- Home

- UpFront

- Take One: Big story of the day

- Misplaced exuberance drives Indian stocks as investors navigate 'hard times'

Misplaced exuberance drives Indian stocks as investors navigate 'hard times'

The Nifty has underperformed the broader emerging markets index by 10 percent in the last six months. Compared to early December, when the Nifty had peaked, it has corrected 8 percent till now, underperforming the MSCI EM index by 10 percent

Foreign investors are viewing India through a prism of confidence and hope that the Asian sub-continent will lead a rally of stocks. Image: Shutterstock

Foreign investors are viewing India through a prism of confidence and hope that the Asian sub-continent will lead a rally of stocks. Image: Shutterstock

What explains a sudden spurt in investors’ renewed enthusiasm for favouring Indian equities even as the world is grappling a ‘sinking feeling’ due to a series of uncertainties? Perhaps, a misplaced exuberance and an unsettling belief that India is a shiny spot with investors worldwide explicitly rushing for cover as recession risks rise eating into corporate balance sheets and further stagnating economic growth.

Related stories

Well, nothing much has materially changed for the Indian markets in the past few months except that foreign investors are viewing India through a prism of confidence and hope that the Asian sub-continent will lead a rally of stocks. What comforts investors favouring India are corrections in relative market valuations and resilient equity inflow.

Arvind Chari, chief investment officer, Q India (UK), an affiliate of Quantum Advisors, foresees some hiccups in the short term, driven by global macro, weak monsoon outlook and the political uncertainties, as India hops on from one state elections to other right until the general elections in 2024. “We are also having a number of conversations with large foreign investors as they consider a dedicated India allocation given India’s long-term economic, financial and geopolitical positioning,” he says. He expects a reversal of flows from global emerging market managers (GEM) back into India as valuations improve.

Equities all over the world have been impacted majorly due to a global liquidity crunch following the collapse of the Silicon Valley Bank, forced merger of Credit Suisse and sticky inflation amid rising interest rates. Gradual deterioration in the growth outlook continues, which means even bigger markets are at the risk of a sudden fall. The most aggressive monetary tightening cycle in the US and the European markets has crunched liquidity worldwide.

A slew of foreign brokerages, however, are gradually turning bullish on India. At the beginning of FY24, Goldman Sachs analysts said it is time to accumulate Indian equities and buy quality stocks at a reasonable price. “While the market could remain choppy in the near-term, amid heightened global uncertainty, deeper corrections beneath the headline index suggest an opportune time for medium-term investors to bottom-fish over the coming months,” the brokerage firm said.

Goldman Sachs expects the benchmark Nifty to hit 20000-level by March next year, driven by a 17 percent earnings growth in 2023 and 15 percent in 2024, implying 15 percent returns.

Morgan Stanley has also upgraded India to an ‘equal weight’ rating given narrowing valuation premiums and a resilient economy. The brokerage firm stays overweight on North Asia, excluding Japan, and underweight on ASEAN markets.

Bernstein expects Indian equity markets to see a quick rebound in the near term after six months of underperformance to emerging markets. “Even in a bearish global setting, we always see room for rallies led by various factors. Our call for a rebound is premised on a confluence of tactical factors, including valuations and a bunch of macro factors,” say Venugopal Garre and Ankit Agarwal, analysts at Bernstein.

Bernstein expects Indian equity markets to see a quick rebound in the near term after six months of underperformance to emerging markets. “Even in a bearish global setting, we always see room for rallies led by various factors. Our call for a rebound is premised on a confluence of tactical factors, including valuations and a bunch of macro factors,” say Venugopal Garre and Ankit Agarwal, analysts at Bernstein.

They expect positive returns in the near term, with the Nifty heading back to 18000-18500, narrowing some underperformance with emerging markets. Financials, real estate and cement are likely to lead the rebound while sectors like staples and utilities will underperform.

However, conflicting signals from equities, economic and corporate fundamentals stoke concerns if the euphoria and exuberance are misplaced and are much ahead of time.

