IPL's taking the game deep despite a tough economy

Advertising from startups going through a funding winter might have taken a backseat, but the most-watched franchise cricket league is bringing in ad revenues higher than its previous editions

Cheering cricket fans at an Indian Premier League (IPL) Twenty20 cricket match between Gujarat Titans and Chennai Super Kings at the Narendra Modi Stadium in Ahmedabad on March 31, 2023.

Image: Punit Paranjpe / AFP

Cheering cricket fans at an Indian Premier League (IPL) Twenty20 cricket match between Gujarat Titans and Chennai Super Kings at the Narendra Modi Stadium in Ahmedabad on March 31, 2023.

Image: Punit Paranjpe / AFP

If the back-to-back thrillers are anything to go by, Indian Premier League (IPL) 2023 doesn’t seem to have lost any of its charm despite big-ticket absentees like Jasprit Bumrah, Rishabh Pant, Shreyas Iyer, Kane Williamson and Jonny Bairstow. Off the field too, the world’s most-watched franchise cricket league has reinforced its credentials as recession-proof, enabling its partners to fight off macroeconomic headwinds and rake in viewership and ad revenues higher than the previous editions.

The first hints of the premium that the IPL could command despite a tough economic climate, worsened by the Russia-Ukraine war, came last June, when the media rights for the 2023-2027 cycle were auctioned for a cumulative Rs48,390 crore, up from Rs16,348 crore in the previous five-year cycle. Star Sports retained the TV broadcast rights for Rs23,575 crore, while the digital rights went to Viacom18 (and its streaming platform JioCinema) for Rs20,500 crore.

Between the auction and the tournament that started on March 31, large multinationals unravelled, thousands were laid off both in India and abroad, and a funding winter hit the startup ecosystem. But by the end of the first fortnight, JioCinema was expected to have lapped up Rs2,500 crore and Star Sports about Rs2,000 crore of ad revenues, says Anupriya Sapra, co-founder and COO, ITW Mediaworx, the media services arm of ITW Consulting. The former, meanwhile, has 23 sponsors, television (TV) has 12 to 14, while the league itself has 10. With the first fortnight as a barometer, it would be safe to say that the total buys in terms of the money raised for IPL 2023 are higher than previous years.

“One match during the IPL on each of the platforms has the potential to generate up to Rs60 crore in ad revenues, with playoffs potentially generating Rs75 crore per match,” says Sapra. “If we apply a 20 percent increase from the current base, Star might close the tournament around the Rs2,500 crore mark and Jio might end up at closer to Rs3,000 crore. A total of Rs5,500 crore in ad revenue from the current economy isn’t bad at all.”

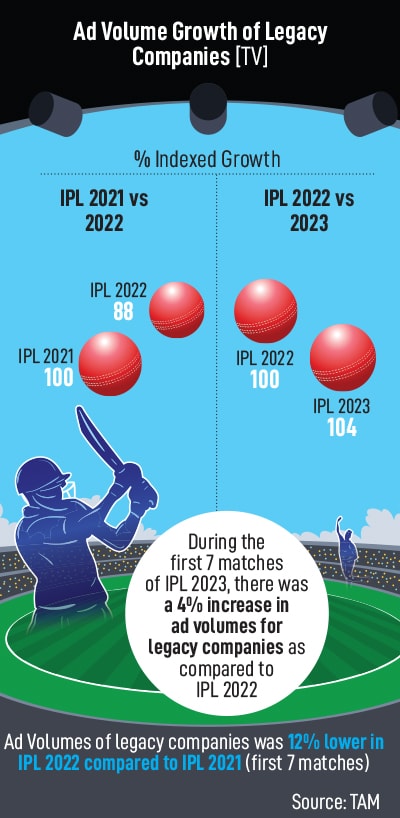

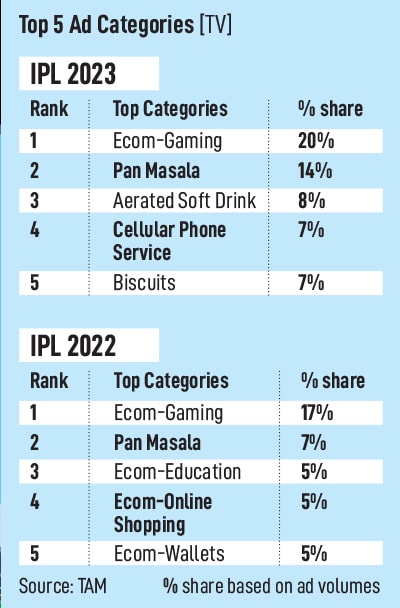

Another industry insider pegs TV to corner a larger share of the ad revenues, somewhere around Rs3,200 to Rs3,300 crore, with digital finishing up between Rs1,500 crore and Rs1,700 crore. [Star and Viacom18 declined to participate in the story.] Either way, the combined value is higher than the Rs4,000-odd crore ad revenues that the Star-Hotstar combine is estimated to have lapped up for IPL 2022. This despite a fall in the number of advertisers for the current edition. According to data from TAM Media Research based on the first seven matches of the tournament, IPL 2023 had 35+ advertisers and 60+ brands on TV, down from the 60+ advertisers and 95+ brands the previous year.

