India's pulled the trump cards out of the card deck. They've got a good hand. But you can play a good hand badly: Aswath Damodaran

The finance professor and the dean of valuation on how India can learn from the economic consequences of 'overreach' in China and avoid the trap of chasing 'double-digit growth at all costs'

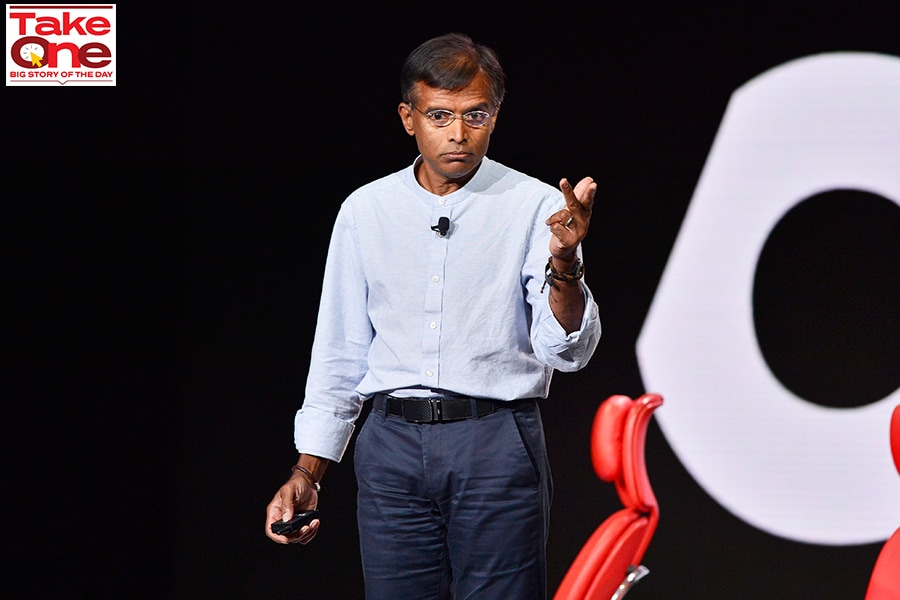

Aswath Damodaran, professor of finance, NYU Stern School of Business Image: Jerod Harris/Getty Images for Vox Media

Aswath Damodaran, professor of finance, NYU Stern School of Business Image: Jerod Harris/Getty Images for Vox Media

On Thursday, India reported a GDP growth of 7.6 percent for the September quarter which was higher than the RBI and Street estimates of 6.5 percent. Although not insulated from global headwinds, India, the world’s fastest growing major economy, has shown a high degree of resilience and is relatively better placed than most of its emerging market peers.

“India has been one of the winners because it had a combination of healthy economic growth and inflation that's not out of control,” Aswath Damodaran, a widely respected professor and investor, who is popularly known as the dean of valuation, said in a wide-ranging conversation on Forbes India Pathbreakers in August. Importantly, nearly 66 percent of India’s population of over 1.4 billion people is below the age of 35 years, and this makes India one of the most attractive markets for global companies.

However, Damodaran had a note of caution: “The danger for India is it shouldn't overreach.” In the last of a special five-part series from the interview, Damodaran, professor of finance, NYU Stern School of Business, shares his views on what India can learn from the unfolding economic chaos in China and how, for the first time in nearly twenty years, India as a democracy has an advantage over China. Edited excerpts:

Emerging markets: ‘A mixed bag’

I think emerging markets are a mixed bag. Brazil is very different from India, is very different from China. So, you almost have to name the emerging market. I don't think there's a collective statement you can make about emerging markets. Emerging markets that keep inflation in check are in much better shape than emerging markets that don't. So, I would argue that we need to start to stop bunching countries together. And this is true not just for emerging markets, but for developed markets too, and start separating countries that are being run sensibly from countries where you know the bill is going to come due. So, I think rather than bunch India with a bunch of other emerging markets with very different issues and problems, I think India has to think about what its specific problems are and what policies might be needed to kind of deal with those problems.Also read: Why India will replace China as the world's growth engine this decade