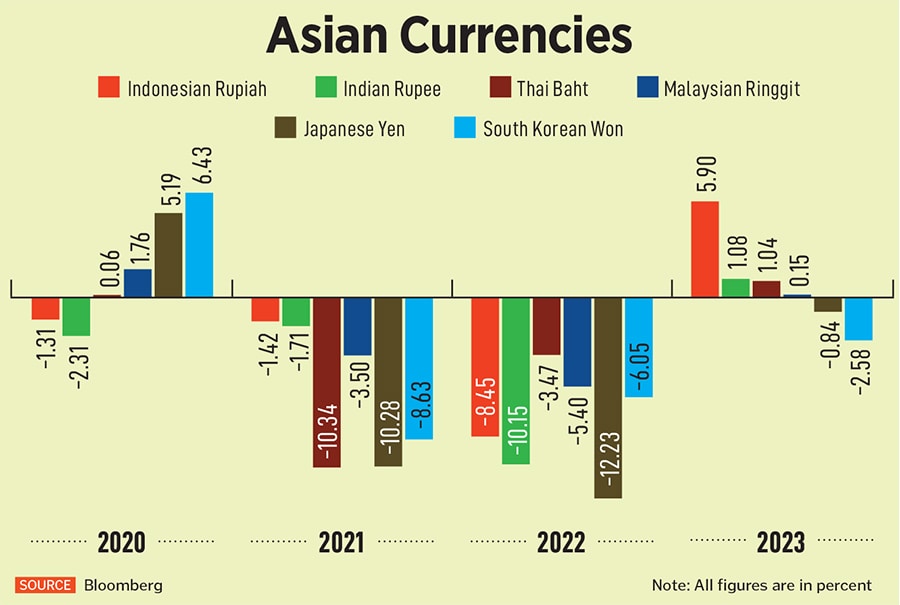

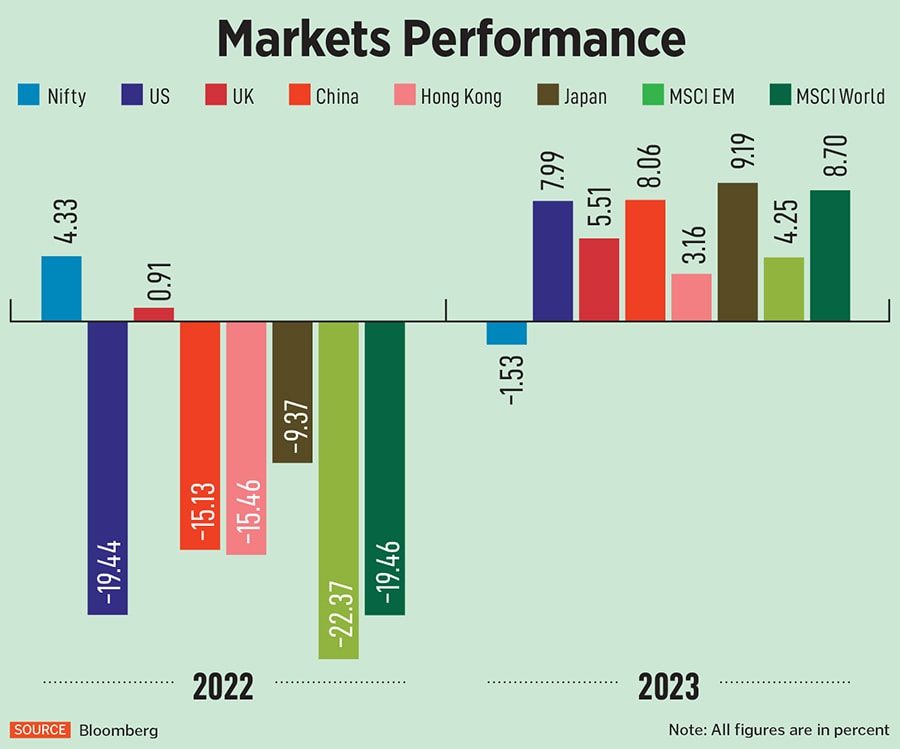

In 2023 so far, Indian markets are the weakest compared to peers in the US, UK, China, Hong Kong and Japan. For instance, the 50-share index Nifty has declined over 1 percent since January, while MSCI Emerging Markets index gained over 4 percent and MSCI World is up by nearly 9 percent. Similarly, markets in the US, UK, China, Hong Kong and Japan have jumped 3-9 percent in 2023 so far. In fact, India performed better in 2022, closing the year with gains of over 4 percent, while MSCI World slumped 19 percent and MSCI EM declined 22 percent. Markets in the US, China, Hong Kong and Japan were worse, shrinking 9-19 percent in 2022.

The Nifty has underperformed the broader emerging markets index by 10 percent in the last six months. Compared to early December, when the Nifty had peaked, it has corrected 8 percent till now, underperforming the MSCI EM index by 10 percent.

Even as the Nifty recovered in March, jumping 1 percent, there is a sharp polarisation within the index with the largest 15 stocks outperforming the rest 35 by 70 percent. However, there are about 26 percent of stocks in the Nifty which have risen this year so far, indicating there is pain left and a broad-based recovery will take longer.

