- Home

- UpFront

- Take One: Big story of the day

- How Maruti Suzuki lost out on India's SUV boom and, with it, market share

How Maruti Suzuki lost out on India's SUV boom and, with it, market share

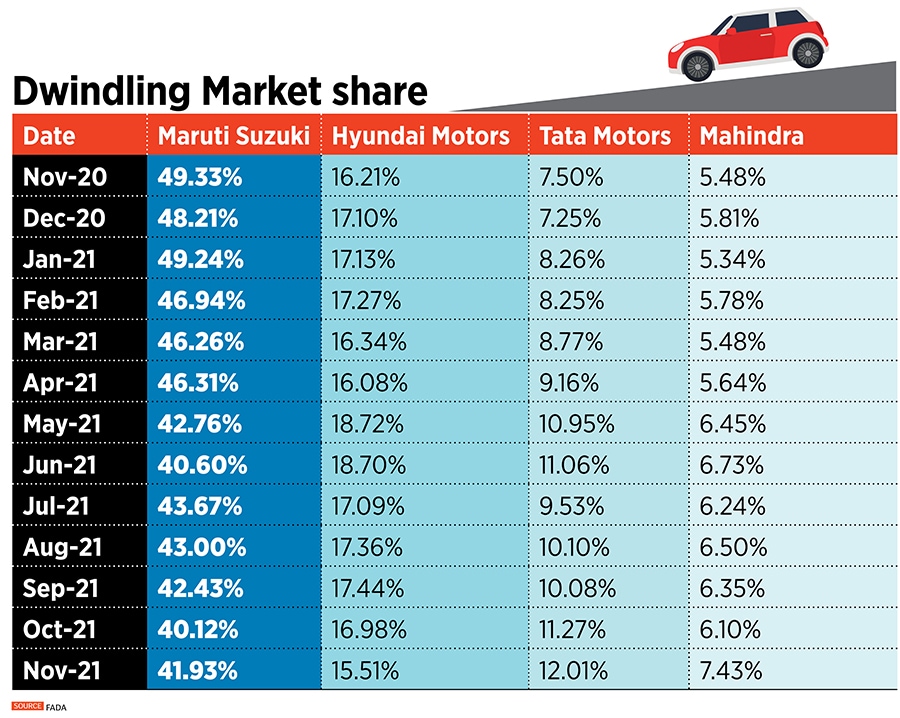

The carmaker's market share has fallen from 49 percent to 42, as it struggles to make inroads with Brezza and S-Cross

Manu Balachandran is a writer for Forbes India, based in Bengaluru. At Forbes India, Manu writes on automobiles, aviation, pharmaceuticals, banking, infrastructure, economy and long profiles among many others. He also moderates many of Forbes India's CEO and CXO events and hosts Capital Ideas, a podcast on the most riveting success stories from the business world. He has previously worked with Quartz, The Economic Times and Business Standard in Mumbai and New Delhi. Manu has a master's degree in journalism from Cardiff University and a degree in economics from the Loyola College. When not chasing stories, he is most likely obsessing over Formula 1 (Read: Lewis Hamilton), historical events and people, or planning long weekend drives from Bengaluru

Kenichi Ayukawa, Managing Director and CEO of Maruti Suzuki India Ltd., at the launch of Vitara Brezza car in Mumbai, in 2016.

Kenichi Ayukawa, Managing Director and CEO of Maruti Suzuki India Ltd., at the launch of Vitara Brezza car in Mumbai, in 2016.

Image: Danish Siddiqui / Reuters

It’s a tough act to stay at the top forever. Except, of course, if you are Maruti Suzuki in the world’s fourth-largest automobile market.

Related stories

The Gurugram-headquartered company has made a habit of selling one out of every two cars in the country and has been doing that for over two decades now. In the last four years, Maruti Suzuki’s market share in India has hovered around 50 percent, even as Covid-19 wreaked havoc across the country.

Not that those fortunes are likely to significantly change anytime soon. The automaker holds a distinct advantage of understanding the Indian consumer, and, in the process, offering vehicles that are affordable, low on maintenance costs, and with superior fuel efficiency. It also boasts an impeccable sales and service network, apart from good resale value for its vehicles, all of which have contributed to the carmakers’ success.

In 2020-21, Maruti Suzuki sold nearly 1.3 million units, worth more than the combined sales of Hyundai, Tata Motors, and Mahindra according to the Society of Indian Automobile Manufacturers (SIAM).

