India's Goldilocks economy: Will the RBI change its policy stance?

The RBI's MPC is widely expected to keep the repo rate unchanged at 6.5 percent on the back of better-than-expected GDP numbers and 18-month low inflation

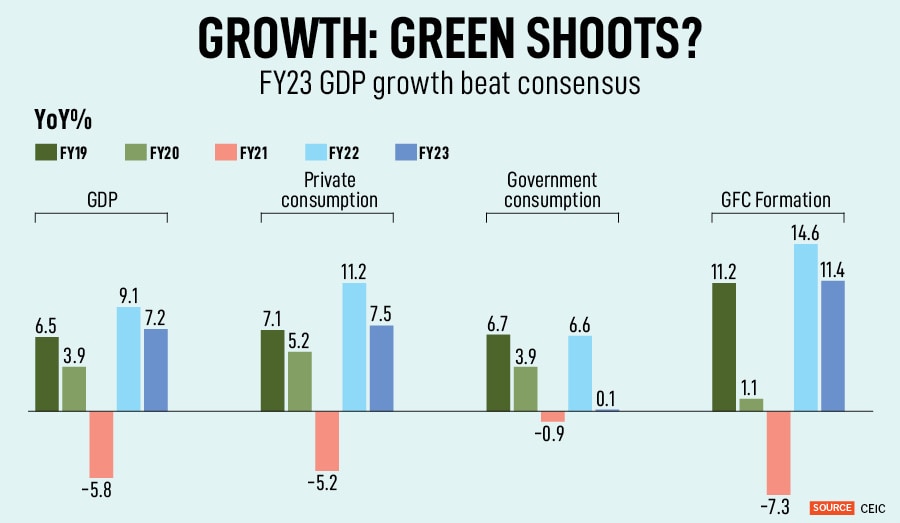

Government spending and the strongest quarter-on-quarter investment growth in 23 years helped real GDP to rise to 6.1 percent in the January-March quarter and 7.2 percent for FY23.

Image: Niharika Kulkarni/NurPhoto via Getty Images

Government spending and the strongest quarter-on-quarter investment growth in 23 years helped real GDP to rise to 6.1 percent in the January-March quarter and 7.2 percent for FY23.

Image: Niharika Kulkarni/NurPhoto via Getty Images

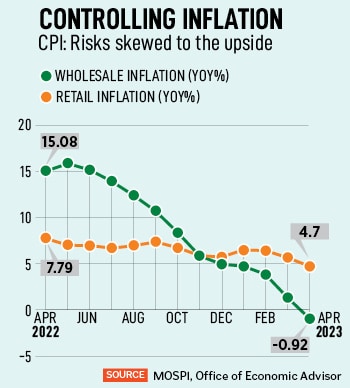

The Reserve Bank of India’s (RBI) year-long battle to rein in inflation—within its target of 4 percent with a margin of plus or minus 2 percent—has borne results for weary policymakers. In April, retail inflation cooled off to 4.7 percent from 7.8 percent in the year-ago period. To control inflation, in FY23, the benchmark interest rate was raised by 2.5 percentage points, and this exerted a toll on growth. But a GDP growth rate of 6.1 percent in the January to March period sprung an unexpected surprise as it beat market estimates and pushed growth to 7.2 percent for FY23.

On the face of it, this puts the Indian economy in a Goldilocks situation: Strong growth momentum and low-price inflation. It is during such times that the RBI’s six-member rate-setting team will meet for its bi-monthly credit policy deliberations between June 6 and 8.

Most analysts and economists believe the Monetary Policy Committee (MPC) will keep the benchmark repo rate on hold at 6.5 percent. There is a clamour for rate cuts from India Inc but the central bank is unlikely to relent. Rather, the discussions are likely to weigh on the central bank’s stated policy stance of “withdrawal of accommodation”.

Santanu Sengupta, Goldman Sach’s chief India economist, believes there is considerable uncertainty around the commodity prices path and global growth and expects a status-quo on rates till December. “We expect the domestic banking system liquidity to remain flush, with the RBI’s decision to withdraw Rs2,000 notes, the recent variable rate repo auction, and our view of a flat balance of payments this year. Given this, the RBI is likely to retain the liquidity tightening stance, as signaled by the comment that the MPC will remain focussed on withdrawal of accommodation,” he adds.

Deepak Agrawal, CIO-debt, Kotak Mahindra AMC, points to the prevailing ambiguity surrounding the future path of the US Federal Reserve’s decision on interest rates in the coming months and expects a dovish tone from the MPC to signal that the rate cycle has peaked. He explains, “India is in a Goldilocks situation with strong GDP data, cool-off in inflation. The forthcoming decision of the MPC transcends the usual deliberations of interest rate hikes or pauses. Instead, it hinges on whether the MPC will pivot towards a ‘neutral’ stance or persist with the current stance of ‘withdrawal of accommodation’.”

![Top 20 countries with largest gold reserves [2023] Top 20 countries with largest gold reserves [2023]](https://images.forbesindia.com/media/images/2023/Dec/img_223933_goldreservesbycountry.jpg?impolicy=website&width=122&height=70)

Monsoon in Kerala—which normally begins from June 1—missed its June 4 deadline. Now, the IMD expects it to be delayed by two to three days and warns that low-pressure conditions may impact its progress. “This will have an impact on domestic food prices and rural demand. The RBI will await more details on status of actual rainfall before taking any action,” says a Bank of Baroda report.

Monsoon in Kerala—which normally begins from June 1—missed its June 4 deadline. Now, the IMD expects it to be delayed by two to three days and warns that low-pressure conditions may impact its progress. “This will have an impact on domestic food prices and rural demand. The RBI will await more details on status of actual rainfall before taking any action,” says a Bank of Baroda report.

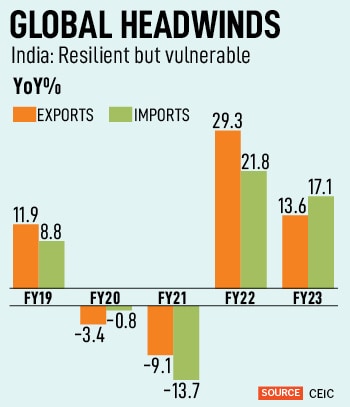

“We expect economy to moderate by 6 to 6.5 percent in FY24 against the headwinds of global economic slowdown, weaker exports, lower services sector due to waning pent-up demand and dwindling agriculture growth, assuming the monsoon is not normal or spatially distributed and aggravating heat wave conditions (El Nino). These remain key risks to our growth projections,” it states.

“We expect economy to moderate by 6 to 6.5 percent in FY24 against the headwinds of global economic slowdown, weaker exports, lower services sector due to waning pent-up demand and dwindling agriculture growth, assuming the monsoon is not normal or spatially distributed and aggravating heat wave conditions (El Nino). These remain key risks to our growth projections,” it states.