- Home

- UpFront

- Take One: Big story of the day

- How metals are forging a recovery

How metals are forging a recovery

Global macro headwinds and lacklustre demand will put a lid on prices this year. But can China reset the cycle?

Neha is a versatile financial journalist with over eight years experience in leading English business news channels. Her wide-ranging reportage includes impactful undercover investigations, multi-billion dollar deal breaks, and incisive coverage of key corporate and policy developments. She’s as comfortable anchoring live news on television, as she is writing insightful columns. She focuses on financial markets and global economy, moderates power-packed panels, and interviews influential industry leaders to get you the latest news, views and analysis of the stories that matter. She holds a postgraduate degree and specialisation certificates in the area of finance from global institutes. When she’s not fussing over inflation or balance sheets you may find her on a yoga mat in some beautiful part of the world. But she's always up for good coffee and interesting ideas.

- Market may not find it easy to climb unless earnings growth surprises materially: Invesco MF's CIO Taher Badshah

- Ancient Ayurvedic wisdom to new-age disruption, how 'Made in India' beauty brand Forest Essentials is going global

- Zomato's Blinkit has a great durable competitive advantage over Flipkart: Sanjeev Bikhchandani and Deepinder Goyal

- Quick commerce is the future: Info Edge's Sanjeev Bikhchandani and Zomato's Deepinder Goyal

- NPCI's Praveena Rai: Shaping India's payments landscape

The near-term growth opportunities in the overseas markets look challenging as, barring possibly China, most of the other leading steel-consuming hubs are likely to witness anaemic growth in steel consumption in CY23.

Illustration: Chaitanya Dinesh Surpur

The near-term growth opportunities in the overseas markets look challenging as, barring possibly China, most of the other leading steel-consuming hubs are likely to witness anaemic growth in steel consumption in CY23.

Illustration: Chaitanya Dinesh Surpur

In an interaction with equity analysts in early April, the management of a leading global metal behemoth, with consolidated revenue to the tune of $28 billion, said it planned to reduce its capital expenditure by a staggering 43 percent over the next four years as it sought to conserve cash flows to mitigate the impact of economic slowdown and weak demand in North America and Europe.

Related stories

The company, Hindalco Industries, India’s largest fully integrated aluminium player, cautioned in a presentation to investors, “Macro headwinds muting near-term performance.” The operating metrics underline the pain in its US-subsidiary, Novelis, which contributes roughly 60 percent to the total revenue.

The KM Birla-owned company expects challenges from volatile energy costs, inflation, and interest rates to persist into FY24. However, it has indicated, as guidance, an adjusted Ebitda per tonne of $525 in Q4FY24 [versus $376 in Q3FY23] “when headwinds subside” and profit margins normalise.

Last year, days after Russia’s invasion of Ukraine in February, aluminium prices hit a record high of $5,000 per tonne stoked by fears of supply constraints and a huge market opportunity opening up due to the growth of electric vehicles (EVs). In the next five-six years, over a million four-wheeler EVs and 13 million two-wheeler EVs are likely to be sold in India per year, according to a report by Motilal Oswal Financial Services.

Against this backdrop, Hindalco bet on the rising global demand for aluminium as it earmarked around $8 billion for expansion over five years, of which $4.7 billion was to be deployed into Novelis and $3.2 billion for domestic operations. But a year later, it cut its capex outlay to approximately $3.3 billion and $1.1 billion respectively to protect the bottom-line.

“Aluminium demand remains weak keeping the market balance in surplus [which] has led to a significant rise in inventory levels, currently at a 20-month high. We forecast aluminum prices to remain range-bound and find risk-reward unfavorable for aluminum producers,” says Jatin Damania, research analyst, Kotak Securities.

Out of the Doldrums?

If the pandemic was a black swan event, the synchronised pace of interest rate hikes by global central banks was unprecedented. Since March 2022, the US Federal Reserve lifted rates by 475 basis points to tackle record-high levels of sticky inflation. Similarly, the Reserve Bank of India increased the benchmark repo rate by 250 basis points to 6.5 percent in FY23 to rein in inflation within its upper tolerance band of 6 percent.

Besides, in a double whammy, China’s Zero Covid policy led to massive supply chain disruptions that were further compounded by the war in Ukraine and higher energy costs. These factors heavily weighed on growth and subsequently the profitability of metal companies. Collectively, the prices gave way to mounting cost pressures and waning demand as investments were put on hold in face of flailing consumption patterns and rising uncertainty.

But, two years ago, when the world was inching back to normalcy after the outbreak of the deadly coronavirus pandemic, the shining performance of commodities, particularly industrial metals, built expectations of an upcoming super cycle as was last seen during the four-year period between 2004 and 2007. At least, that’s what the price trend indicated.

But, two years ago, when the world was inching back to normalcy after the outbreak of the deadly coronavirus pandemic, the shining performance of commodities, particularly industrial metals, built expectations of an upcoming super cycle as was last seen during the four-year period between 2004 and 2007. At least, that’s what the price trend indicated.

