- Home

- UpFront

- Take One: Big story of the day

- Inside Vedanta's gigantic semiconductor ambitions

Inside Vedanta's gigantic semiconductor ambitions

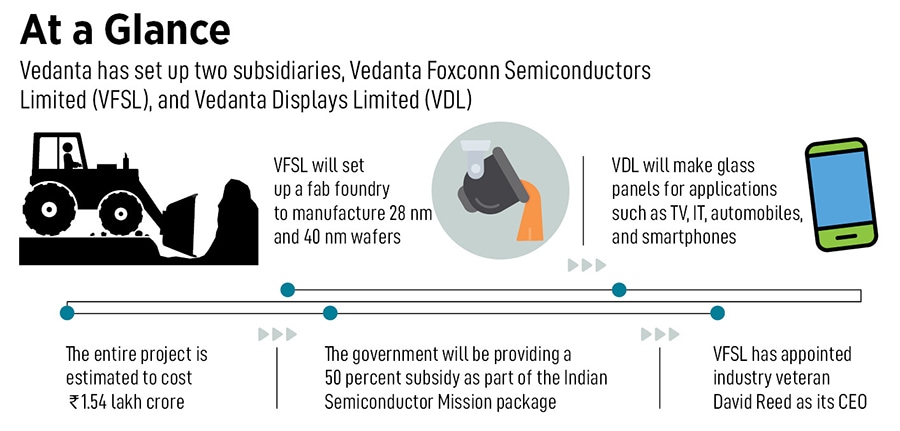

The company is betting big on a novel ecosystem to develop around India's semiconductor and glass manufacturing industries. The entire project is estimated to cost Rs1.54 lakh crore and will involve a bunch of risk takers and entrepreneurs

Manu Balachandran is a writer for Forbes India, based in Bengaluru. At Forbes India, Manu writes on automobiles, aviation, pharmaceuticals, banking, infrastructure, economy and long profiles among many others. He also moderates many of Forbes India's CEO and CXO events and hosts Capital Ideas, a podcast on the most riveting success stories from the business world. He has previously worked with Quartz, The Economic Times and Business Standard in Mumbai and New Delhi. Manu has a master's degree in journalism from Cardiff University and a degree in economics from the Loyola College. When not chasing stories, he is most likely obsessing over Formula 1 (Read: Lewis Hamilton), historical events and people, or planning long weekend drives from Bengaluru

Akarsh Kattingeri Hebbar - Global Managing Director, Display and Semiconductor. Image: Mexy Xavier

Akarsh Kattingeri Hebbar - Global Managing Director, Display and Semiconductor. Image: Mexy Xavier

For Akarsh Hebbar, the watershed moment came sometime in late 2017.

The son-in-law of metal and mining magnate Anil Agarwal, Hebbar had been carefully avoiding the lure of joining the family business since his marriage to Priya Agarwal in 2013. Instead, the 35-year-old went on to study at the London School of Business, before joining global consultancy McKinsey as an associate after a brief internship at Google.

Related stories

McKinsey became his ‘target’ primarily because it had a business technology consultancy arm, which would allow Hebbar—a confessed aficionado of technology—to work with the world’s top technology companies. “I was traveling all over the world doing that,” says Hebbar, who had previously worked with Oracle in India, Japan and Jordan.

Then, the inevitable happened. “One day, my father-in-law, says, Yeh kya professional job kar raha hai? [Why are you doing this professional job?]. Let him see our business.” To begin with, Agarwal, the chairman of Vedanta Resources, with interests spanning mining, oil and gas, and electric utility among others, tried coaxing his son-in-law into the world of mines, the mainstay of the family fortune.

“I was very bored,” Hebbar says. “What am I going to do with the mines?”

Thankfully for Hebbar, Agarwal’s ploy came up at a time when the family had set its eyes on AvanStrate Inc, a financially struggling Japanese manufacturer of LCD glass substrates. The acquisition was expected to give a fillip to Vedanta’s plans of setting up India’s first plant to make flat panel displays for televisions (TV) through its arm, Twin Star Display Technologies. Coincidentally, the billionaire had engaged McKinsey for due diligence on the asset.

“I looked at it as part of McKinsey and found it amazingly interesting,” Hebbar says. “I thought it was a pearl in the ocean and I said you should definitely go for it.” That firm tone of approval from his son-in-law, who had by then become rather obsessed with the stunning Japanese technology to manufacture thin display glasses, certainly was music to the ears of 69-year-old Agarwal. He then asked Hebbar to lead the distressed AvanStrate, which Vedanta acquired for $158 million in December 2017.