Also read: IPO analysis: After unlocking, will it be time to unload?

Contrasting flows

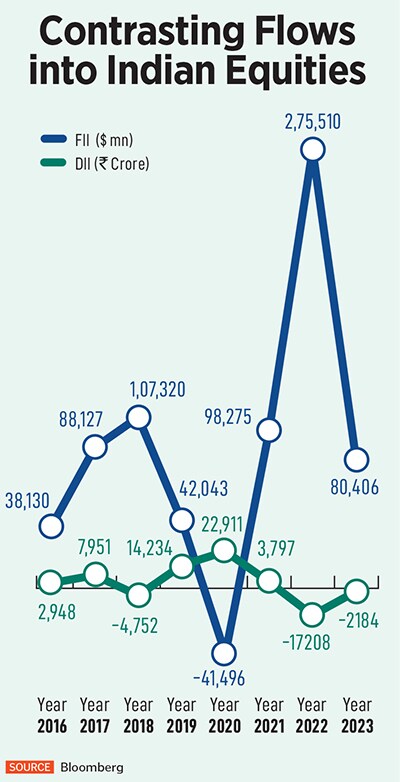

As a few foreign investors turned positive on India, institutional flow to equities showed a net inflow in March following a consistent selling pressure in the previous three months. In March, foreign institutional investors (FIIs) were net buyers of Indian shares worth $1.8 billion, but were overall net sellers of $2.2 billion this year so far. In 2022, FIIs dumped Indian shares worth $17.2 billion which was at a multi-year low.

This is in sharp contrast to the pumping up of money by domestic mutual funds, banks and insurance companies which have supported Indian stock markets arresting further decline. In this year, domestic institutional investors (DIIs) have parked Rs80,406.12 crore in Indian shares while investing a record Rs27,5510.24 crore in 2022.

Net inflows into equity mutual funds rose from Rs11,000 crore in December to an eight-month high of Rs18,600 crore in February, after bottoming at Rs4,200 crore in November. Most of these inflows continued from systematic investment plan (SIP) where monthly inflows are debited from salaries. SIP inflows rose from Rs13,600 crore in December to a record Rs13,900 crore in January and Rs13,700 crore in February.

Also read: India Inc's Limping Earnings Recovery In March Quarter Likely To Be Lopsided

Valuations: Biggest worry

“The challenge, as always in India, remains relatively high valuations,” says Christopher Wood, global head, equity strategy, Jefferies, in his note Greed and Fear. The Nifty is around 18 times earnings on a 12-month forward basis compared to a long-term average of 16.2 times since 2008. Earnings estimates based on one-year forward have climbed-down from the level of 21 percent seen at the beginning of FY23. Nifty earnings are forecast by consensus to grow by 20.7 percent in FY24.

Wood remains slightly overweight on India in the Asia-Pacific region, excluding Japan relative-return portfolio, with a dominant 39 percent of the portfolio invested in India.

While the Nifty valuation is still slightly higher than its long-term mean, its premium over the emerging index has reduced by 22 percent since its October 2022 peak, pulling it below the five-year average. While India's valuation relative to EM has come below its five-year average, Nifty valuation is still slightly above (10 percent) its long- term average. Looking at the five-year average for Nifty price-to-earnings (PE), it is currently 7 percent below its mean.

“The sectors which began the year at elevated valuations—IT, consumer, and select private financials—have seen moderation in valuations multiples during the year. That said, while absolute valuations are reasonable and well within the range of long period average (LPA) multiples, the relative valuations for MSCI India are still at an 82 percent premium versus MSCI EM. This compares with the LPA of 67 percent. While the Reserve Bank of India (RBI) has raised rates by 250 bps, the 10-year yield has increased 50 bps in FY23. Given this context, we believe the relative equity versus bond valuations are now far more palatable than at the beginning of FY23,” says Gautam Duggad, head of research, institutional equities, Motilal Oswal Financial Services.

India’s market capitalisation-to-gross domestic product (GDP) ratio has been volatile—it stood at 56 percent of FY20 GDP in March 2020, down from 80 percent in FY19, but recovered sharply to 112 percent in FY22. The ratio now stands at 95 percent (of FY23 GDP), much above its long-term average of 79 percent. The ratio is derived by using the total market cap of a country’s listed stocks as the numerator and GDP as the denominator.

Also read: What punctured markets' euphoria on Budget day?

Earnings recovery?

