Mamaearth's parent valuations fair play?

The digital-first BPC brand aims to raise around Rs 1,701 crore via IPO, with a price band of Rs 308-Rs 324 a share. Will the new valuations fetch fresh investors for Mamaearth's parent in primary markets?

Varun Alagh, co-founder & CEO; Ghazal Alagh, co-founder & CIO, Honasa Consumer Ltd. Image: Madhu Kapparath

Varun Alagh, co-founder & CEO; Ghazal Alagh, co-founder & CIO, Honasa Consumer Ltd. Image: Madhu Kapparath

Even as Honasa Consumer, which owns the flagship brand Mamaearth, has stripped its valuations to raise funds via the initial public offering (IPO) route, not all are convinced. It is pegged roughly at a valuation of $1.2 billion (Rs 10,000 crore) in its current form, which is much less than what the company had earlier projected, at $3 billion (Rs 24,000 crore), in its draft red herring prospectus (DRHP) last December. Its current valuation is similar to its fundraising in January 2022, when the company was valued at $1.2 billion.

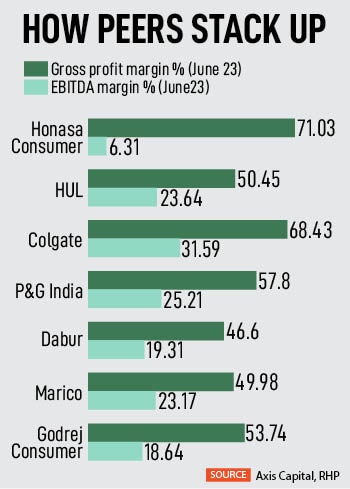

“Based on its annualised FY24 earnings per share, the IPO appears to be aggressively priced at 97 times, discounting all immediate positive factors and seems like the company is leveraging its proven track record to justify a premium valuation,” say analysts at brokerage firm BP Equities. They explain that along with its recent profitability, Honasa’s ongoing struggle to fortify its bottom line and ensure sustainable earnings growth demand cautious consideration. Honasa generates the bulk of its business from Mamaearth, with its revenue dependence at 82 percent in FY23, which is concerning and high risk, say analysts.

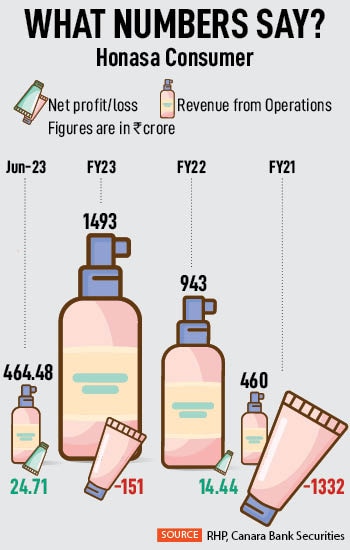

Honasa Consumer posted a net loss of Rs 151 crore in FY23 compared to a net profit of Rs 14.44 crore in FY22. It had closed FY21 with a net loss of Rs 1,332.21 crore. In the latest available financials, for the three months ending June, it reported a net profit of Rs 25 crore. Its revenue has grown at a CAGR of 80 percent over FY21-23, with a volume growth of 102.28 percent. As on FY23, it has an adjusted Ebidta of 3.4 percent, with negative working capital due to its asset light model.

The digital-first beauty and personal care (BPC) brand aims to raise around Rs 1,701 crore, with a price band of Rs 308-Rs 324 a share. The offer consists of a fresh issuance of shares worth Rs 365 crore, and an offer-for-sale (OFS) of 4.13 crore equity shares by promoters and investors. The issue will be open for subscription from October 31 to November 2.

Based on the upper band of the price, Nitin Gupta, analyst at Emkay Global Financial Services, considers three scenarios to assess its valuations. He finds valuations of Honasa Consumer expensive, in a scenario where revenue CAGR would be 10 percent with Ebidta margin at 6 percent. For Gupta, the valuation looks attractive in a scenario where the company looks to double its turnover in the next three years, while it looks fair when the company would register a 20 percent revenue CAGR with Ebidta margin at 10 percent.