If price shocks persist, we have to act: RBI

RBI Governor Shaktikanta Das expects headline inflation to rise in the coming months due to supply disruptions, volatile food and energy prices, geopolitical tensions, and extreme weather conditions

Reserve Bank of India (RBI) governor Shaktikanta Das (C) arrives along with deputy governors to address a press conference in Mumbai on August 10, 2023. - India's central bank again left interest rates unchanged on August 10 but warned that higher food prices, caused in part by extreme weather, had impacted household budgets and halted a downward inflation trend. Image: Indranil Mukherjee / AFP

Reserve Bank of India (RBI) governor Shaktikanta Das (C) arrives along with deputy governors to address a press conference in Mumbai on August 10, 2023. - India's central bank again left interest rates unchanged on August 10 but warned that higher food prices, caused in part by extreme weather, had impacted household budgets and halted a downward inflation trend. Image: Indranil Mukherjee / AFP

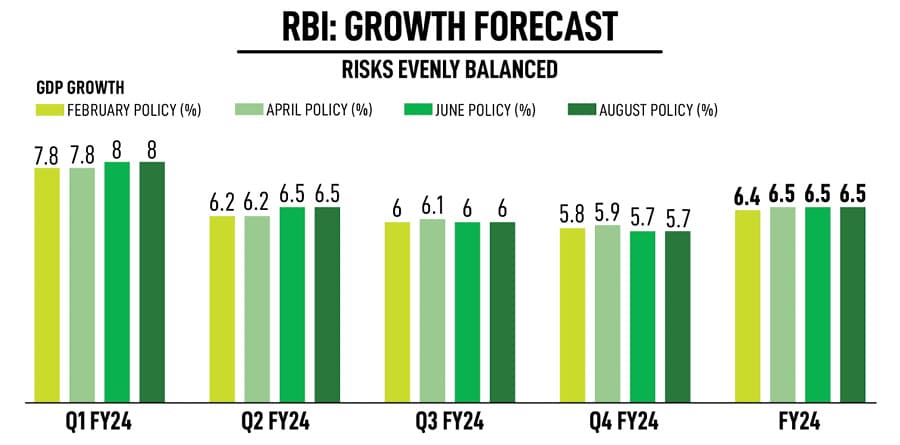

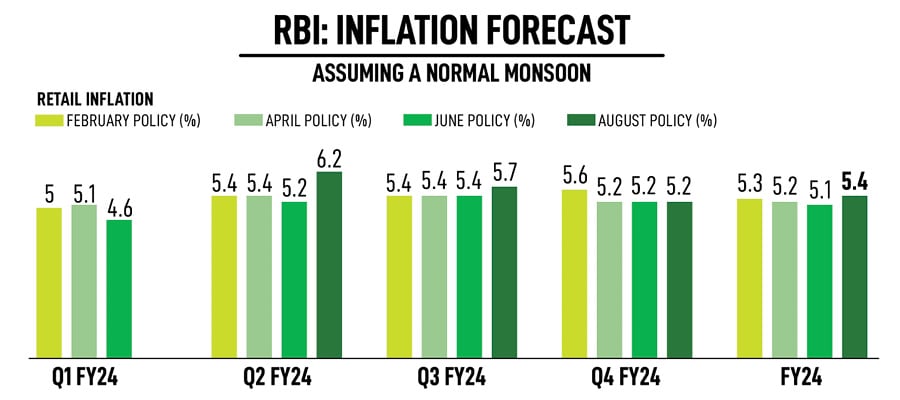

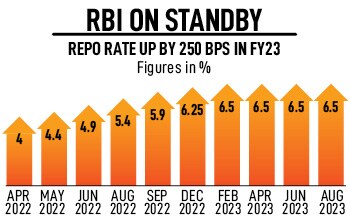

On Thursday, the six-member rate-setting panel decided unanimously to hold the benchmark repo rate at 6.5 percent. Excluding Jayanth Varma, all other members voted to remain focussed on withdrawal of accommodation to align inflation to the target of 4 percent while supporting durable growth in the economy. Importantly, the central bank raised its inflation outlook for the July-September quarter to 6.2 percent from 5.2 percent earlier (see table), signalling that the war against inflation is not over and interest rates may be higher-for-longer, and retained its growth estimate for FY24.

“We have made good progress in sustaining India’s growth momentum. While inflation has moderated, the job is still not done. We continuously assess the impact of our past actions, the evolving inflation dynamics and the implications of incoming data for the economic outlook. We do look through idiosyncratic shocks, but if such idiosyncrasies show signs of persistence, we have to act,” RBI Governor Shaktikanta Das said as he unveiled the bi-monthly monetary policy.

Iyer points out that ICRR hike will suck out around Rs95,000 crore from the system. “This could dampen short-term bond yields in the near term. Bond prices could see relief buying as the mood was quite sombre assuming a very hawkish commentary.” RBI stated the overall daily absorption under the liquidity adjustment facility (LAF) was Rs1.7 lakh crore in June and Rs1.8 lakh crore in July.

Iyer points out that ICRR hike will suck out around Rs95,000 crore from the system. “This could dampen short-term bond yields in the near term. Bond prices could see relief buying as the mood was quite sombre assuming a very hawkish commentary.” RBI stated the overall daily absorption under the liquidity adjustment facility (LAF) was Rs1.7 lakh crore in June and Rs1.8 lakh crore in July.