How China has dragged down investor returns over the past decade

With a cynical view of India, global investors had bet big on Chinese equities. Now, decades later, the MSCI China Index has delivered no returns, but the MSCI India Index has gained a whopping 2,000 percent

The mainland’s Zero Covid policy has led to frequent lockdowns and supply chain disruptions. Its impact on social life is significant, and consumer sentiment is bleak.

Image: Getty Image

The mainland’s Zero Covid policy has led to frequent lockdowns and supply chain disruptions. Its impact on social life is significant, and consumer sentiment is bleak.

Image: Getty Image

No candid investor will flinch while confessing the hype around China at most fundraising roadshows. For decades, global investors have fancied China over India for big-ticket investments and the lure of higher returns. That notion may bite the dust given the stark underperformance of China stocks.

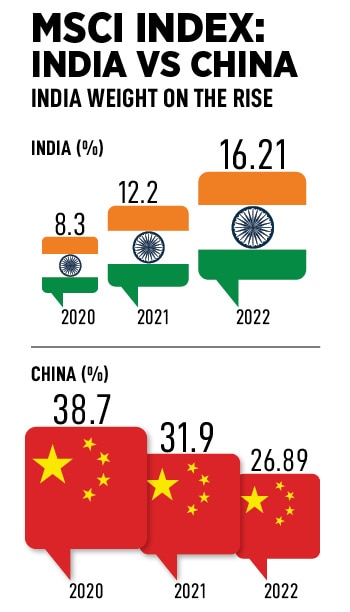

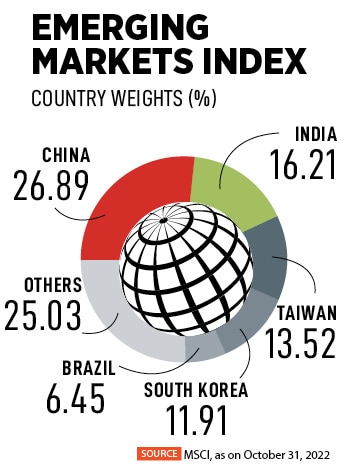

Saurabh Mukherjea, founder and CIO, Marcellus Investment Managers, says the portfolio allocation of most global family houses and endowment funds towards Chinese stock markets is four-five times that of India, although returns from China have been dismal over the past decade in relation to India.

“In New York or London, you will not hear a word about the Indian stock market. Most investors, for decades, have had a cynical view of India. They had this wildly bizarrely positive notion about China, which is neither founded on fact, nor on investment returns. I think that anomaly has begun to correct,” Mukherjea adds.

China vs India: Eye on Returns

China vs India: Eye on Returns

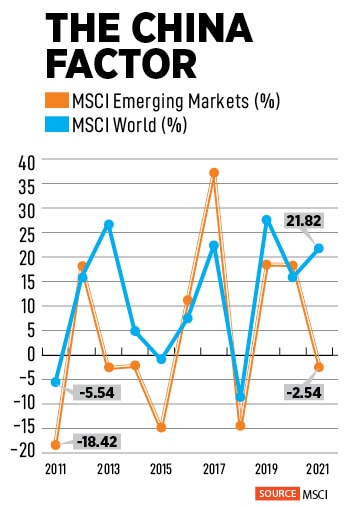

Interestingly, since its inception nearly thirty years ago, the MSCI China Index has delivered no returns to investors. In contrast, the MSCI India Index returned a whopping 2000 percent and the MSCI Emerging Market Index rose over 160 percent.

In this backdrop, China’s economic pain is deepening. “It looks like a comprehensive economic blow-up in China of not just the housing market but also its financial system,” says Mukherjea.

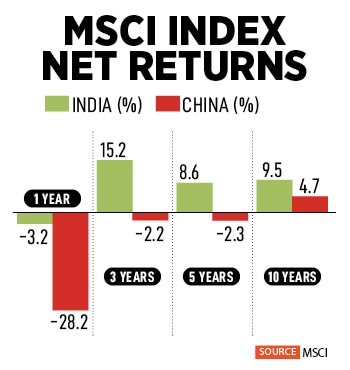

In this backdrop, China’s economic pain is deepening. “It looks like a comprehensive economic blow-up in China of not just the housing market but also its financial system,” says Mukherjea.  Also, the MSCI India Index has largely outperformed the MSCI China Index. For example, over a three-year period, India gave net returns of 15.2 percent. In comparison, China gave negative returns of 2.2 percent.

Also, the MSCI India Index has largely outperformed the MSCI China Index. For example, over a three-year period, India gave net returns of 15.2 percent. In comparison, China gave negative returns of 2.2 percent.