- Home

- UpFront

- Take One: Big story of the day

- How established paint companies are tackling hot competition from newer rivals

How established paint companies are tackling hot competition from newer rivals

As fresh entrants like Indigo Paints and JSW Paints look to gain market share, the old guard—Asian Paints, Berger Paints, Kansai Nerolac—is working on beefing up its competitive advantage

After studying law I vectored towards journalism by accident and it's the only job I've done since. It's a job that has taken me on a private jet to Jaisalmer - where I wrote India's first feature on fractional ownership of business jets - to the badlands of west UP where India's sugar economy is inextricably now tied to politics. I'm a big fan of new business models and crafty entrepreneurs. Fortunately for me, there are plenty of those in Asia at the moment.

Asian Paints’ formidable distribution network means that dealers have to wait no more than four hours from the time they order the paint to getting it delivered in their stores.

Image: Dhiraj Singh/Bloomberg via Getty Images

Asian Paints’ formidable distribution network means that dealers have to wait no more than four hours from the time they order the paint to getting it delivered in their stores.

Image: Dhiraj Singh/Bloomberg via Getty Images

Omkar Kamat Sambary who runs a renovation company in Goa is used to buying paint from retailers. With long-standing relationships, he’s served quickly (usually on the same day) and at prices that make his business viable. But over the last year, competition among the companies he buys from has increased manifold. It’s almost as if time is running out for them.

Related stories

“Paint companies are rushing to instal tinting machines and gyroshakers,” he says. These paint-making apparatus that are kept in dealer stores are the key to getting increased sales.

While he’s not clear why there’s an urgency, he sees the old guard—Asian Paints, Berger Paints, Kansai Nerolac—moving aggressively to expand their footprint. They’ve got hot competition from the new crop—Indigo Paints and JSW Paints. “I myself have been offered a tinting machine and gyroshaker for free from Berger Paints, Indigo Paints and JSW Paints,” Sambary adds, pointing to the fact that the industry hasn’t changed so rapidly in the 15 years he’s been in the business.

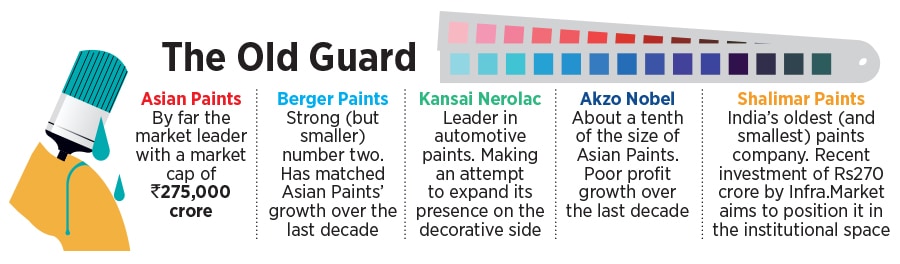

Paint, for as long as analysts who track it can remember, has been at best a three-player industry in India. The top three—Asian Paints, Berger and Kansai Nerolac—account for about 80 percent of the business. They’ve grown steadily at rates that are 1.5 times GDP growth.

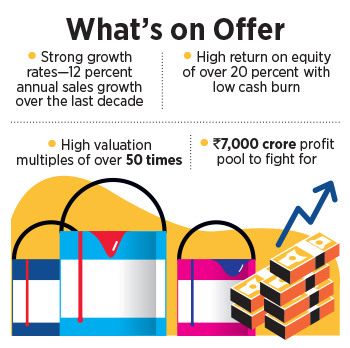

Unlike other businesses like cement and steel, which are cyclical, the decorative paint business grew steadily in a decade where the industry saw a real estate down cycle. Demand from home renovations kept the business ticking. Over the last decade, the top two—Asian and Berger—have each seen sales expand by 12 percent a year, and profit at 12 and 17 percent respectively. Their market cap has moved up from a combined Rs43,000 crore to Rs432,000 crore or 25.9 percent a year.

These are decadal growth rates that match or beat even their famed consumer goods rivals like Hindustan Unilever and Marico, and have come about with no cash burn and efficient use of capital. Return on equity for the top two Indian paint companies is upwards of 20 percent. Over the last five years, Asian Paints—with a gross block of Rs5,000 crore—has generated Rs4,500 crore in free cash flow every year.