Another industry insider pegs TV to corner a larger share of the ad revenues, somewhere around Rs3,200 to Rs3,300 crore, with digital finishing up between Rs1,500 crore and Rs1,700 crore. [Star and Viacom18 declined to participate in the story.] Either way, the combined value is higher than the Rs4,000-odd crore ad revenues that the Star-Hotstar combine is estimated to have lapped up for IPL 2022. This despite a fall in the number of advertisers for the current edition. According to data from TAM Media Research based on the first seven matches of the tournament, IPL 2023 had 35+ advertisers and 60+ brands on TV, down from the 60+ advertisers and 95+ brands the previous year.

“The expectation for a connected TV is around Rs6 lakh for a 10-second spot,” says Sapra of ITW. “JioCinema has monetised the on-the-spot rate model for connected TVs. While this is common in the West, it is an industry-first initiative in India. This was introduced for FIFA a few months ago.”

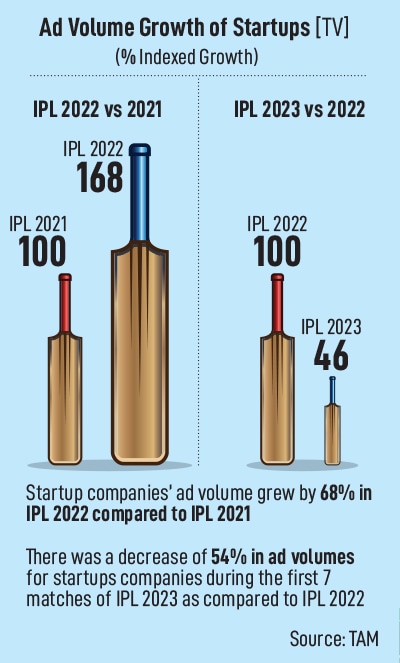

“The expectation for a connected TV is around Rs6 lakh for a 10-second spot,” says Sapra of ITW. “JioCinema has monetised the on-the-spot rate model for connected TVs. While this is common in the West, it is an industry-first initiative in India. This was introduced for FIFA a few months ago.” It’s not unlikely, given that over 25,000 employees have been laid off by 88 startups since the beginning of 2022, including unicorns like Byju’s, Dunzo, Ola, Unacademy, MPL and Vedantu, according to Inc42’s layoffs tracker. The volume of startups deals also reached a nine-year low in February, while funding in startups in the first quarter of the calendar year 2023 fell by 75 percent to $2.8 billion compared to the corresponding year-on-year period, when it stood at $11.9 billion, says Tracxn that covers startups.

It’s not unlikely, given that over 25,000 employees have been laid off by 88 startups since the beginning of 2022, including unicorns like Byju’s, Dunzo, Ola, Unacademy, MPL and Vedantu, according to Inc42’s layoffs tracker. The volume of startups deals also reached a nine-year low in February, while funding in startups in the first quarter of the calendar year 2023 fell by 75 percent to $2.8 billion compared to the corresponding year-on-year period, when it stood at $11.9 billion, says Tracxn that covers startups.  Bardia of RISE Worldwide cites the example of leading D2C brand Happilo, which was the front-of-the-jersey sponsors of RR till last year, but have tied up with RCB for a less-premium right chest logo this year. “The sheer impact and reach of the IPL make it compelling for brands to be associated with it,” says Bardia. At the end of the day, he adds, brands look to unlock maximum value, and are increasingly looking at multi-franchise as partners to reach out to a larger demographic set. “At RISE Worldwide, we have done nine multi-team deals. Such has been the demand that we closed deals worth Rs400 crore, with a 30 percent increase in the number.”

Bardia of RISE Worldwide cites the example of leading D2C brand Happilo, which was the front-of-the-jersey sponsors of RR till last year, but have tied up with RCB for a less-premium right chest logo this year. “The sheer impact and reach of the IPL make it compelling for brands to be associated with it,” says Bardia. At the end of the day, he adds, brands look to unlock maximum value, and are increasingly looking at multi-franchise as partners to reach out to a larger demographic set. “At RISE Worldwide, we have done nine multi-team deals. Such has been the demand that we closed deals worth Rs400 crore, with a 30 percent increase in the number.”