How will US mid-term elections impact Indian markets and economy

As Republicans win House and Democrats retain Senate, experts feel a divided government will not directly impact India, but some of the indirect effects will be felt through rising oil prices and spending cuts

NORTH LAS VEGAS, NEVADA - NOVEMBER 10: Ballots are processed by bipartisan election workers at the Clark County Election Department during the ongoing election process on November 10, 2022 in North Las Vegas, Nevada. Two days after midterm elections Nevada election officials continue counting votes in state races. Image: Mario Tama/Getty Images)

NORTH LAS VEGAS, NEVADA - NOVEMBER 10: Ballots are processed by bipartisan election workers at the Clark County Election Department during the ongoing election process on November 10, 2022 in North Las Vegas, Nevada. Two days after midterm elections Nevada election officials continue counting votes in state races. Image: Mario Tama/Getty Images)

Even as the Republicans fell short of the expectations of the mighty ‘red wave’ in the US mid-term elections, capturing the House of Representatives with a thin majority, the markets are not disappointed.

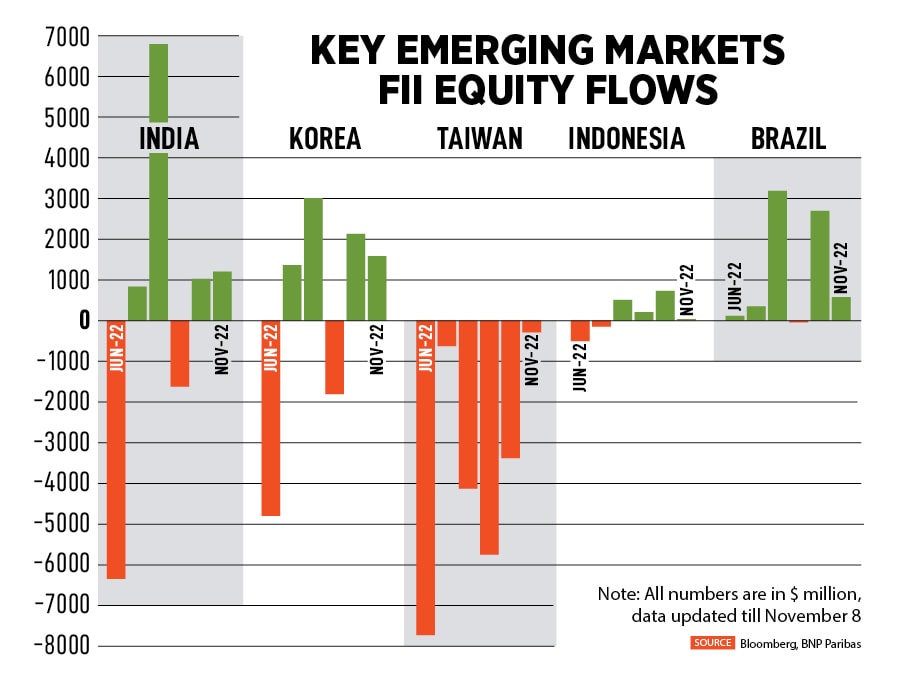

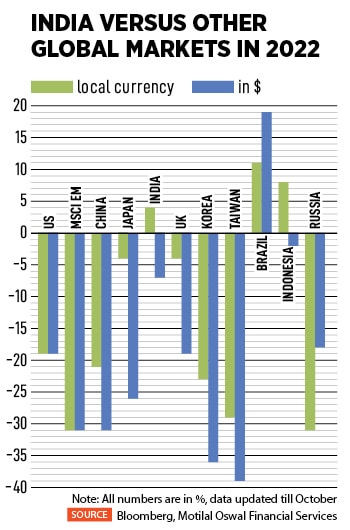

According to experts, the US mid-term election results are not likely to have any meaningful impact on emerging markets like India. However, key issues like inflation, monetary policy normalisation, policies influencing economic growth, push for spending cuts and fiscal consolidation will remain central for market investors and economists. Analysts expect India to outperform developed markets despite the US Federal Reserve accelerated policy to hike rates to tame inflation.

Analysts feel that a Republican win in the mid-term US elections may be mildly positive for Indian equities. “Results show the expected ‘red wave’ has not materialised. Overall, a divided government is good for businesses since the current democratic government led by Biden will not be able to pass legislation for higher taxes on corporates while also being more restricted in increasing government spending, which would have otherwise led to higher inflation,” says Nishit Master, portfolio manager, Axis Securities PMS says.

On the flip side, Master believes a Republican-led House could potentially open an investigation on US President Joe Biden and his family over influence peddling, which might lead to obstruction in the legislative business. Overall, the election results are a mild positive for EMs, especially in India.

In the final results of the polls held on November 8, Republicans have regained control of the House with 218 seats as Democrats retain control of the Senate. All 435 seats in the US House of Representatives went for polls, as were 35 US Senate seats and 36 governorships.

The Indian rupee, and other emerging market currencies, have been on a slippery slope for the past few months due to a strong US dollar index, which has been pumped up by aggressive tightening by the US Federal Reserve to tame inflation despite growing signs of an impending recession.

The Indian rupee, and other emerging market currencies, have been on a slippery slope for the past few months due to a strong US dollar index, which has been pumped up by aggressive tightening by the US Federal Reserve to tame inflation despite growing signs of an impending recession.