How long will the IPO fever continue?

Initial Public Offerings are the latest stock market darlings. Their dream run could be on its last legs

Image: Adeel Halim/Bloomberg via Getty Images

Image: Adeel Halim/Bloomberg via Getty Images

When a company raises money through an initial public offering it’s usually for the long term. Few investors, however, hold the stock for more than a day. Their aim: Make the most of listing day gains and move on to the next opportunity.

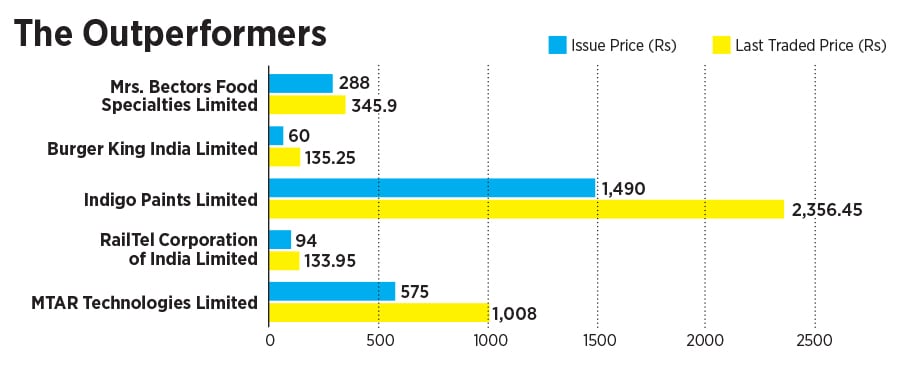

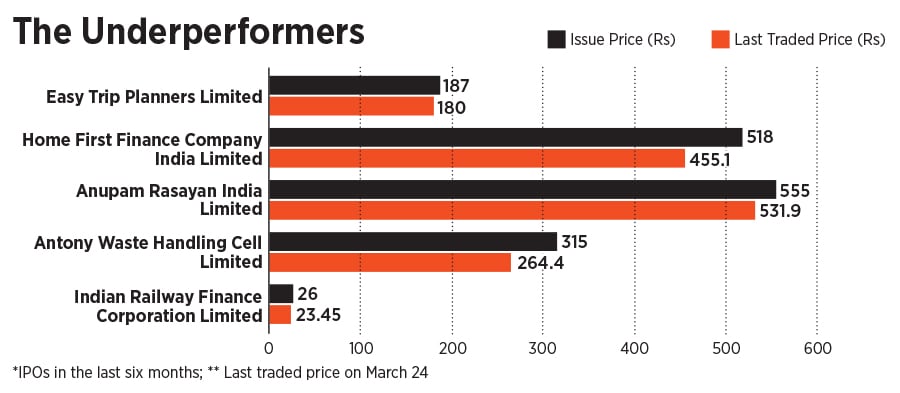

Aiding them is an IPO market that is seeing levels of enthusiasm (read oversubscription) not seen since the pre-Lehman days. Popular issues get bids worth several hundred times of the shares on offer. And the first day usually sees hectic buying and selling.

Brokers Forbes India spoke to pointed to a market where there is still easy money to be made, IPO financing easily available to high net worth investors and low returns in other asset classes, most notably real estate, as factors driving this boom. “Things seem good for now but sentiment can easily change once a couple of big name issues do badly,” said one broker. He pointed to the fact that the Nazara Technologies listing is being watched as a barometer of market sentiment.

Data from Refinitiv shows that 64 issues received bids worth $5.8 billion (Rs42,340 crore) in 2020 and 2021. In comparison, 2017 saw 180 issues receive bids worth $10.7 billion (Rs78,110 crore). Those numbers were skewed upwards on account of the DMart IPO in March 2017.