher, at least in the first few years. “You can manage your operations from individual sponsorship, mainly by selling space on the jersey,” says Rajesh Sharma, managing director and chief financial officer of Capri Global, the owners of UP Warriorz. “But, in the initial years, you cannot cover the franchise fee. When you buy a franchise, that’s an investment one has to make.”

Also read: Fun and Games: How sports tourism is picking up pace in India

Why would corporates fork out a premium to own the franchises? For the skyrocketing value it can generate over the years, as it has proved with the IPL. In 2009, Forbes had pegged an average value of $67 million to the eight IPL franchises, which saw an annualised growth of 24 percent to reach $1.04 billion in 2022, when the league expanded to 10 teams.

“The initial set of IPL teams was bought for around Rs 300-400 crore in 2008, while the RP-Sanjiv Goenka Group bought the Lucknow team in 2022 for Rs 7,090 crore, amping up the valuation of the league,” says Shanth of ITW. “We also have to keep in mind that the rights are for perpetuity and the value is created over the long run. For example, the Chennai Super Kings and Mumbai Indians (MI) IPL franchises are worth over $1 billion now, but they were bought for 1/10th or 1/12th of that.” With the WPL, too, analysts predict a similar rise in valuation.

The sponsors share the optimism as well. Dream Sports, the owners of fantasy sports platform Dream11, which is the official 'fantasy partner' sponsor of the WPL for three seasons, feels the women’s game is on the verge of becoming significantly more mainstream. “There has been a steady growth in the women’s game over the last few international seasons and the emergence of exciting Indian talent. We expect the league to give opportunities to youngsters to break through and make a mark on the biggest stage. These give us confidence that the WPL will cut across audiences and make it a marquee event in women’s sports every year.” says Vikrant Mudaliar, chief marketing officer.

TURNING THE TIDE

The WPL is also sitting on the cusp of a transformative era for women’s sports globally, driven by a clamour for inclusivity and equality. According to the Wall Street Journal, last February, the WNBA raised $75 million from investors in what it said is the largest-ever capital investment for a women’s sports property, while the prize money in the Ladies Professional Golf Association tour has increased by 31 percent in three years, thanks to rising corporate sponsorship. It is also for the first time that Fifa, world soccer’s governing body, is selling the broadcast and sponsorship rights for the women’s world cup independently, unbundling it from the men’s package.

No surprises perhaps that Royal Challengers Bangalore (RCB), which in 2019 had put forward a proposal of a mixed-gender exhibition match only to be turned down by the BCCI, jumped at the opportunity of owning a team for the WPL. Six months ago, even before the league was announced, the franchise recruited former cricketer Vanitha VR as a scout. “Inclusivity is a big agenda for us at Diageo. When we heard talks about a women’s league, we were clear we would want to own a team,” says Rajesh V Menon, VP and head, RCB.

Or for MI, where owner and Reliance Foundation chairperson Nita Ambani has been vocal about the promotion of women in sports [The Reliance Group owns Network18 that publishes Forbes India]. “The MI women’s team is just another step in that direction,” says an MI spokesperson. “It sets out initiatives to enhance women’s and girls’ participation as players, coaches and leaders.”

In keeping with the gender-centric theme, most teams have set out with a goal for the benefits of the WPL to trickle down to aspiring players at the grassroots. Through MI Junior, Mumbai Indians has already been partnering with cricket associations across Maharashtra to host age-level competitions for both boys and girls; the UP Warriorz is firming up plans to conduct round-the-year local activations and engagements with its own investments and the stadium revenue it earns in subsequent seasons; and RCB will scout in the hinterlands to build capacities and give women a chance to play.

Says Joy Bhattacharjya, former team director, KKR, and CEO, Prime Volleyball League: “The league will get the pool of good Indian women cricketers up by 200 percent. Even now, once you go past the first 50-60 cricketers, the gulf is wide. The WPL will change that over the years.”

RCB also wants to shape their players into icons to inspire fans and the next generation. “The growth of each sport comes with icons. Look at what Lionel Messi or Cristiano Ronaldo have done to football, or Kapil Dev, Sachin Tendulkar or Virat Kohli have done to cricket,” says Menon of RCB. “We would want our players to acquire such stature.”

Also read: Advantages of sports sponsorship: Where there is a bill there is a pay

BUILDING A BRAND

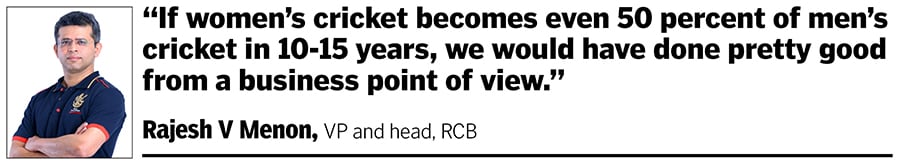

Menon won’t put a timeline to when the WPL team can turn profitable. “Maybe in the next 8-10 years. It all depends on the next rights cycle,” he says. “But we’ve crunched our data and feel that if women’s cricket becomes even 50 percent of men’s cricket in 10-15 years, we would have done pretty good from a business point of view.”

