- Home

- UpFront

- Take One: Big story of the day

- Maruti Suzuki—the common man's carmaker—might be dead. Long live the new Maruti Suzuki

Maruti Suzuki—the common man's carmaker—might be dead. Long live the new Maruti Suzuki

The Indian market has been moving towards premiumisation. And with the launch of its multipurpose vehicle Invicto, the company, keeping with the times, has added a new dimension to Nexa's portfolio—and to Maruti Suzuki as a brand

Manu Balachandran is a writer for Forbes India, based in Bengaluru. At Forbes India, Manu writes on automobiles, aviation, pharmaceuticals, banking, infrastructure, economy and long profiles among many others. He also moderates many of Forbes India's CEO and CXO events and hosts Capital Ideas, a podcast on the most riveting success stories from the business world. He has previously worked with Quartz, The Economic Times and Business Standard in Mumbai and New Delhi. Manu has a master's degree in journalism from Cardiff University and a degree in economics from the Loyola College. When not chasing stories, he is most likely obsessing over Formula 1 (Read: Lewis Hamilton), historical events and people, or planning long weekend drives from Bengaluru

(L to R) Mr. Hisashi Takeuchi, Managing Director & CEO, and Mr. Shashank Srivastava, Senior Executive Officer (Marketing & Sales) at the launch of ‘Invicto’, Maruti Suzuki’s new three-row premium UV

Image: Courtesy Maruti

(L to R) Mr. Hisashi Takeuchi, Managing Director & CEO, and Mr. Shashank Srivastava, Senior Executive Officer (Marketing & Sales) at the launch of ‘Invicto’, Maruti Suzuki’s new three-row premium UV

Image: Courtesy Maruti

On July 5, Maruti Suzuki, India’s largest carmaker, gave the country something of a reality check. The carmaker is no longer what it used to be.

Launching the Invicto, a multi-purpose vehicle that shares a platform with Toyota Hycross, Maruti Suzuki priced its three variants of the Invicto between Rs 24.79 lakh and Rs 28.42 lakh. That means, for the first time, the on-road price of a Maruti Suzuki will cross Rs 30 lakh in the country, making Invicto the most expensive vehicle from the automaker’s stable.

The pricey affair puts an end to Maruti Suzuki’s decade-old perception as a common man’s carmaker, known largely for their affordable and value-for-money offerings ranging from the wildly popular Maruti Suzuki 800 to the Alto and Wagon R among others. Or it could simply mean that the automaker has come to realise that the Indian economy has changed, and its purchasing capacity has significantly leapfrogged, with customers willing to spend the extra buck for additional features, safety, and even design.

Invicto will be the eighth car that Maruti Suzuki intends to sell through its Nexa showrooms, the company’s premium sales channel through which it already sells several vehicles ranging from Grand Vitara to Baleno and Jimny. “Our entry into the premium three-row UV segment with the launch of the Invicto adds a new dimension to Nexa’s portfolio and to Maruti Suzuki as a brand,” Hisashi Takeuchi, the managing director & CEO of Maruti Suzuki India Limited, said during the launch.

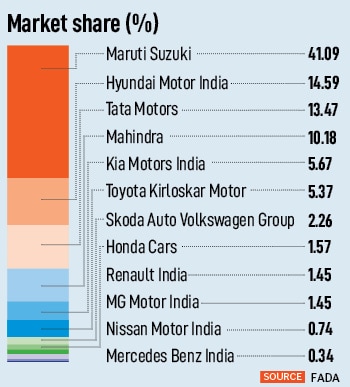

For long, Maruti Suzuki has had to grapple with an image issue, especially among premium buyers. But a slew of recent launches, ranging from the Fronx to the Jimny and Grand Vitara, all aimed at winning back Maruti’s lost share in the country’s booming SUV market, has also meant that the automaker has shifted much of its might to the premium range, especially as it fights both homegrown and global automakers in winning back market share that has hovered around 40 percent over the past few years. Maruti’s market share a decade ago was around 50 percent.

“Since the launch of Nexa, Maruti Suzuki has been operating in the premium segment,” Harshvardhan Sharma, the head of auto retail practice at Nomura Research Institute says. “The Indian market has been moving towards ‘premiumisation’ and rightly so. As the share of discerning consumers increases, we will continue to see a surge in premium play. Besides it also helps in better contribution margin yields for OEMs.”