While FY24 earnings could see downgrades, Garre and Agrawal do not expect a collapse considering the current environment is different from the great financial crisis. “In FY23, we have seen only modest downward revisions for forward Nifty earnings, that is for FY24, which is still expected to grow in the mid-teens. For FY23 also, Nifty growth is likely to be double-digit and has not seen much cut over the past few months,” say Garre and Agrawal.

They add that a fall in commodities is expected to support margins while early cycle benefit in sectors (like financials), which have a higher mix in overall index earnings, is increasing the expectation of low risk of earnings cut.

However, the picture may not be that rosy and smooth. Analysts feel corporate earnings in the fourth quarter of FY23 will be lopsided and most of the heavy lifting is likely to made by banking, financial services and the insurance (BFSI) sector companies. Decline in commodity-led companies, like the metal sector, is expected to be a drag on overall earnings in the quarter.

“The contraction of the Ebitda (earnings before interest, taxes, depreciation, and amortisation) margin has been a sore point for earnings, excluding BFSI, in FY23, as they have compressed by nearly 300 basis points from their peak. However, the pain now seems to be ebbing. The uptick shall depend on demand dynamics,” says Prateek Parekh, equity strategist, Nuvama Group.

Parekh cautions that demand deterioration is broadening from exports to some segments of domestic consumption, and it will eventually weigh even on credit and capex. According to Parekh, Nifty earnings per share (EPS) FY23 is likely to grow 10 percent after a growth of 40 percent in FY22 with commodities as the main drag. “Demand rather than costs are likely to be the key concern in FY24,” he cautions.

Economic indicators

The International Monetary Fund (IMF) has slashed India’s GDP forecast by 20 bps to 5.9 percent for FY24, indicating a cut of 0.2 percentage points since the previous estimates in January.

However, the estimates are lower than the RBI’s projection of real GDP growth rate at 6.4 percent in FY24, it had set in the Monetary Policy Committee meeting in February. The World Bank projects a 6.3 percent growth rate while Asian Development Bank sees 6.4 percent growth in FY24. Nomura has projected a growth rate of 5.3 percent for the fiscal, the lowest so far.

Also read: Life after IPOs: From sizzling highs to sobering lows, Humpy Dumpty had a great fall

“External calm hides domestic growth risks,” say Aurodeep Nandi and Sonal Varma, economists at Nomura. “We are concerned that the coincident indicators are yet to entirely reflect the headwinds from slowing global growth, delayed impact of domestic policy tightening and inherent weakness in private capex. We believe the trends in the trade data carry early warning signs that a more potent downturn awaits growth in the second half of 2023 and into 2024 when the global growth situation is likely to further deteriorate,” they add.

According to Nomura’s estimate, the combination of lower trade deficit and strong services surplus should lead to a current account deficit of 1.8 percent of GDP in FY23, expecting it to remain at similar levels in FY24. Both merchandise export and import growth contracted materially in March, from upward revised growth rates in February, with exports underperforming imports. Trade deficit expanded to $19.7 billion in March from $16.4 billion average in January-February.

As the external demand drag could accentuate, given slowing global trade and output, internal consumption demand is not that encouraging so far. Companies like Marico, Godrej Consumer Products and Dabur India have indicated in their March quarter update that inflation continues to weigh on demand, and that there has been no meaningful improvement in the underlying consumption trends.

“Indian markets are expected to be volatile over the short term and the future trajectory will remain guided by factors such as pause by the RBI and global central banks to the interest rate hikes cycle, extent of impact on economic growth, more so in developed economies, lag effect of a rise in interest rates on demand cycle on earnings growth in India,” according to ICICI Securities.

In March, the US Federal reserve raised its policy rate by 25 basis points (completing a total of 475 bps of hikes in the Fed Funds rate over the past 12 months), while the European Central Bank raised its policy rate by 50 bps to 3.5 percent (from zero for three years before the first of its recent rate hikes, the Bank of England raised its policy rate by 25 bps (to 4.25 percent) and the Swiss National Bank raised its policy rate 50 bps to 1.5 percent (a total increase of 225 bps from a year ago).

The tightening by global central banks re-emphasised that the fight against inflation still takes priority over any wobbles in the financial system. The RBI has paused its rate hike cycle although it retained its stance of ‘withdrawal of accommodation’. Economists at ICICI Securities believe that policy rates have peaked for this year in India, and growth will not be further constrained by interest rates even as the RBI will remain vigilant to any further supply-driven inflation shocks.

However, the Indian market is still expensive among peers and an earnings recovery is critical while economy factors need to grow at a sustained pace to support rallies in Indian equities. Slowdown in pent-up demand, rising interest rates as well as a deceleration in activities prior to the elections in FY24 are likely to weigh on markets sentiment.