March quarter earnings show green shoots, monsoon key for consumption revival

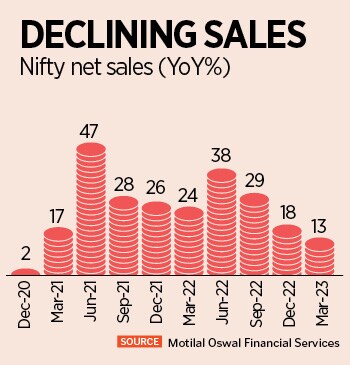

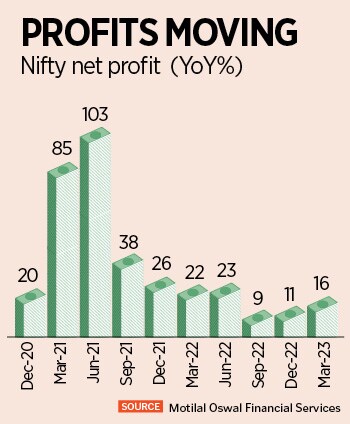

Aggregate net profit of Nifty companies grew 16 percent while net sales jumped 13 percent in the March quarter. Manufacturing companies fared well, the ones exposed to consumption and outsourcing faced demand-related challenges

Aggregate net profit of Nifty companies, excluding the financial sector, improved 7 percent year-on-year in March quarter. This compares to a nil growth in the preceding three months and a 16 percent growth in the March quarter of FY22.

Image: Shutterstock

Aggregate net profit of Nifty companies, excluding the financial sector, improved 7 percent year-on-year in March quarter. This compares to a nil growth in the preceding three months and a 16 percent growth in the March quarter of FY22.

Image: Shutterstock

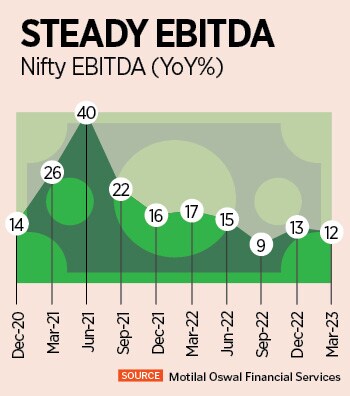

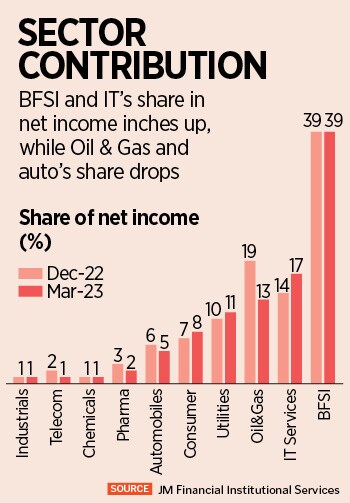

Even as earnings of Indian companies remained skewed in the three months ending March, easing global supply chain issues and inflationary pressures cooling off across the commodity basket helped companies manage their margins. However, persistent slowdown in consumer demands, especially in rural India, remain a worry as revival hinges on a good monsoon. Companies in the financial sector continued to show better performance, while those in oil & gas and metals lagged in the January to March period.

A Forbes India analysis of earnings showed that aggregate net profit of Nifty companies, excluding the financial sector, improved 7 percent year-on-year in March quarter. This compares to a nil growth in the preceding three months and a 16 percent growth in the March quarter of FY22. However, if we further tighten the universe and exclude companies in oil & gas and metal, the numbers look better: Nifty aggregate net profit climbed 30 percent year-on-year in March quarter compared to 31 percent in Q3FY23 and 19 percent in March quarter of FY22.

Overall, the aggregate net profit of Nifty companies grew 16 percent while net sales jumped 13 percent in the March quarter, showing a decline. Net sales climbed 18 percent in the December quarter while it rose 24 percent in Q4FY22. The analysis is based on data provided by Motilal Oswal Financial Services.

“We would categorise the March quarter FY23 earnings as broadly in line versus muted expectations but strong on a regional basis, despite macro-headwinds. While companies exposed to the manufacturing side of the economy fared well, the ones exposed to consumption and outsourcing faced demand-related challenges,” says Trideep Bhattacharya, CIO-Equities, Edelweiss Mutual Fund. He adds that weakness across most consumption categories continued in Q4, although lending remained robust.