Yet, over the past few months, it hasn’t been entirely smooth sailing for it, something that’s begun to reflect in the automakers’ market share according to the Federation of Automobile Dealers Association in India. In November, Maruti Suzuki sold about 100,727 vehicles across the country, cornering a market share of 41.93 percent. In contrast, just a year ago, the company held a market share of 49.24 percent. In October, Maruti Suzuki had a 40.12 percent market share, down from 49.67 percent the year before.

In fact, over the course of the current financial year, which began in April, the company has struggled to push its market share well past 43 percent every month. Much of that, Maruti says, has to do with a global shortage of semiconductors, which has piled up orders as production has been hit hard. The automaker has a pending order book of over 250,000 vehicles. “We have had big cuts of production in August, September, October and partly in November as well due to the semiconductor chip shortage,” Shashank Srivastava, senior executive director, marketing & sales told Forbes India in an interview.

Semiconductors are critical components that are used in vehicles for numerous features, including navigation, infotainment, and traction control among others. Much of the global shortage had to do with the phenomenal demand for semiconductor chips from the electronics industry as people turned to their phones, televisions, and game consoles due to lockdowns across the world. In addition, shutdown of factories, a trade war between US and China, had also added to the massive shortage globally, hampering productions at automakers globally.

But that may only be a part of the growing troubles at India’s largest automaker. There is a bigger dilemma at play for Maruti Suzuki, which has admittedly missed the bus in India’s booming SUV market, which is now dominated by its rivals—Hyundai Motors India and Tata Motors among others.

“One reason for the current market share is because of the production shortfall,” Srivastava says. “We have a pending order of 263,000 vehicles. Second, in the SUV segment, which has really grown in the last few years, our market share is still quite low. In that segment, our market share is about 11.7 percent, whereas if you look at the market share in hatchbacks this year, it is 66 percent.”

Missing the bus

To put it in perspective, India’s SUV market is one of the world’s fastest-growing markets, and the country is in the middle of an SUV wave. By Maruti Suzuki’s own assessment, the market now accounts for about 39 percent of all the car sales, which is only expected to grow to some 50 percent in the next few years. That means, one in every two-vehicle sold in the country will be an SUV.

During the July-September quarter, India’s SUV sales overtook that of hatchbacks and sedans for the first time, and Maruti Suzuki, with just two models out of some 43 SUVs in the country lags far behind in the segment. Among others, popular models in the category include Tata Harrier, Hyundai Creta, Kia Seltos, and MG Hector.

The SUV market in India comprises various categories such as small, mid-size, and large SUVs. The likes of Tata Punch, Kia Sonet, Hyundai Venue, and Mahindra XUV 300 come under the small SUV segment even as manufacturers are busy creating newer segments within that category, such as mini, micro and compact SUV’s. The mid-size SUVs in the country include cars such as Hyundai Creta, Kia Seltos, Volkswagen Taigun, Tata Harrier, MG Hector, Mahindra XUV 700 among others while full-fledged SUVs comprises the likes of Toyota Fortuner and Ford Endeavour.

“We are now at around 11.4 percent in the SUV market, and this happens to be the fastest-growing, giving the perception that Maruti is losing market share,” adds Srivastava. The company currently operates in the segment with the Maruti Suzuki Brezza, which was launched in 2016 with a diesel engine, and the S-Cross. By 2019, the company announced its intention to leave the diesel market in India, with the focus shifting entirely to petrol engines and CNG-based engines.

“The diesel segment used to be pretty large,” Srivastava says. “But it has come down from about 30 percent to 18 percent. We are not there and our market share in diesel is zero.”

Much of that decision was largely on the back of the rising cost of developing environmentally-friendly engines. The share of diesel vehicles in India’s passenger vehicle category is currently less than 17 percent, a massive fall from 2013-14 when diesel cars used to account for 60 percent of the overall sales.

But, at the same time, the SUV market is currently dominated by diesel powertrains, which account for about 57 percent of the market, although it is steadily coming down. “The bulk of the diesel market is actually mid-SUV, which is about 57 percent where you have the Creta, Seltos, and Harrier, where our market share is quite low because we have S-Cross which isn't doing so well.” While the company has a strong contender in the Brezza, which Maruti reckons accounts for some 20 percent of the entry-level SUV market, in the mid-SUV segment, the company currently only has a 3.9 percent market share.

