IPO analysis: After unlocking, will it be time to unload?

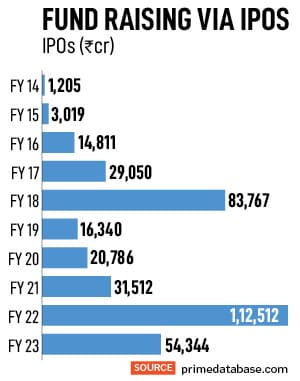

Pre-listing shareholders' lock-in will open for 33 companies in April-July, creating further volatility, while IPO fund raising almost halved to Rs 52,116 crore in FY23

With the lock-in period of a few companies that raised funds through initial public offerings (IPO) is expiring for various categories of shareholders, stocks worth Rs 61,338 crore stand the risk of sell-offs in four months starting April. This is assuming all shareholders start dumping these stocks as soon as the Sebi-mandated lock-in period expires. Typically, companies feel the selling pressure, with a sharp swing in stock prices, after shareholders start selling them in tranches following the lock-in expiry, post listing on the exchanges.

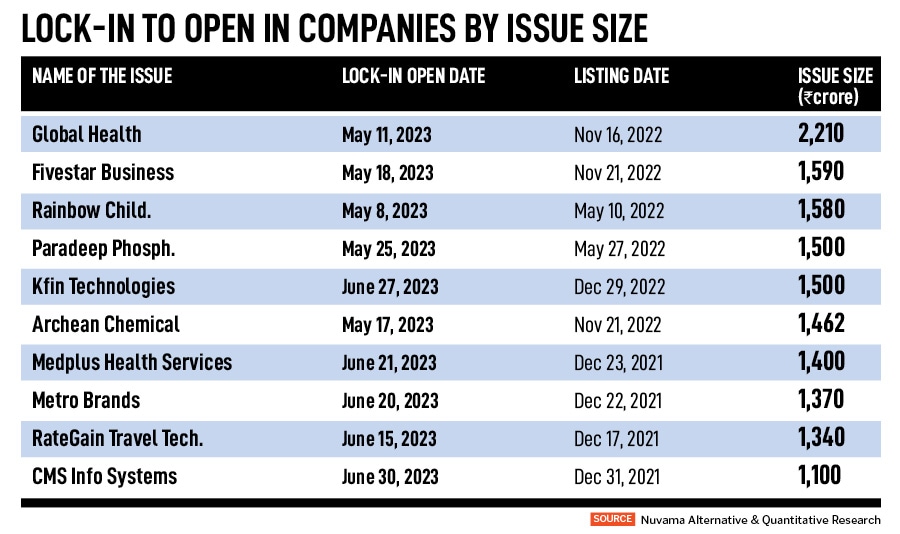

Pre-listing shareholders’ lock-in will open for 33 companies in the April-July period, which may knock off shares worth Rs 61,338 crore, based on an analysis by Nuvama Alternative & Quantitative Research. The analysis considers the closing price of all the stocks as on March 31. These companies had collectbively raised Rs 31,550 crore, and include Global Health (Medanta), Five Star Business Finance, Bikaji Foods, Inox Green, Paradeep Phosphates, RateGain Travel Technologies and KFin Technologies.

As per the analysis, five companies—Radiant Cash Management, Divgi TorqTransfer Systems, Sah Polymer, Electronics Mart, and Kaynes Technology—will see their lock-in period opening in April, while 15 will open in May.

Of the stocks under analysis, there are three that have gained over 100 percent over its issue price. Till March end, the share price of Hariom Pipe has seen a bumper rally, surging 221 percent over its issue while its listing gains were 51 percent. Data Patterns’ (India) share price zoomed 131 percent, after a listing gain of 29 percent, while Venus Pipes has jumped 123 percent, with listing gains of 9 percent.

Then, there are those that have lost too. The share price of AGS Transact Technologies slipped 74 percent till March end over its issue price. Elin Electronics shed 52 percent over its issue price, while on the listing day it fell 8 percent. DCX Systems fell 31 percent since its listing, but gained 49 percent on its day of listing.

Anchor investors collectively subscribed to 32 percent of the total public issue amount, while qualified institutional buyers (including anchors Investors) as a whole subscribed to 59 percent of the total public issue amount.

Anchor investors collectively subscribed to 32 percent of the total public issue amount, while qualified institutional buyers (including anchors Investors) as a whole subscribed to 59 percent of the total public issue amount.