Made in India, sold worldwide: How India is becoming an export hub for passenger vehicles

From Ford to Suzuki and Kia Motors, foreign carmakers are increasingly manufacturing a range of passenger vehicles in India to export to newer, more advanced markets

Rahul Bharti, executive director, corporate affairs, Maruti Suzuki India

Image: Madhu Kapparath

Rahul Bharti, executive director, corporate affairs, Maruti Suzuki India

Image: Madhu Kapparath

In September, when Ford Motor Company announced its intention to reopen its Chennai plant—it had stopped operations in 2021—primarily for exports, the development grabbed headlines. Although the American automaker has not revealed details of its plans, there have been news reports of the company exploring options in the light commercial vehicle and pick-up segments, in both internal combustion engine and electric options. There have also been news reports of potential partnerships with other automakers, with Volkswagen being named as a possible candidate. Ford declined to comment for this story.

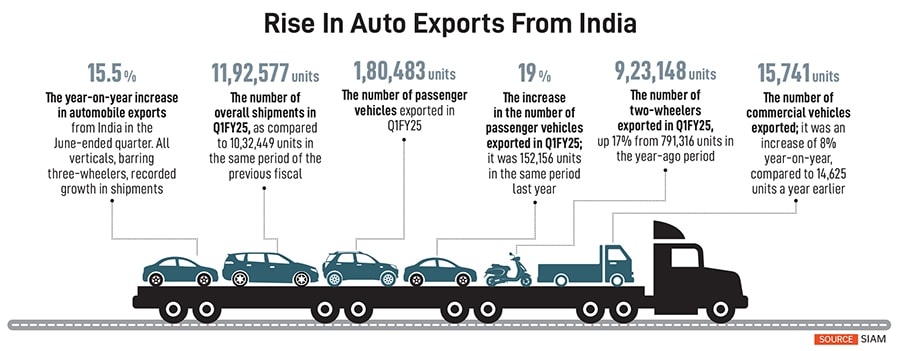

Ford’s announcement brought into the limelight, once again, the various factors that have contributed to the uncertain performance of European and American carmakers in the highly price-sensitive and competitive Indian automobile market. However, Ford’s announcement also puts the spotlight on the emergence of India as an export hub for foreign carmakers. Whether it is Maruti Suzuki, which entered the Indian market in 1981, or Kia Motors, the youngest kid on the block that entered India in 2017, exports are becoming an increasingly significant part of their strategies, and revenues. While Indian exports have conventionally been sent to markets in Africa and Latin America, Japanese carmakers such as Honda and Maruti (58 percent of its equity is held by the Japanese Suzuki Motor Corporation) are now exporting passenger vehicles to their home country as well, marking a shift away from a general perception that Indian products were not good enough for developed markets.

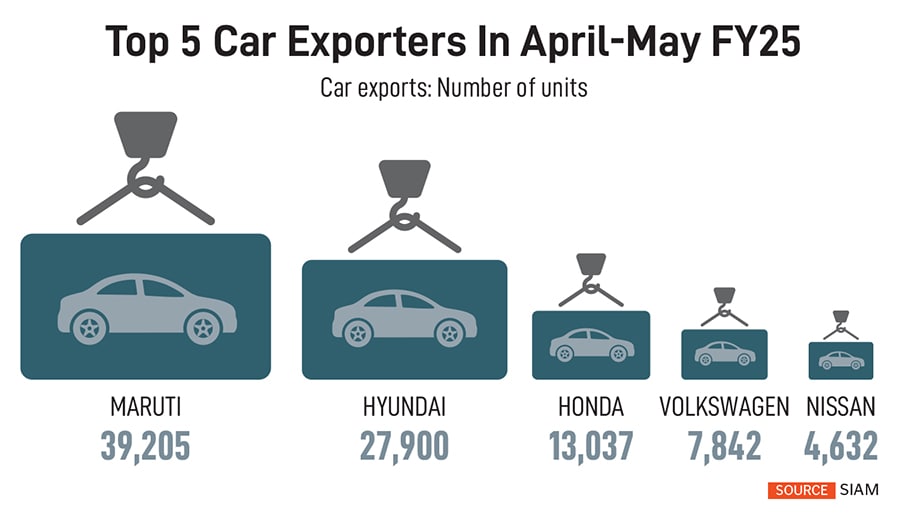

“In 2024, the number of cars exported from India was about 6.7 lakh units,” says Hemal Thakkar, senior practice leader and director, Crisil. “Exports have increased as a total percentage of sales, to 15 to 16 percent.” He adds that earlier, more than 50 to 60 percent of exports comprised hatchbacks, whereas about 20 percent was SUVs; today, SUVs comprise about 40 percent of exports.

Maruti Suzuki—the largest exporter of passenger vehicles from India (see box)—had been exporting vehicles to Europe since 1987-88, but this had remained a small number of units and had never gone mainstream. “Given the vision of Prime Minister Narendra Modi’s Viksit Bharat programme, we realised that the ambition cannot be fulfilled by domestic demand alone. India has to take a larger share of the global market, which is by exporting more. And it became clear to us, whether it is for India or for our own business, we have to export more and we have to grow it exponentially,” says Rahul Bharti, executive director, corporate affairs, Maruti Suzuki India Limited (MSIL).

(This story appears in the 01 November, 2024 issue of Forbes India. To visit our Archives, click here.)