“We have about 20 percent share in entry SUV market and about 4 percent in mid-SUV, giving an 11.4 percent market share in SUV’s,” Srivastava says. “But the positive is that, in this segment, the percentage of diesel used to be about 96 percent two years ago, and that has come down.”

Diesel engines account for about 1 percent in the hatchback segment with another 5 percent in the passenger vehicles, according to Maruti. Until 2014, diesel prices in India were subsidised largely to help farmers run their machines and for freight transport, which meant that diesel prices were nearly Rs 25 cheaper than petrol per litre. That meant that many customers, who travelled frequently, preferred diesel vehicles even though they were priced higher than petrol vehicles.

Diesel engines account for about 1 percent in the hatchback segment with another 5 percent in the passenger vehicles, according to Maruti. Until 2014, diesel prices in India were subsidised largely to help farmers run their machines and for freight transport, which meant that diesel prices were nearly Rs 25 cheaper than petrol per litre. That meant that many customers, who travelled frequently, preferred diesel vehicles even though they were priced higher than petrol vehicles.

“If you look at the entry-level SUV, diesel percentage is just around 20 percent now,” Srivastava says. “Two years ago, it was 88 percent. That’s because the prices of gasoline and diesel are very close, and the all-India gap is just Rs 5. In some states, like Gujarat, Goa, Jharkhand, Pondicherry, Odissa, it’s equal. People who used to choose diesel because of running costs have moved away from diesel.”

That’s also why even with the Brezza, the company abandoned its successful diesel engine for a petrol one. Maruti had, in 2019, said the company wouldn’t sell diesel cars from April 2020. “The behaviour of the entry SUV segment indicates that if there is a strong petrol vehicle in mid-SUV, this equation can change,” Srivastava adds. That’s the hope that the automaker is currently working with.

Yet, there are likely to be consumers who might prefer diesel vehicles for their higher torque and power, something that’s a crucial factor among SUV buyers. “In the mid-SUV segment, there are some people whose criteria is not just the economics of running costs, but they want a higher torque,” Srivastava says. “Which might explain the slightly higher preference for diesel in the mid-SUV segment. That will be tested whenever a new good SUV with petrol comes in that segment. Diesel seems to have failed in all other segments even in entry SUV, but still seems to be working in the mid-SUV segment.”

Hyundai Motors, Tata Motors, and Mahindra are among players who haven’t abandoned their diesel powertrain options, especially since those engines return higher fuel efficiency and are equipped with better power and torque. In fact, over 60 percent of the sales of the popular Hyundai Creta continue to come from the diesel variant, while the same holds for the Tata Harrier.

But diesel powertrains aside, much of Maruti’s recent problems might have to also do with the company’s product strategy that has been left wanting. “They really missed the bus in the SUV category,” says Puneet Gupta, the director for automotive forecasting at market research firm IHS Markit. “It is the fastest-growing segment in the world and the competition has also been very aggressive in this space. They have clearly given away their share to them. Part of the reason is Suzuki’s focus in Japan on hatchbacks and sedans which had also affected their thinking.”

While a spokesperson for the company declined to speak about the company’s upcoming vehicles, reports suggest that Maruti Suzuki is planning as many as five new vehicles, all aimed at the SUV market. These include a challenger for Creta and a three-row premium SUV, among others. “But we need to see if the customers are willing to pay upwards of Rs 15 lakh for a Maruti vehicle,” adds Gupta of IHS.

“We will be very mindful, and we'll be aggressive in introducing new products,” Srivastava adds. “If you see this phenomenon of SUV, it is across the world. So it is not just a fad. If you see Latin America, China, the US, and Europe, the SUV market is roughly about 45 to 49 percent. So, it seems to plateau around that 45 percent to 48 percent range. Currently, it is at 39 percent in India. The expectation is the SUV market will grow before plateauing out.”

Much of the uptick in SUV sales in India has to do with the riding comfort, the design language, higher clearance, road presence, and even a status factor. “It's not really off-roading roading, but they have better usage of space,” adds Srivastava.

“As a market leader, Maruti Suzuki is defending a fairly large goal post and hence sometimes it is possible that leaders may need to strengthen and adjust their tactical positioning,” says Harshvardhan Sharma, head of auto retail practice at Nomura Research Institute. “However, given the expanse of their network, time to market with new product development capabilities, and rapid deployment history, Maruti Suzuki will be able to surely leverage its economy of scale advantage once they decide to enhance their product portfolio.”