Also read: India woos semiconductor makers in quest to become key player

“The future in India is only for two or three things,” Agarwal tells Forbes India over a video call from London. “Seventy percent of our import are between natural resource and electronics. For electronics, the basic raw materials are chips and glass. So, I thought that if I can hold on to AvanStrate, I can build on that foundation.”

Today, it’s that decision that has given Vedanta enough ammunition to try and build India’s first semiconductor and glass display manufacturing facility. It has set up two subsidiaries, Vedanta Foxconn Semiconductors Limited (VFSL), which will set up a fab foundry to manufacture 28 nanometre (nm) and 40 nm wafers (slices of semiconductor material used to make integrated circuits), and Vedanta Displays Limited (VDL) that will make glass panels for applications such as TV, IT, automobiles and smartphones.

The entire project is estimated to cost Rs1.54 lakh crore, with the central government providing a 50 percent subsidy to both projects, as part of its $10 billion (Rs76,000 crore) Indian Semiconductor Mission package to promote semiconductor manufacturing in India.

Vedanta has already tied up with Taiwanese technology company Hon Hai Precision Industry, commonly known as Foxconn, for its semiconductor business. The joint venture has also brought on David Reed as the CEO of Vedanta Foxconn Semiconductors Limited. Reed, an industry veteran with over three decades of experience, previously worked with Dutch chip company, NXP Semiconductors, and GlobalFoundries.

“Semiconductor chips are the brains of every device,” explains Hebbar, who is now the global managing director of Vedanta’s semiconductor and display business. “We're also looking at the display ecosystem, which are the eyes of everything. Together they make up 60 percent of any electronic device. With our project, we are becoming the nucleus for electronic manufacturing.”

What’s Vedanta’s plan?

Minister of Electronics and Information Technology Ashwini Vaishnaw had said last August that a decision on semiconductor approvals often takes between 14 and 16 months. By that estimate, the Indian government, which accepted applications in January 2022, is likely to give project approvals in the next few months.Therefore, Vedanta reckons its applications are in their last mile run, even as it has almost firmed up land for its project in Gujarat. “We are going ahead,” Agarwal says. “Land has been allotted and the partnership with Foxconn has been tied up.”

On its part, Vedanta says it has met all the criteria laid out by the government. Vedanta holds a 63 percent stake in the semiconductor project, while Foxconn holds the remaining. The partnership, a first-of-its-kind in India, was stitched on mutual trust, and a strong belief by Foxconn that Vedanta is swift with their act, Agarwal says. “There cannot be two drivers on a car,” Agarwal says. “Young Liu, (Foxconn’s chairman) suggested that, because you are the son of the soil, you drive the car, and we'll sit by the side. They will take full responsibility on the technology side.”

“We realised very early on that what Vedanta has, Foxconn doesn't, and what Foxconn has, Vedanta doesn't,” Hebbar explains. “We have different revenues and different business streams. The forte that we have in manufacturing and business in India and the forte that they have in the technology ecosystem are complementary to each other.” Foxconn will be fully responsible for the operations and sales, and also the entire technology of the project.

Besides, the partnership is looking to acquire new licenses as quickly as it can as semiconductor technology undergoes a significant shift. “Semiconductor is such a business that we're acquiring production licenses every single day,” Hebbar says.

Also read: Why isn't Apple worried about Taiwanese chips?

Foxconn has roped in a technology partner with a production-grade licence and expertise in manufacturing, as per government requirements. Vedanta, however, doesn’t want to divulge details about this company, although there were rumours of talks with STMicroelectronics. The company has also roped in Terry Daly, an IBM veteran and former senior vice president at GlobalFoundries, as an advisor for its semiconductor business.

“We have a very strong partner whose name we will reveal later, but they are a high volume, industrial automotive grade, 40 nm technology player,” Hebbar says. “When you're talking about automotive grade and industrial grade, you are surpassing every other grade, because of the safety nature of automotive.”

VFSL’s integrated semiconductor fab foundry will have the capacity to manufacture 40,000 wafers per month to cater to mobiles, consumer electronics, automotives, and network equipment. “We have got the technology partner, we have got the technology agreements, the definitive agreements, and submitted them to the government,” says Hebbar. “As our application gets processed, it will go through the most stringent process, to make sure we are not only the first but also the example for 10 more companies to come.”

