ITC to spin-off cash-guzzling hotel business: Why aren't the shareholders euphoric?

Post-listing of the hotel business, ITC's balance businesses are expected to garner better return ratios, but there are concerns on the new subsidiary and what happens to British American Tobacco's holding in the long run

The board of ITC has given an in-principal approval to demerge the hotels business into a wholly-owned subsidiary.

Image: Shutterstock

The board of ITC has given an in-principal approval to demerge the hotels business into a wholly-owned subsidiary.

Image: Shutterstock

Even as ITC has finally decided to spin off its cash-guzzling business of hotels into a separate segment, analysts do not see it as much of a gamechanging strategy for the fast-moving consumer goods (FMCG) company, which draws its majority of revenues by selling cigarettes. Though there are a few concerns that have clouded the stock, post-listing of the hotel business ITC’s balance businesses are expected to be able to garner better return ratios, which would increase its profitability.

“We seek clarity on the rationale behind retaining 40 percent stake in the new entity, the royalty structure, any tax implications and the key criteria for a strategic investor, partner or collaborations in the business,” says Nitin Gupta, analyst, Emkay Global Financial Services. However, Gupta maintains a positive outlook and sees a K-Shaped recovery in ITC’s ‘other FMCG’ business.

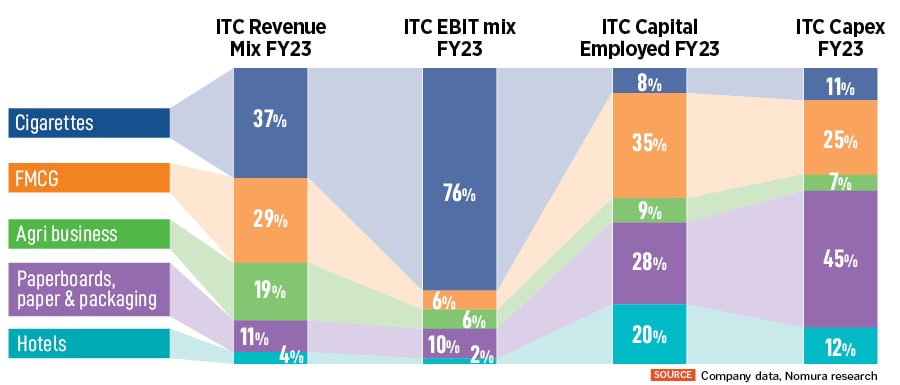

Others concur the demerger will create value-unlocking and improve the balance sheet of ITC, along with capital allocation and return on capital employed (RoCE). The hotel business share in revenue and EBIT was 4 percent and 2 percent in FY23 respectively, accounting for 20 percent and 12 percent of the overall capital employed and capex in FY23.

“In the financial year 2023, hotels segment RoCE stood at 9.6 percent while ITC's total segment RoCE was at 34.5 percent. Excluding the hotel business, its total segment RoCE improves to 37 percent,” says Mihir P Shah, analyst, Nomura. The financial term RoCE is used to typically assess a company's profitability and capital efficiency and helps to understand how well a company is generating profits from its capital as it is put to use.

ITC’s hotels business’ average annual capex pre-Covid was Rs 600-700 crore, while capex over FY21-23 moderated to Rs 200 crore as it moved to an asset-right model.

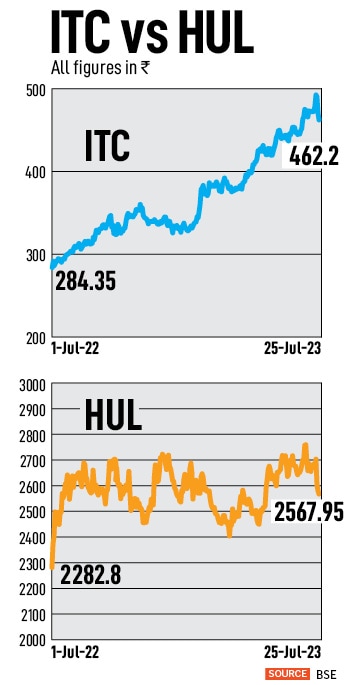

On July 20, ITC market capitalisation had hit a milestone of Rs 6 lakh crore, rising over 50 percent in a year. With a market cap of Rs 6.22 lakh crore, ITC had moved ahead of HUL at Rs 6.12 lakh crore. However, at current levels, ITC’s market cap stands at Rs 5.89 lakh crore while HUL is still above Rs 6 lakh crore.

On July 20, ITC market capitalisation had hit a milestone of Rs 6 lakh crore, rising over 50 percent in a year. With a market cap of Rs 6.22 lakh crore, ITC had moved ahead of HUL at Rs 6.12 lakh crore. However, at current levels, ITC’s market cap stands at Rs 5.89 lakh crore while HUL is still above Rs 6 lakh crore.