For instance, domestic steel prices touched and hovered around an all-time-high of Rs70,000 per tonne and non-ferrous metals such as aluminium and copper rose over 62 percent and 88 percent respectively. Metal stocks were on fire. In FY22, the BSE Metal index returned over 160 percent versus 62 percent by the BSE 500 index. Industry insiders say these signs were reminiscent of the commodities boom fifteen years ago.

However, the strong rally in commodity prices, in 2021, was fuelled by ultra-accommodative monetary policies, government sops, restocking of inventory, green shoots in industrial activity, and lower steel output by the world’s largest producer- China. After the initial spurt in prices, the depth and magnitude of the slowdown crashed expectations of a boom in the metal cycle but prices have been resilient.

For example, according to analysts, in CY22 Indian hot-rolled coil (steel) prices declined to an average Rs53,550 from Rs63,000 per tonne in CY21. Yet, prices held up higher than the pre-pandemic average of Rs38,567 per tonne in CY19. Presently, prices are in the region of Rs 58,000 per tonne. Does this suggest a durable recovery in industrial metals is underway or is the cycle yet to bottom out?

“If you look at metals, the picture is definitely muddled,” says Madan Sabnavis, chief economist, Bank of Baroda.

Also read: Has TV Narendran brought Tata Steel out of its lost decade?

Lacklustre Growth

During the previous super cycle of 2004-2007, the global economy had a compound annual growth rate (CAGR) of 5 percent. But the post-pandemic recovery of the world economy has been shallow and uneven: The IMF slashed its global growth forecast from 6 percent in 2021 to 2.8 percent in 2023 and 3 percent in 2024. In fact, advanced economies are likely to see a pronounced economic slowdown with flattish growth of 1.3 percent in the current calendar year.

Jayanta Roy, senior vice-president and group head, corporate sector ratings, ICRA says, “The near-term growth opportunities in the overseas markets look challenging as, barring possibly China, most of the other leading steel-consuming hubs are likely to witness anaemic growth in steel consumption in CY23. Therefore, India’s finished steel exports, after an estimated 51.5 percent steep decline in FY23, are expected to witness only a modest growth of 3-4 percent y-o-y in FY24 due to muted external demand.”

Despite the global slowdown, the Indian economy is the fastest growing major economy in the world. Most estimates peg India’s GDP growth around 6.5 percent in the current financial year. Many economists argue that a possible recession in western economies could lower the growth rate to around 5.5 percent.

Despite the global slowdown, the Indian economy is the fastest growing major economy in the world. Most estimates peg India’s GDP growth around 6.5 percent in the current financial year. Many economists argue that a possible recession in western economies could lower the growth rate to around 5.5 percent.

“We like to trumpet around we are the fastest growing economy but we are growing slower than last year and we still have problems with investment, consumption, employment- pre-pandemic challenges continue,” Sabnavis adds.

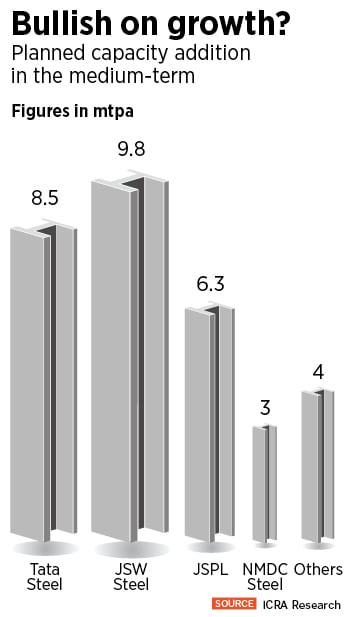

ICRA forecasts domestic steel demand to decline to 7-8 percent in FY24 versus 11.3 percent in FY23 and 11.5 percent in FY22, and estimates industry leverage to deteriorate to 2-2.5 times from 1.1 times in FY22 as committed capex plans gather momentum even as earnings are likely to moderate in light of global volatility.

“While private sector investments have generally remained muted at present, the government’s capex drive has helped maintain the industry’s capacity utilisation rate at an estimated 79 percent in FY23. With steel consumption expected to grow in high-single digits next year, we expect the industry’s capacity utilisation rate to improve to around 80 percent in FY24 despite the commissioning of some new expansion projects,” adds Roy.