“I liken this (project) to a Wernher von Braun moment [father of space travel] for India,” says Reed, who has recently made the shift to India. “This is an opportunity to bring the world's best talent from around the world, and everybody's interested in the world's first Indian production wafer plant.”

David W. Reed, CEO Vedanta Semiconductor. Image: Amit Verma

David W. Reed, CEO Vedanta Semiconductor. Image: Amit Verma

Also read: Will India's PLI Scheme help it transform into a semiconductors powerhouse?

Meanwhile, in its glass display business, Vedanta has tied up with Taiwan-based InnoLux Corporation as its partner. The Taiwanese company was already AvanStrate’s client, which made the partnership an easy one to stitch. VDL will focus on Gen 8.6 A-Si IPS fabs, including glass, panel, and module with a per-month capacity of 60,000 sheets and 10 nm modules to cater to TV, IT, automobiles and smartphones.

“India has 25 percent of the world's population, which means there is captive demand,” Hebbar says. “Our import bill for electronics was $53 billion, about two-and-a-half years ago, but now it's close to $100 billion and that's going to become $400 billion by 2026-27. We are making this in India because we have the required assets. India is going to be the fifth country in the world that's going to have this ecosystem.”

The big semiconductor focus

Despite Vedanta’s glass display ambitions and expertise, all eyes are on its semiconductor business, primarily because of the ongoing shortage of semiconductor chips. “Between 2016 and 2020, the consumption of semiconductors doubled in India,” Hebbar says. “It was about $12 billion, which became $20-25 billion, and that is going to double again in the next few years and by 2030 will be $80-100 billion.”The global semiconductor shortage was further aggravated by the Covid-19 pandemic, largely due to supply chain disruptions, with companies in Taiwan and South Korea shutting down, and demand for new devices soaring. This made global companies look at a diversified supply chain to combat the crisis.

Also read: How the global chip shortage is creating new power players

Semiconductors are critical components in consumer electronics. In vehicles, for instance, they are the mainstay of control and entertainment systems, and domestic automakers have faced severe production delays in the past few years. “At the height of the chip shortage, global auto production slumped 26 percent during the first nine months of 2021,” says a JP Morgan report.

Vedanta has now signed Memorandums of Understanding (MoU) with companies in Japan and South Korea, and reckons that an $80 billion ecosystem across semiconductors and display units can be built once Vedanta starts operations. What gives the company confidence about its plan is also its target of manufacturing 40 nm chips, which it believes will eventually help it make 28 nm chips, since the process is similar; 40 nm and 28 nm chips contribute to over 66 percent of the global demand for chips and are used in ICT devices and electric vehicles (EV), among others.

“Eighty to 85 percent of the 40 nm process is used in the 28 nm process,” Hebbar says. “Foxconn is an expert in this. They are not just the technology transfer company or assembly and test company. They're an industry transfer company. They will also bring the entire industry with them. They've done that in China, they're going to do it in India.”

Then there is the massive captive demand that the joint venture is looking to tap into. India, according to Hebbar, does not require chips lower than 22 nm, such as those used in high-end phones such as iPhones. “I think we are making about 250 million smartphones, about 30 million TVs, and another 25 to 30 million notebooks. These all are not the highest-grade technologies,” he says. “We are making sure that we have a tried-and-tested technology and the market for it.”

Also read: Diversification away from Taiwan chipmakers is necessary

“Electronic imports worth $300 billion are next only to oil,” says Tarun Pathak, research director with Counterpoint Technology Market Research. “Vedanta can tap into that opportunity especially since government policies have become attractive. What they need to do is pitch their battle well and identify the focus areas. For now, they are rightly focusing on the older nodes which constitute 66 percent of the semiconductor demand. That was also where the shortage had happened. Now as companies want to de-risk from their focus on one country, India can offer a cost-effective alternative.” Counterpoint reckons that India’s semiconductor component market will see its cumulative revenues climb to $300 billion during the 2021-2026 period.

Alongside, Vedanta’s focus on display panels will allow manufacturers, especially new ones, to step forward and build their TVs, notebooks or mobile phones within the country, giving a big fillip to medium- and small-scale enterprises. “We are going to go through the same phase that China went through,” Hebbar says. “We will be able to build our own Oppo and Vivo. This is the kind of movement that we are going to bring about.”

But fuelling Vedanta’s grand ambitions won’t be cheap by any means. The project, which costs Rs1.54 lakh crore, will be partially funded by the government through its subsidy. State governments are also expected to dole out another 20 percent through various programmes, which significantly reduces the capital cost. Vedanta had been recently hit hard by its ballooning debt concerns, which had affected its liquidity, although the company has managed to pare it down by almost a billion dollars.

