Last MPC meeting of 2022: RBI unlikely to pause rate hikes

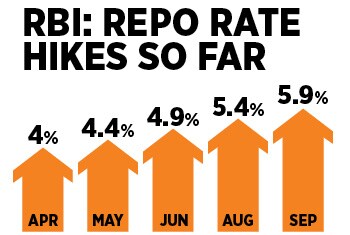

Since May the Reserve Bank's Monetary Policy Committee has hiked the benchmark rate by 1.9 percent. Economists and market watchers expect a repo rate hike of at least 35 basis points next week

RBI governor, Shaktikanta Das

Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

RBI governor, Shaktikanta Das

Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

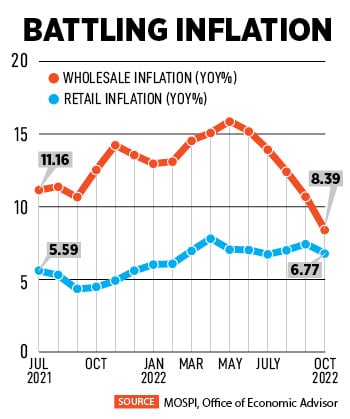

A lot changes in one year. This time last year, the Reserve Bank of India chose to look the other way despite firm signs of rising retail and wholesale price levels. A few economists and market veterans the author interacted with a year ago dismissed the alarming trend as “transient”. What other option does the central bank have, they argued. But many economists feared that inflation—as we at Forbes India also wrote—was very much the elephant in the economy.

At that time, Shaktikanta Das, RBI governor, had asserted the central bank would do whatever it takes to support durable recovery. “Overarching priority at this juncture (is) to broaden the growth impulses,” Das said in the last credit policy meeting of 2021.

However, after nearly two years of unprecedented liquidity and low interest rates to battle a once-in-a-lifetime pandemic, central banks worldwide found themselves with a bigger problem to solve. On the one hand, nations had to revive economic growth after months of lockdowns and Covid-related social restrictions. Plus, countries had to rein in rampant inflation. The means to achieve one goal required sacrificing the other.

Spurred by the US Federal Reserve’s move to hike benchmark rates to arrest 40-year high inflation levels, Das, after months of muted policy response, cracked the whip on rising prices in an off-cycle emergency MPC meeting in May. Until then, ironically, interest rates stood at a historic low of 4 percent, inflation hovered around 7 percent, but growth was stunted with feeble signs of recovery.

Spurred by the US Federal Reserve’s move to hike benchmark rates to arrest 40-year high inflation levels, Das, after months of muted policy response, cracked the whip on rising prices in an off-cycle emergency MPC meeting in May. Until then, ironically, interest rates stood at a historic low of 4 percent, inflation hovered around 7 percent, but growth was stunted with feeble signs of recovery.

“There is the collateral risk that if inflation remains elevated at these levels for too long, it can de-anchor inflation expectations which, in turn, can become self-fulfilling and detrimental to growth and financial stability,” Das announced in May.

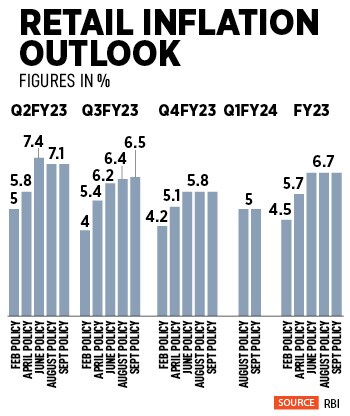

“The average CPI in India for FY24 is expected in the band of 5.00-5.25 percent. We expect 35 basis points hike in the December policy, along with change in monetary policy stance from ‘withdrawal of accommodation’ to ‘neutral’ indicating further action to be data dependent. Post this hike, the overnight rates in India would have increased by approx. 300 basis points during CY22,” says Deepak Agarwal, CIO (debt), Kotak Mahindra AMC.

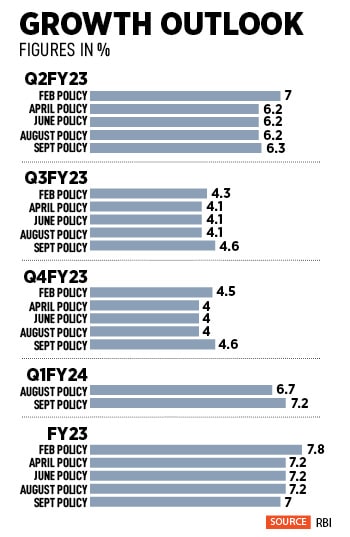

“The average CPI in India for FY24 is expected in the band of 5.00-5.25 percent. We expect 35 basis points hike in the December policy, along with change in monetary policy stance from ‘withdrawal of accommodation’ to ‘neutral’ indicating further action to be data dependent. Post this hike, the overnight rates in India would have increased by approx. 300 basis points during CY22,” says Deepak Agarwal, CIO (debt), Kotak Mahindra AMC. Nomura says India’s growth rate cycle has peaked and a broad-based slowdown is underway. “While lower inflation should help support private consumption in coming months, the lagged effects of tighter financial conditions and weak global demand will weigh on both investment and exports, while the post-pandemic catch-up in services is largely complete. We expect GDP growth to slow from 6.8 percent y-o-y in 2022 to a below-consensus 4.7 percent in 2023,” its economists say.

Nomura says India’s growth rate cycle has peaked and a broad-based slowdown is underway. “While lower inflation should help support private consumption in coming months, the lagged effects of tighter financial conditions and weak global demand will weigh on both investment and exports, while the post-pandemic catch-up in services is largely complete. We expect GDP growth to slow from 6.8 percent y-o-y in 2022 to a below-consensus 4.7 percent in 2023,” its economists say.  Moreover, GST collections have been strong, averaging Rs 1.49 lakh crore on a monthly basis. In fact, October reported the second highest level at Rs 1,51,718 crore, according to government data. Furthermore, the capex cycle has picked up, and private enterprises, reportedly, are ready to increase investments. RBI data suggests corporate bank loans increased to 12.6 percent versus 1.7 percent on a y-o-y basis.

Moreover, GST collections have been strong, averaging Rs 1.49 lakh crore on a monthly basis. In fact, October reported the second highest level at Rs 1,51,718 crore, according to government data. Furthermore, the capex cycle has picked up, and private enterprises, reportedly, are ready to increase investments. RBI data suggests corporate bank loans increased to 12.6 percent versus 1.7 percent on a y-o-y basis.