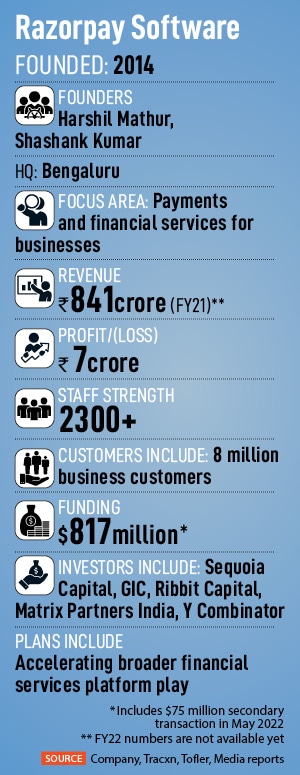

India's maturing fintech ecosystem: Five companies to watch in 2023

Each of these ventures is at a point of big change and growth over the next 12 months and beyond—from payments and lending to fintech software

Digital payments, the biggest fintech segment right now, will continue to see the strong growth of recent years, touching an estimated $153 billion in transaction value in 2023, compared with $133 billion in 2022, according to data from Statista

Image: Photo Illustration by Rafael Henrique/SOPA Images/LightRocket via Getty Images

Digital payments, the biggest fintech segment right now, will continue to see the strong growth of recent years, touching an estimated $153 billion in transaction value in 2023, compared with $133 billion in 2022, according to data from Statista

Image: Photo Illustration by Rafael Henrique/SOPA Images/LightRocket via Getty Images

As India’s innovation-with-regulation experiment in fintech enters 2023, we are likely to see companies emerge that will change how we see various aspects of finance—from loans for small purchases to financial software for large businesses. Emerging new models will likely see traction on the back of the phenomenal public-private infrastructure that is evolving in financial services, but also in the broader area of all digital services.

Digital payments, the biggest fintech segment, will continue to see the strong growth of recent years, touching an estimated $153 billion in transaction value in 2023, compared with $133 billion in 2022, according to data from Statista. Neo banking, which typically refers to fintech ventures that offer banking products and services in partnership with regulated entities, and can also include modern digital banking, will touch $65 billion in transaction value this year, versus $47 billion last year.

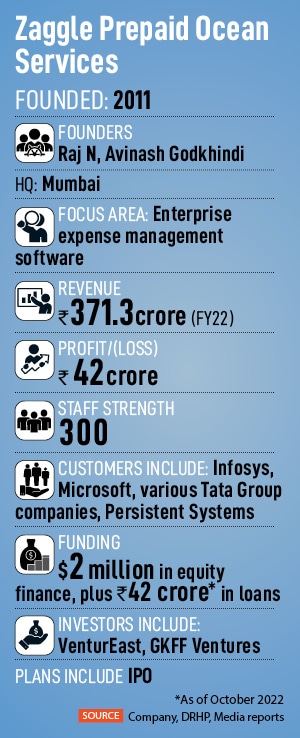

One thing about India’s fintech ecosystem is that regulation is striking a fine balance between innovation and security, says Avinash Godkhindi, co-founder and CEO of Zaggle, which offers expense management software to enterprise customers. The one-time password on the cell phone for various transactions is a simple, but great example of that, he says. The bottom line is, “people should be able to trust your platform,” he points out, and if the innovation-with-regulation approach continues to ensure that, large global fintech companies could emerge from India.

For now, here are five companies to watch in 2023, as they seek their next phase of growth.

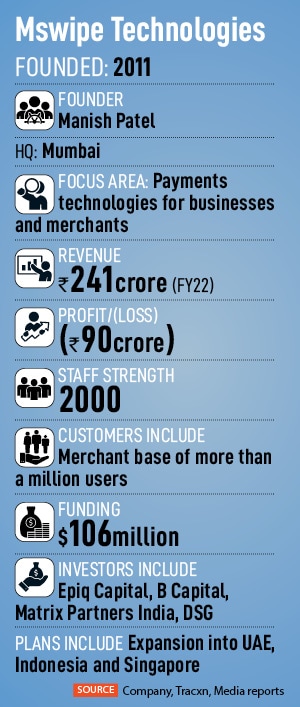

Mswipe: Taking a swipe at expansion

Ketan Patel, cofounder, Mswipe Technologies

Ketan Patel, cofounder, Mswipe Technologies

Mswipe Technologies was started more than 11 years ago, and over the course of time, “we've seen everything, survived everything, and tried to master whatever we could,” CEO

Mswipe Technologies was started more than 11 years ago, and over the course of time, “we've seen everything, survived everything, and tried to master whatever we could,” CEO  Sashank Rishyasringa (left), Gaurav Hinduja cofounders, axio finance

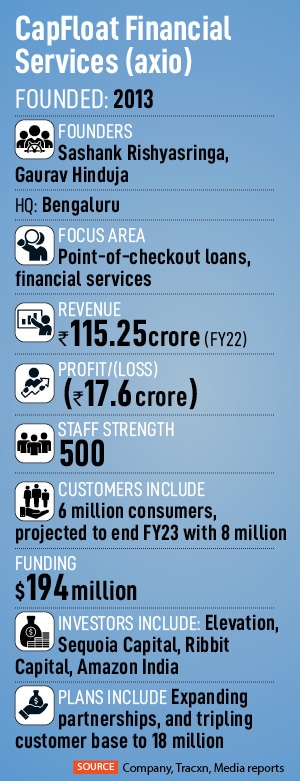

Sashank Rishyasringa (left), Gaurav Hinduja cofounders, axio finance Axio’s founders took their time finding their groove. The Bengaluru company started with a license to provide loans as a non-banking lender, and the plan was to use proprietary algorithms and processes to figure out creditworthiness and give loans painlessly and quickly.

Axio’s founders took their time finding their groove. The Bengaluru company started with a license to provide loans as a non-banking lender, and the plan was to use proprietary algorithms and processes to figure out creditworthiness and give loans painlessly and quickly.

Zaggle is a B2B2C software-as-a-service fintech company, offering its tech to enterprise customers who in turn use those solutions to digitise various financial and related processes for individual employees, such as benefits, rewards and expense management. The company also offers channel incentive management—for businesses to deal with their dealers and distributors, for example—and is expanding strongly into vendor management.

Zaggle is a B2B2C software-as-a-service fintech company, offering its tech to enterprise customers who in turn use those solutions to digitise various financial and related processes for individual employees, such as benefits, rewards and expense management. The company also offers channel incentive management—for businesses to deal with their dealers and distributors, for example—and is expanding strongly into vendor management.