“Today, across the world, $3 trillion fund is available and not even 20 precent has been deployed for infrastructure or for semiconductors,” Agarwal says. “We will put 30 percent equity which we are comfortable with, and there will be a queue of people for the rest, because these kind of projects are not there in the world. There is enough water in the well for these kind of projects.”

“One of Vedanta's strengths is that we've raised $35 billion in the past,” Hebbar says. “And this is business as usual for us. All the banks know what our credibility is. We've never defaulted. We know how to make this project strategic business-wise. We want to be the first foundry, but we don't want to be the only foundry. India can develop about 20 to 30 foundries for its captive demand before it even thinks about exporting.”

Also read: How to lay the solid foundation for semiconductor fabrication in India

Besides, success in the semiconductor manufacturing business is also likely to help the company diversify into the outsourced semiconductor assembly and test (Osat) arena. Osats are companies that provide packaging and testing for silicon devices manufactured by foundries before their shipment to the market. “So, we are developing more downstream methodology,” Hebbar says,

Where does Vedanta go from here?

For now, if everything goes according to plan, Vedanta foresees revenues from its semiconductor business starting in 2027. The company intends to start commercial production with 5,000 units of its 40 nm wafers, before going on to 15,000 units, and finally getting into 28 nm wafers. “From displays, revenues could come even earlier in 2025 end or 2026,” Hebbar says.The company is working simultaneously on setting up its facility and hiring people, including expats with the right technical know-how. While it has identified Dholera in Gujarat as its primary location, it is also assessing other locations to make the project cost-effective. “Gujarat has very kindly offered to make the entire setup at Dholera conducive for our semiconductors,” Hebbar says. “But before we sign the final agreement with Gujarat, we'll have to have negotiations on land requirements and costs.”

In the glass display business, Vedanta claims to have tried-and-tested Gen 8 technology, and LCD technology for India, which is relevant for the next 10 to 15 years. Already, Hebbar says, AvanStrate is only one of four companies with the base glass-making capacity in the world, and its partner InnoLux makes automotive displays for the likes of Tesla.

Also read: The tech cold war's 'most complicated machine' that's out of China's reach

All that means Vedanta is now betting big on a novel ecosystem to develop around India’s semiconductor and glass manufacturing industries, with what Hebbar believes will be “bunch of risk takers and entrepreneurs who will come in” to build new products. “It is being created bigger than Silicon Valley,” Agarwal says. “It is the heart, and from that, it will pump into so many areas.”

Then there is also the potential that the sunrise sector offers in creating jobs. Already, Reed says there is significant interest from top talents across countries such as Japan, South Korea, Taiwan, Singapore, Malaysia, Europe, the US, Canada, and Mexico, who are keen to join the plan to build India’s first semiconductor foundry.

“We are looking at about 80,000 to 100,000 jobs being generated,” Hebbar says. “And this is just related to semiconductors and glass. When you're looking at MSMEs, you're looking at a higher number.” That’s because Vedanta expects India to have over 1,000 MSMEs who could be direct beneficiaries of semiconductor and display glass manufacturing, in addition to giving a boost to local technology transfer.

“This is not a five-year project,” Hebbar says. “This is not a 10-year project. It's a 20-year stabilisation of the entire semiconductor industry in India and this is the start of it.”

“What’s different this time, unlike in the past, is that the government appears to be more committed,” says Yugal Joshi, partner at Texas-based research firm Everest Group. “Today, while there is a growing sensitivity towards being self-reliant in the semiconductor space across Europe or the US, it may not be 100 percent possible. The industry is also cyclical with constraints and oversupply across various categories. India, meanwhile, should offer Vedanta with a captive market.”

The new opportunity also allows Vedanta to position itself strongly as a global technology company. “Vedanta is very focussed on making sure that we have a starting point, which is making 60 percent of the electronics,” Hebbar says. “But we can go downstream and start making phones or TVs. We make nickel, which means we have the raw material for EV batteries. We can acquire lithium when it comes. We're doing our evaluation to go into other businesses. This will be a new age business vertical.”

So, is Vedanta looking to capitalise on the first-mover advantage once its approvals come through? “We are not here to occupy the whole pie,” Hebbar adds. “There's enough pie for people to share. It will be a miss if India doesn’t take an opportunity like this and immediately capitalises on it.”