Razor-sharp checkout: How Razorpay grew close to eight times in four years

Fiscal discipline, sharp B2B focus and a string of buyouts have helped Razorpay grow at a furious pace. But will the RBI's digital lending norms queer the pitch for India's most-valued fintech startup?

Left to Right: Shashank Kumar and Harshil Mathur, the cofounders of Razorpay. Bengaluru. February 2021.

Image: Nishant Ratnakar

Left to Right: Shashank Kumar and Harshil Mathur, the cofounders of Razorpay. Bengaluru. February 2021.

Image: Nishant Ratnakar

The offer sounded like a quintessential Diwali Dhamaka. Well, Harshil Mathur and Shashank Kumar can’t be blamed for thinking so. After all, who doesn’t want skyrocketing valuations and explosive growth? The logic apparently was simple. “Why don’t you guys enter BNPL [buy now pay later],” asked a curious investor last year. “Your valuation will immediately shoot up by at least 3x to 4x,” the funder underlined the new fad that had caught the fancy of venture capitalists (VCs) worldwide.

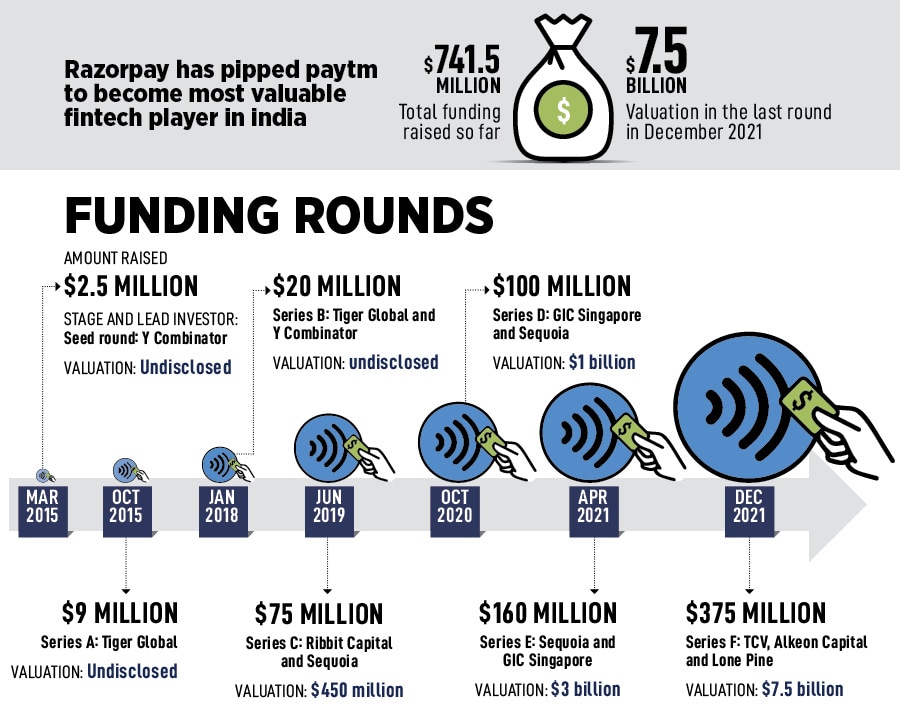

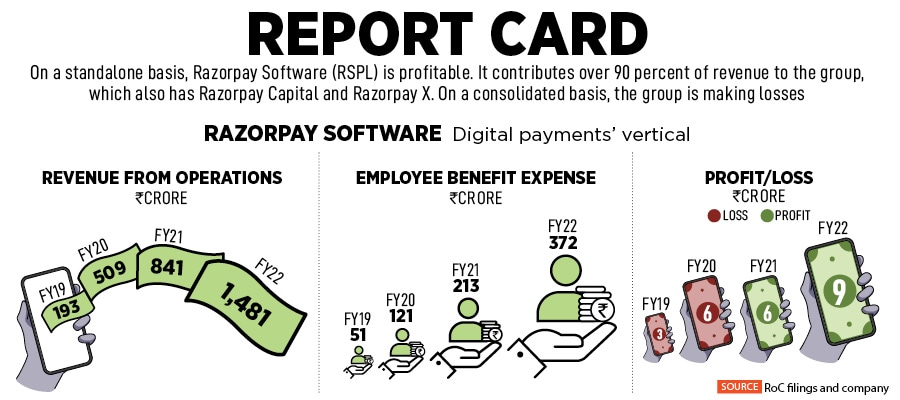

Started in 2014 as an online payments gateway for B2B ventures, Razorpay has had three rounds of funding till 2018—$2.5 million, $9 million and $20 million. The valuation, though, stayed undisclosed. In June 2019, it raised $75 million at a valuation of around $450 million. In terms of performance, the value was getting close to valuation: An operating revenue of Rs 193 crore and a loss of Rs 3 crore in FY19. “BNPL,” the investor underlined last year, “will give you heady valuation.”

Last year, indeed, was financially intoxicating. The market was flush with dollars, which meant loads of money on the table. In 2021, $32.3 billion was pumped in by investors in late-stage deals (series B and beyond) in India, according to Tracxn, a market intelligence provider of data of private companies. The comparative number for 2019, a non-pandemic year, was $8.8 billion. “Everybody is doing it. You guys must also think seriously,” stressed the VC, egging on the co-founders to join the party. Mathur and Kumar, who had scaled their payments and banking platform for businesses to Rs 841 crore and posted a standalone profit of Rs 6 crore in FY21, wondered whether they are missing out on the next big thing. “Should we get in,” was the question debated by the duo.

The second buyout—Opfin—happened towards the end of the year in November 2019. Kumar explains the trigger. “The startup perfectly fitted into our future roadmap,” he says. The big question for Razorpay, he lets on, is to consistently figure out different ways in which businesses could be served. One of the pain points was payroll management. Opfin, a cloud-based payroll management software firm, was a two-member company, had 15 to 20 customers and less than modest scale. The acquisition logic was unique. Acquisitions, stresses Mathur, are less about what exists today. “It is more about what we can build together tomorrow,” he adds.

The second buyout—Opfin—happened towards the end of the year in November 2019. Kumar explains the trigger. “The startup perfectly fitted into our future roadmap,” he says. The big question for Razorpay, he lets on, is to consistently figure out different ways in which businesses could be served. One of the pain points was payroll management. Opfin, a cloud-based payroll management software firm, was a two-member company, had 15 to 20 customers and less than modest scale. The acquisition logic was unique. Acquisitions, stresses Mathur, are less about what exists today. “It is more about what we can build together tomorrow,” he adds.