These are decadal growth rates that match or beat even their famed consumer goods rivals like Hindustan Unilever and Marico, and have come about with no cash burn and efficient use of capital. Return on equity for the top two Indian paint companies is upwards of 20 percent. Over the last five years, Asian Paints—with a gross block of Rs5,000 crore—has generated Rs4,500 crore in free cash flow every year.

The industry also comes with a Rs7,000 crore profit pool that’s worth fighting for. An analyst tracking the industry points out on condition of anonymity that, “It’s a wonder this (increased competition) didn’t happen earlier given that the business has a 20-30 year runway.”

The last time this happened was in telecom, which had a similar profit pool to fight for. That business has consolidated and become a two-horse race. Paints, he says, is likely to see many more efficient companies as the industry has taken notice of the performance of new entrants, Indigo Paints and JSW Paints. “Even if one gets 5 percent profit share, that’s still Rs350 crore,” he explains.

Over the past 24 months, while industry participants had been gradually watching the rise of newer rivals, it was Grasim’s announcement on May 24 that got everyone to sit up and take notice. In an earnings call, the company announced that it was doubling its proposed investment in the paints business to Rs10,000 crore. The company expects to launch in under two years by the fourth quarter of FY24 with a capacity 1,332 million litres per annum.

The announcement set the cat among the pigeons with brokerage Jefferies dubbing it a ‘Jio moment in paints’. Rivals moved to rework their strategies, Asian and Berger Paints saw a combined 40,000 crore erosion in their market cap and observers scratched their heads as to why Grasim is adopting what seems like a capital-intensive route to get into the business? (The conventional wisdom is that the business has to be built gradually from the ground up.)

While the answers will take time to become apparent, the last three years offer some clues on where the industry is headed. They also point to the different strategies companies are likely to adopt in getting a slice of the market.

Expanding footprint

Halfway through the last decade, market leader Asian Paints began exploring ways to increase revenue from outside the paints business. There was the launch of the kitchens business with Asian Paints Sleek, a home painting service, and range of products like polish. At the same time, the company noticed that the waterproofing business was a significant whitespace the company hadn’t tapped. Here the market leader was Pidilite with its Dr Fixit product, which was mixed in cement during construction. Unlike paints, which is low on technology, this was a technologically advanced product that had a leading market share. Asian Paints also launched a waterproofing business with ‘damp proof’ products.

At the same time, the company noticed that the waterproofing business was a significant whitespace the company hadn’t tapped. Here the market leader was Pidilite with its Dr Fixit product, which was mixed in cement during construction. Unlike paints, which is low on technology, this was a technologically advanced product that had a leading market share. Asian Paints also launched a waterproofing business with ‘damp proof’ products.

While this gave the company inroads into cement dealerships, Asian was soon to launch a product, putty, that would take it head-to-head with the largest cement company Ultratech. This is the first most basic layer of paint applied on walls and Birla White’s putty is by far the market leader in this business. Ultratech doesn’t break out numbers for Birla White, but a company blog says the product had a growth rate of 14 percent compared to 11 percent for the industry. Over the last three years, dealers estimate that Asian Paints’ putty would have a 20 percent share of the organised market. Asian Paints did not respond to a request for comment.

Unlike cement, which is sold through a distributor network, the paint industry in India operates on a direct-to-dealer distribution model. Asian Paints’ formidable distribution network means that dealers have to wait no more than four hours from the time they order the paint to getting it delivered in their stores. Some dealers are supplied with the paint directly, while others are supplied with the base. Once the shade is selected, the base is added to the tinting machine and then shaken in a gyroshaker to get the exact colour. It is a business that is low on investment and high on asset turns.

The inroads made into cement dealers meant Asian Paints was able to persuade them to offer paint as well. All they had to do was keep shade cards to show customers and the product would be available in a few hours. It was a successful pitch and in the seven quarters since April 2020, their dealer network has risen by 61 percent to 145,000 dealers.

It is likely that after seeing this synergy, Grasim, too, decided to enter the business. The company did not respond to Forbes India for a comment.