Till that happens, the WPL is a category-builder and one has to start from ground up to build the game and the league. The cornerstone of building a brand is to first establish an ethos among the stakeholders that gives the team a shared vision. This is where the WPL franchises can take a leaf out of their IPL counterparts.

“Forty years ago, sports teams just came and played, and won and lost. Not anymore,” says Bhattacharjya. “Now you need to define how your team should be structured, how they would play, how they would recruit.”

“If you take examples from an IPL franchise, look at the cultures established by RCB and CSK, the values they are known for,” he adds. “RCB, for example, has been a star-driven franchise. They've had the biggest names–Chris Gayle, AB de Villiers, Virat Kohli. And while they haven't won the cup yet, they have always been an exciting franchise that plays bold cricket. CSK, on the other hand, is not bothered about a brand of cricket, no flash and dash, all they want is to bring the cup back.”

This is where new teams like Gujarat Giants and UP Warriorz, first-time owners of a cricket team, have a blank canvas to play with. “Our culture will be to play aggressive cricket, win or lose,” says Sharma of UP Warriorz. “We want to be recognised for playing that brand of cricket.” The franchise has used the idea as the leitmotif across its name (warriors), jersey (that has an imprint of Rani Laxmibai, the firebrand queen from Jhansi), and the team (led by explosive Aussie keeper-batter Alyssa Healy).

Also read: Why are startups betting big on sports marketing?

Second, as it happens with any business with substantial fixed costs, the onus of scaling up the brand will be on marginal revenue. But the first season of the WPL will be devoid of two of the key revenue levers that IPL franchises deploy–ticketing (since the matches will be held in Mumbai and not home grounds), and merchandise (given the short turnaround time of 37 days between the announcement of the franchise and the start of the tournament).

“Apart from the shared revenue from central sponsorships and broadcast, individual team sponsorships should be the main source of revenue for teams in the early years,” says Shanth of ITW. “And the main challenge for the franchises would be to create partnerships with brands that echo their ethos.”

Appliance makers Usha, a WPL partner for MI, for example, has had a tie-up with the franchise for over a decade for its men’s team and MI Emirates, and has now extended the partnership to its women’s team. Says the MI spokesperson: “Our objective is to focus on brands whose synergies match those of MI’s and bring them on board as partners. Lotus Herbals, Ashok Leyland, Sonata Software, Max Life Insurance and Nutrizoe are all new relationships.”

What’s in it for the brands? Exposure to a new category of consumers beyond mere cricket fans. Travel aggregator EaseMyTrip has signed an exclusive back-of-the-jersey deal with UP Warriorz for five years bolstered by the rise of women travellers on its platform. “We want to tap that market, and the large population of the state, through our association with the women’s league,” says Nishant Pitti, CEO and co-founder.

The most crucial aspect of building a WPL franchise into a sustainable brand would be to craft a loyal fanbase. This would give a headstart to the existing IPL franchises, who will leverage their current fanbase and social media following. RCB, for instance, with 9.7 million followers on Instagram, has been recognised among the top five global sports accounts in terms of interactions–it has registered 55.1 million interactions in January 2023 alone. And it would rely on it to start the buzz for its women’s team. “It is critical that existing IPL franchises enter the WPL because we have the levers to build the fanbase. This would be essential in category-building,” says Menon of RCB.

Franchises with multiple cricket teams, like MI and DC, would get an opportunity to pull the clout of fans from the international outfits, who, otherwise, might not have warmed up to the WPL. DC, for instance, has earned a South African following through their SA20 side Pretoria Capitals, and had seen them being converted to DC fans. Would they also cheer for the Meg Lanning-led WPL side? “I believe we can build a larger WPL fanbase, and consequently the brand, through the followers in Pretoria and Dubai,” says Malhotra of DC.

But, if you go by the IPL experience, the most attractive valuations are grabbed by the teams that perform the best on the field. According to a December 2022 report by Brand Finance, five-time IPL winner Mumbai Indians is also the league’s highest-valued brand at $83 million, followed by two-time winners KKR at $76.8 million and four-time winners CSK at $73.6 billion. The pattern is quite evident here, and Menon of RCB would have sniffed it when he ends the conversation with: “We need to win the title. It’s a no-brainer.”