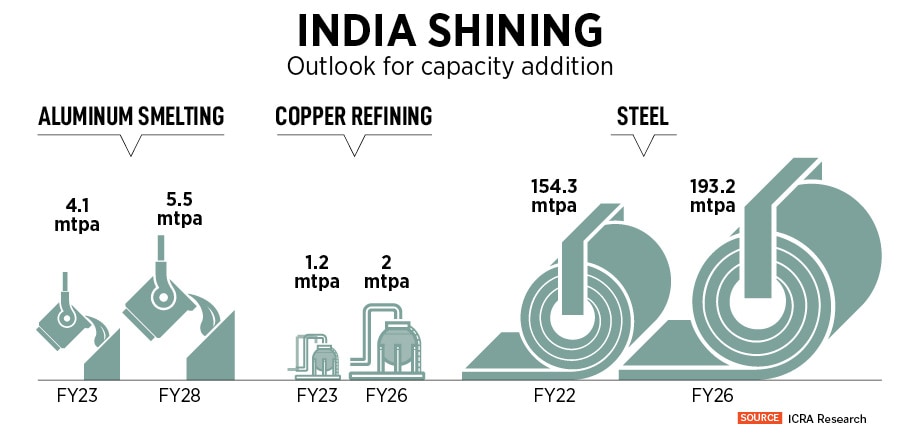

New steel capacities of nearly 35-40 million tonne per annum (mtpa) are lined up for commissioning in the next 2-3 years. Metal manufacturers are anticipating a revival in domestic economic activity spurred by the government’s ambitious capex outlay of Rs10 lakh crore which they believe will crowd in private investments and create a multiplier effect to boost growth. But high borrowing costs have been a dampener for consumers and private firms in construction and automobiles sectors.

“There is certainly a slowdown in project segments both government as well as private sector and therefore if you see (steel) rebar prices were at Rs63,000 at one time but now they’ve gone down to Rs59,000,” says Amit Dixit, analyst, ICICI Securities.

Manufacturing PMI—a snapshot of industrial activity—increased to 56.4 in March from 55.3 in February and 54.7 in April 2022. The Index of Industrial Production (IIP) rose to 5.6 percent y-o-y in February versus 5.2 percent in the previous month and 7.1 percent in April 2022.

Also read: Pulkit Baldev wants to rewire the steel industry with Metalbook

China: Is the Dragon Ready to Roar?

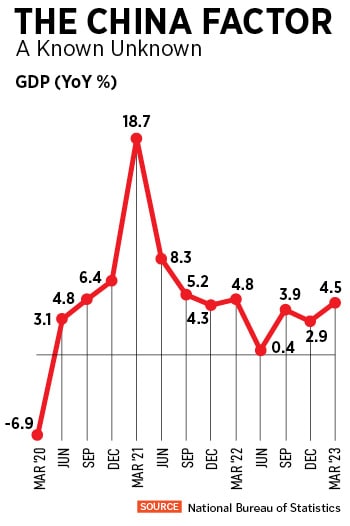

While companies are betting on domestic demand to tide through global challenges, there is a fair degree of uncertainty on how the Chinese economy will perform in the coming months. It is tough to predict with what force the economy will bounce back after it reopened this year.

“International steel prices reached a nine-month high in the second week of March 2023 as easing of Chinese lockdown restrictions led to a pick-up in economic activity for the world’s largest producing and consuming nation,” ICRA’s Roy points out.

Moreover, China beat analyst forecasts as its economy grew by 4.5 percent in y-o-y versus 2.9Epercent in the December quarter. Bank of America’s Greater China Chief Economist Helen Qiao notes, “We raise our China GDP growth forecast to 6.3 percent in 2023 versus 5.5 percent previously and consensus at 5.3 percent. Besides the ongoing consumption rebound, we expect the growth driver to further expand into investment. We believe the strong credit impulse in Q1 will lift cyclical growth momentum in the next 1-2 quarters.”

Moreover, China beat analyst forecasts as its economy grew by 4.5 percent in y-o-y versus 2.9Epercent in the December quarter. Bank of America’s Greater China Chief Economist Helen Qiao notes, “We raise our China GDP growth forecast to 6.3 percent in 2023 versus 5.5 percent previously and consensus at 5.3 percent. Besides the ongoing consumption rebound, we expect the growth driver to further expand into investment. We believe the strong credit impulse in Q1 will lift cyclical growth momentum in the next 1-2 quarters.”

Importantly, core economic indicators were a mixed bag. While services rose to 5.4 percent year-on-year in the March quarter from 2.3 percent in the previous quarter, industrial and construction activity marginally edged down to 3.3 percent from 3.4 percent. It remains to be seen if the pent-up demand can be sustainable in the coming months.

“The pace of consumption recovery could slow down sequentially given the pent-up demand will gradually fade out and inflation stays sluggish. On the other hand, investment momentum may pick up in coming quarters, with the robust credit growth spurring capex in 2Q-3Q,” Qiao adds.

The rise of the dragon also clouds the outlook for crude oil.

“Strong economic data in China will provide further cues to the oil prices. A strong data set pushes oil prices on the higher side, likely helping it scale the $90/bbl. level,” say analysts at Emkay Wealth.

Moreover, many economists are sceptical of China’s might in the commodities segment over the long-term. “Whenever we have had any commodity super cycle it is always a case of the China factor because of its expansion but now I don’t think China will ever be able to grow at 10 percent rate for five continuous years. They have possibly passed the prime and will probably be growing at 5-8 percent,” says Sabnavis.

***

With multiple moving parts and uncertainties, the balance is tilted towards risks that can possibly rub the sheen off metals in the coming quarters.

“It will be a reasonable assumption that after this year passes, we can say it has bottomed out. I would say we have to wait and watch because we are not quite sure of a soft landing or a hard landing and how this year will turn out to be,” Sabnavis says. At best, prices are likely to remain flattish and range-bound in the near-term but the long-term trajectory of metal prices looks upbeat given the underlying growth potential of the domestic economy.