For now, it is Grasim’s big-bang announcement that has got the industry talking. The Rs10,000-crore investment is likely to come onstream by FY24. The company clarified that this includes the cost of setting up the plant as well as pre-operative capex to operationalise the business.

“Grasim’s entry is going to shake things up. The numbers quoted by them show their intent,” says Parth Jindal, managing director at JSW Paints.

Grasim is yet to explain how it will synergise the cement business, Ultratech, with the decorative paints business operated through Grasim. Both are listed entities with a different shareholder base.

When specifically asked on its earnings conference call, Himanshu Kapania, business head, paints at Grasim, said, “…you are absolutely right, white cement (putty) has multiple application and over the years, white cement application has tended to be more towards the paint side, especially towards the undercoat side, but the fact remains, Birla White is a division of Ultratech and it is a very strong brand and it has independent set of shareholders. So, Grasim has chosen to launch its paint services through the Grasim vehicle. Ultratech remains focussed on the cement side of the business, including the white cement side of the business, and both the shareholders at an appropriate point of time will work out a necessary arrangement to work on synergies so that both Ultratech and Grasim profit from the growth or entry of Grasim into the decorative paints business.”

Other players

Outside of Asian Paints, Berger and Ultratech, there are other smaller players adopting a step-by-step approach. They’re attracted by the economics of the business (high return on equity, inventory turns and low cash burn) as they are with the valuations—an earnings multiple in excess of 50—that established paint companies command.

JSW Paints in the last three years has built a Rs1,100 crore business with Rs450 crore coming in from decorative paints and the rest from coil coatings that are done for JSW Steel products. They now have a pan-India presence with a network of 3,500 dealers. Their unique proposition—pick any shade and we offer it at the same price. This is not the industry norm.

Indigo Paints entered the business with a niche approach on floor paints (think of road markings or tile paints) and has now expanded to the decorative side. Listed in January 2021, the company has a market cap of Rs7,500 crore. Founder Hemant Jalan swears by the step-by-step approach. “That is the only way one can build this business,” he says. He also dismisses the talk of Grasim’s entry being a Jio moment. In this business, the distribution network, brand equity, number of tinting machines on the ground and connect with painters and painting contractors determine the winner. A large investment is no guarantee of success.

Other entrants include JK Cement, which has committed to an investment of Rs600 crore over a five-year period, and Astral Limited, which acquired Gem Paints in April. Kairav Engineer, vice president, business development at Astral, has modest aims: Grow the business at 15 percent per annum without too much capital investment. “We will grow slowly and gradually. It is impossible to shake Asian Paints,” he says.

The road ahead

Investors tracking the industry agree that the next five years will see several new entrants. They also question the right of one entrant to take a lion’s share of the market. “Why should one company hold such a large share of the market in a product that is not so high on technology and R&D?” asks Jindal. He believes there is room for many more players and admits the company is relooking at its plans given Grasim’s aggressive plans. The company has a Rs6,000 crore topline target by FY26 and aims to be among the top three.

What industry observers disagree about is the effect on the sector’s profitability. No one knows how that will play out. With high inflation, there are already some signs of downtrading. Pranav Bhavsar, co-founder at India Independent Insight, a research firm, says, “We realise that customers are not willing to accept prices in applications where the visibility of the brand is not material like paint or tiles. There is a lot of downtrading happening.” It is this sensitivity to the customer wallet that new players can capitalise upon.

Asian Paints and Berger Paints, with their formidable distribution network, hope to withstand the onslaught, but it is anybody’s guess on how pricing holds up. As of now, falling profits are not the base case. “Profitability could be under stress I agree, but will it fall significantly? I am not sure," says Abhishek Malhotra, partner at McKinsey and Company. He points to some profit-enhancing avenues like premiumisation or express painting that the older players have to expand their profit pool. Anything that gets them ahead of the competition by even a little will add to their competitive advantage.

The old guard is certainly not taking this threat lying down. Kuldip Singh Dhingra, chairman of Berger Paints, has spent a lifetime in the industry. Dhingra points to the fact that the industry has always been competitive, including due to the fact that it was not protected due to the Licence Raj. He’s not taking the new competition lightly and says, “We take competition very seriously.”