Going forward

For now, while the company isn’t losing sleep over the SUV market even though it knows it has some serious catching up to do if it wants to maintain its dominance.

“If you take the total passenger car market which is hatches and sedan, our market share is 61.3 percent. In the MPV market, it is 63.2. Maruti Suzuki has been always very aggressive in introducing new products and we keep monitoring consumer choices and preferences,” Srivastava says.

“The mid-SUV segment is an important market undeniably,” adds Sharma of Nomura. “There are many OEMs who have successfully launched new products here. However, let’s also bear in mind that although growth in hatchbacks and entry-level sedans might be slow but that’s on account of a huge base and hence it is difficult to register double-digit growth in that segment especially now since it’s a fairly crowded segment. Maruti Suzuki is an undisputed leader in that segment, they developed that segment from scratch.”

In addition, the company is also pinning its hopes on the CNG market. “Our market share is about 82 percent,” Srivastava says. During the first half of the current financial year, sales of CNG cars totalled some 101,412 units, in comparison to 51,448 units in the year-ago period, indicating a 97 percent growth. CNG-based vehicles provide cheaper running costs, especially since fossil fuel prices had been on the rise in the country. A shortage of refuelling options, meanwhile, has been a deterrent towards mass adoption of the vehicles. Maruti Suzuki’s models such as Alto, S-Presso, Celerio, Wagon R, Dzire, Ertiga, and Eeco have all been equipped with a CNG option.

In addition, the company is also pinning its hopes on the CNG market. “Our market share is about 82 percent,” Srivastava says. During the first half of the current financial year, sales of CNG cars totalled some 101,412 units, in comparison to 51,448 units in the year-ago period, indicating a 97 percent growth. CNG-based vehicles provide cheaper running costs, especially since fossil fuel prices had been on the rise in the country. A shortage of refuelling options, meanwhile, has been a deterrent towards mass adoption of the vehicles. Maruti Suzuki’s models such as Alto, S-Presso, Celerio, Wagon R, Dzire, Ertiga, and Eeco have all been equipped with a CNG option.

Even there, the company’s sales were affected after the government decided to divert industrial cylinders for oxygen purposes at the peak of the second wave of Covid-19 in India. “We had closed our CNG units in April, May, and June,” Srivastava says. “But we are the market leaders, and we continue to grow there.”

Perhaps that’s why the company isn’t quite worried about the market share situation. In addition, it also reckons that the falling fortunes will likely correct itself, as it had seen over the past 20 years, having never been challenged for the top position even once. “When you look at a longer term, probably it will even out and we will even get to where we are,” Srivastava says. “If you look at market share, it has been 50 percent and above on four occasions and those four occasions were the last four years. So, the customer base is there.”

For now, the company has categorised its plans into four segments, on which it needs to act. A first, green segment is where it considers the segments to be entirely developed. The other area is blue, where the segment itself has not been created. “It's like a farm where no trees are there, and nobody knows how big that farm will become,” Srivastava says. “So, you can go and plant your trees and maybe it will become big and you can enjoy the benefits of market share later.” The company claims it is akin to the compact hatchback segment, where it deployed the Swift model, and became a runaway success.

The third area is the white area where the market has not fully developed, and the company has the potential to build it, for instance, like a cross-over market. Then comes the red area, where the segment has developed, the market is massive, and the company has no presence. “The farm is quite big, but unfortunately our crops are not working. That currently is the SUV area. The segment is pretty large—it's 39 percent now of the market. Last year was 32 percent,” Srivastava says. The segment currently has 43 models across the country, with Maruti’s options limited to just the S-Cross and the Brezza.

“We have those two out of 43, so obviously you need to strengthen the portfolio,” Srivastava says. “There is no doubt about it. In that sense, it is a worry. Because if we want to reach our objective of 50 percent market share in a segment as large as SUV, you need to have much better market share than 11.4.”

He also agrees that the company lost a massive opportunity by not foraying faster. “In the mid-SUV segment, the new models which have come, like the Seltos, Harrier, and Creta, also have that first-mover advantage. To that extent, you can say there is an opportunity lost. But again, there is no point in looking back at it.”

For now, however, Srivastava and Maruti Suzuki aren’t backing down. “We need to clinically examine it and methodically see areas we need to improve in,” Srivastava says. “We need to see how to expand our portfolio so that we can also hope to dominate this SUV segment as well. Without diesel, people expected that we will not have 50 percent of the market. But we did. So, it is possible.”