“We would categorise the March quarter FY23 earnings as broadly in line versus muted expectations but strong on a regional basis, despite macro-headwinds. While companies exposed to the manufacturing side of the economy fared well, the ones exposed to consumption and outsourcing faced demand-related challenges,” says Trideep Bhattacharya, CIO-Equities, Edelweiss Mutual Fund. He adds that weakness across most consumption categories continued in Q4, although lending remained robust.

Others concur. According to Gautam Duggad, head of research-institutional equities, Motilal Oswal Financial Services, earnings performances for companies under their coverage and Nifty were lopsided and led by a few heavyweights in the March quarter. “Five companies within our coverage (SBI, Tata Motors, BPCL, IOC and Reliance Industries) contributed 83 percent of the incremental year-on-year earnings. Similarly, within Nifty, five companies (SBI, Tata Motors, BPCL, Reliance Industries, and Axis Bank) contributed 96 percent of the incremental YoY accretion in earnings,” he explains.

Also read:

Also read:  It was a big mixed performance by the IT companies in Q4FY23. Tier-1 IT firms reported muted revenue growth and moderate margins, while tier-2 companies outpaced with stronger revenue growth. Tata Consultancy Services (TCS) said the near-term uncertainty is more pronounced in the US region, while a meaningful demand recovery is seen in the UK and Europe regions.

It was a big mixed performance by the IT companies in Q4FY23. Tier-1 IT firms reported muted revenue growth and moderate margins, while tier-2 companies outpaced with stronger revenue growth. Tata Consultancy Services (TCS) said the near-term uncertainty is more pronounced in the US region, while a meaningful demand recovery is seen in the UK and Europe regions. For consumer-focussed companies like FMCG, price hikes have been realised and commodity costs have stabilised or even declined in some cases, and there has been an improvement in the product mix for a few companies, according to analysts. Management commentary from most of the companies suggested that ad spending has returned to normal levels and companies will refrain from investing in advertising and promotion going forward.

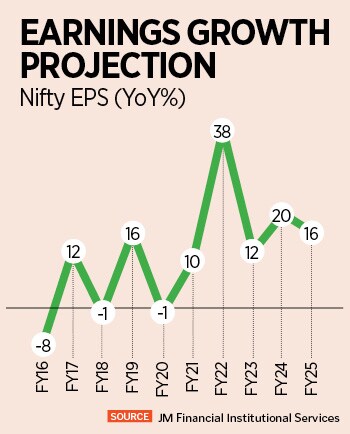

For consumer-focussed companies like FMCG, price hikes have been realised and commodity costs have stabilised or even declined in some cases, and there has been an improvement in the product mix for a few companies, according to analysts. Management commentary from most of the companies suggested that ad spending has returned to normal levels and companies will refrain from investing in advertising and promotion going forward.  Duggad expects the Nifty EPS to grow 20 percent in FY24, forecasting FY24 earnings growth to be led by BFSI, oil & gas, metals and automobiles, as the four sectors are expected to contribute 82 percent of the incremental earnings to Nifty. The top earnings upgrades in FY24: Tata Motors (13 percent), Bharti Airtel (8 percent), Bajaj Auto (7.3 percent), Divi’s Lab (7 percent), and Hero MotoCorp (5 percent). The top earnings downgrades in FY24 are ONGC (-16 percent), UPL (-13 percent), Grasim Industries (-11 percent), Hindalco (-9 percent), and Coal India (-8 percent).

Duggad expects the Nifty EPS to grow 20 percent in FY24, forecasting FY24 earnings growth to be led by BFSI, oil & gas, metals and automobiles, as the four sectors are expected to contribute 82 percent of the incremental earnings to Nifty. The top earnings upgrades in FY24: Tata Motors (13 percent), Bharti Airtel (8 percent), Bajaj Auto (7.3 percent), Divi’s Lab (7 percent), and Hero MotoCorp (5 percent). The top earnings downgrades in FY24 are ONGC (-16 percent), UPL (-13 percent), Grasim Industries (-11 percent), Hindalco (-9 percent), and Coal India (-8 percent).