How Maruti Suzuki is gearing up to win back its lost SUV market

The carmarker is foraying into the segment with two launches in three weeks to corner market share in the category that, in India, is among the fastest-growing in the world

The managing director and chief executive officer of Maruti Suzuki India Limited (MSIL) Hisashi Takeuchi poses with the new SUV Grand Vitara during its global unveiling ceremony in Gurgaon on July 20, 2022.

Image: Prakash Singh / AFP

The managing director and chief executive officer of Maruti Suzuki India Limited (MSIL) Hisashi Takeuchi poses with the new SUV Grand Vitara during its global unveiling ceremony in Gurgaon on July 20, 2022.

Image: Prakash Singh / AFP

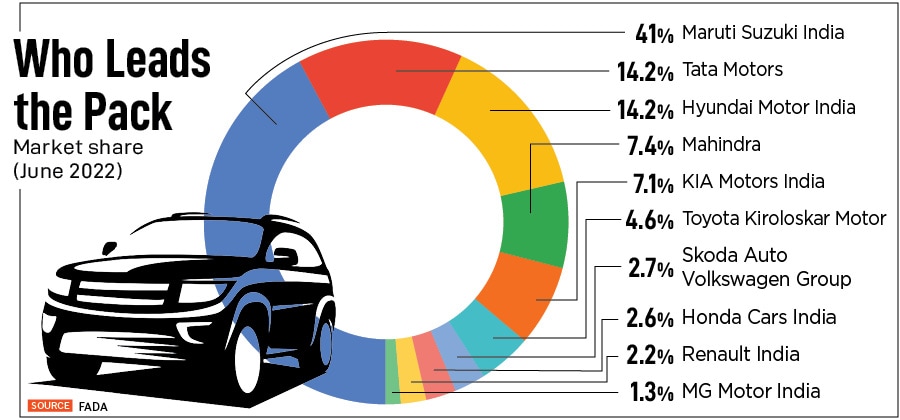

India’s largest carmaker is going all guns blazing. In a span of just three weeks, Maruti Suzuki has launched two new vehicles—both in the SUV segment—where it had been consistently losing ground for the past few years.

On June 30, the company launched the next generation variant of its entry-level SUV, Maruti Suzuki Brezza, six years after it was first introduced. Then, three weeks later, on July 21, the Gurugram-headquartered company showcased its premium mid-size SUV offering, the Grand Vitara, expected to finally give the carmaker a much-needed foothold in the booming SUV market.

While the Brezza’s pricing starts at Rs 7.99 lakh, the Grand Vitara—which rivals popular SUVs such as Hyundai Creta, Kia Seltos, Tata Harrier, and MG Hector among others—is expected to start retailing at Rs 10 lakh. The Grand Vitara has already raised eyebrows for offering range-topping fuel efficiency of 28 km for its hybrid offering.