Yet, time is key, especially since many rivals have been moving at breakneck speed to launch new models or offering facelifts. “Last year, the SUV segment was only 32 percent of the market. But suppose, it becomes 50 percent—it becomes more and more an uphill task. So, you need to achieve a good market share in the SUV segment,” Srivastava says.

“SUV segment surely feels glamorous, but hatchback and Sedan are bread and butter and that’s where the volumes are,” says Sharma. “As urbanisation and income levels improve, there are going to be more first-time buyers in India than anywhere else in the world and a vast majority of them are going to start with entry-level products where Maruti Suzuki has a moat.”

Then, there is the possibility that Maruti might just be holding back as the company undergoes transformation as part of a global partnership between Suzuki and Toyota. In 2019, Toyota and Suzuki announced that the two companies had entered into a long-term partnership for promoting collaboration in new fields, including autonomous driving. In India, Toyota had begun badging its vehicles that are built on Maruti Suzuki’s platforms such as the Brezza and Baleno.

“They could be making a strong comeback next year,” says Gupta of IHS. “With all the restructuring underway, a lot of changes may not be visible to us and that means there could be hiccups in the short term.”

In addition, with Covid-19 creating a massive push towards personal mobility, Maruti could also be a big gainer in the domestic market. “A lot of households could be looking at a second vehicle and Maruti could gain as a result of that,” adds Gupta. “At the same time, competition is also becoming aggressive and many of Maruti’s products are at the end of their lifecycle. Similarly, their core advantage of dealer networks has also undergone changes with digitsation.”

Going electric

Unlike many of their peers, meanwhile, Maruti hasn’t been going aggressive on its electric play.

For instance, Tata Motors, which already sells the largest number of electric vehicles in India, has set up a subsidiary for its electric vehicle play and, in the process, became India’s most valuable EV company, after raising $1 billion from private equity major TPG Rise Climate. The deal values the yet-to-be operational subsidiary at over $9 billion and the capital infusion is expected around March.

Tata Motors will invest $2 billion into the subsidiary over the next five years. The new company, Tata Motors believes, will leverage all the existing investments and capabilities of the parent company in addition to channelising all the future investments into electric vehicles and dedicated battery vehicle platforms and technologies, among others. Over the next five years, the company will also create a portfolio of 10 EVs while also partnering with Tata Power to create charging infrastructure to help with early adoption.

“This is a big opportunity to lead the charge in this space (EV) and go about creating 10 products, and also create the ecosystem around it so that the aspiration of driving growth in electrification does not suffer because of lack of ecosystem,” Shailesh Chandra, president of Tata Motors’ passenger vehicle segment, had told Forbes India.

Similarly, Mahindra had, in May, approved the merger of the EV subsidiary Mahindra Electric Mobility Ltd (MEML) with the company to consolidate operations, development, sourcing, and manufacturing. It also set aside ₹3,000 crore for its EV plans, six of which will be launched by 2026.

“I think everybody realises that going forward, environment-friendly vehicles will be the requirement,” adds Srivastava. “It will be mandated by governments across the world. So, the question about electric vehicles becoming mainstream is not so much doubtful. Going forward, ICE vehicles will increasingly become more expensive because you require to meet higher, tighter emission norms like BS6.”

So, what’s Maruti’s plan when it comes to electric vehicles? “We have already announced that we will bring an electric vehicle before 2025,” says Srivastava. “However, the battery cost hasn't come down as much as expected. The battery cost, which was expected to be about $60 per kWh in 2021 is at $110.”

That means, the company has pinned its hope on hybrid vehicles, akin to what Suzuki has been attempting globally. “Even in Europe, hybrids are about 14 percent while EVs are about 5-6 percent,” Srivastava says. “For electric, the battery cost has to come down so that vehicle prices come down.”

And that decision to foray massively into electric play may also be a well-thought-out strategy. “Large OEMs would definitely not want to pivot to only one powertrain and hence one may see a balanced and well-diversified powertrain mix from large OEMs spread across hybrids, CNG, Hydrogen, and ICE,” says Sharma. “We are at the cusp of a tectonic change in the way mobility is perceived. OEMs fully understand this opportunity and hence many efforts ranging from powertrains, agile organisation, digitisation and revenue models are underway.”a

If there is one car manufacturer who knows the pulse of the Indian market, its Maruti Suzuki. But weathering out a globally changing automobile landscape, with some intense competition, may not come easy. But, then, Maruti has always found a way out of a bumpy ride.