The premium SUV play

In many ways, Maruti’s focus on improving its premium offerings also has to do with the company’s renewed focus on its SUV market. Barring the Ciaz and the Baleno, the company’s remaining six models being sold through the Nexa channel are all SUVs.

“Maruti Suzuki initially had been known to be a brand which gives value,” Shashank Srivastava, the executive director at Maruti Suzuki says. “Our tagline was Count on us, which was about reliability, efficiency, lower cost, good after-sales service, and low maintenance. That is why there is this general thought that Mark Suzuki is a brand which is a common man’s brand.”

Also read: Has Budget 2023 done enough for India's automobile industry?

The perception also came from the company’s long-held belief in pushing more people towards buying cars, as was one of the founding objectives of the company. Currently, only about 22 people per thousand own a car in India, while in the US and UK, that number stands at 980 and 850.

“For a very long time penetration of cars in India has been very low and the requirement of the consumer was for such (cheaper and affordable) vehicles,” Srivastava says. “The lower-end segment has been always very large in our country and Maruti Suzuki obviously did what the consumers wanted and slowly, as economic growth happened, there was a shift in terms of what some of the consumers wanted. The buying criteria started moving towards more aspirational. It was about design, performance, feature, technology.” That led to the launch of Nexa showrooms in 2015.

Yet, despite its focus on a premium sales channel over the years, the company had lost out significantly on the country’s SUV boom and had admittedly lost significant market share. That meant, from a market share of around 50 percent three years ago, Maruti Suzuki’s market share is now around 41 percent. That steep decline was due to the company’s paltry market share in the SUV business, where the company didn’t have enough offerings, which it has now rectified in a year.

“We are now the market leader in the Rs 10 lakh to Rs 20 lakh price bracket,” Srivastava says. India’s SUV segment currently accounts for 47 percent of all the cars sold in the country, with hatchbacks accounting for about 32 percent. The sedan segment meanwhile has been seeing a decline in sales.

Of this, Maruti Suzuki claims a market share of over 60 percent in the less than Rs 10 lakh market, which largely comprises hatchbacks. “We thought, let us now get into a segment even higher than Rs 20 lakh. That segment has also been growing,” Srivastava says. Maruti says the sub-Rs 10 lakh market, which was about 85 percent of the market, is now 60 percent of the market. The greater than Rs 20 lakh market meanwhile has grown from 2 percent of the market to 8 percent currently.

“We wanted to take part in the growing segment also and our confidence is coming from the fact that we have become market leader in the Rs 10 lakh to Rs 20 lakh category. Nexa has been able to establish that premium positioning,” Srivastava says. Nexa, Srivastava says, has already emerged as the number two brand after Maruti Suzuki across numerous states in India, beating the likes of Hyundai, Tata, and Mahindra, in terms of sales.

That’s also because of the growing SUV offerings at Nexa showrooms. To put it in perspective, India’s SUV market is one of the world’s fastest-growing markets, and the country is in the middle of an SUV wave. The market is expected to grow to some 50 percent in the next few years. That means, one in every two vehicles sold in the country will be an SUV. Last year, India’s SUV sales overtook that of hatchbacks and sedans for the first time.

That’s also because of the growing SUV offerings at Nexa showrooms. To put it in perspective, India’s SUV market is one of the world’s fastest-growing markets, and the country is in the middle of an SUV wave. The market is expected to grow to some 50 percent in the next few years. That means, one in every two vehicles sold in the country will be an SUV. Last year, India’s SUV sales overtook that of hatchbacks and sedans for the first time.

The SUV market in India comprises various categories such as small, mid-size, and large SUVs. The likes of Tata Punch, Kia Sonet, Hyundai Venue, and Mahindra XUV 300 come under the small SUV segment even as manufacturers are busy creating newer segments within that category, such as mini, micro, and compact SUVs. The mid-size SUVs in the country include cars such as Hyundai Creta, Kia Seltos, Volkswagen Taigun, Tata Harrier, MG Hector, and Mahindra XUV 700, among others, while full-fledged SUVs comprise the likes of Toyota Fortuner and Jeep Meridian.

“The demand for SUVs and compact SUVs has been on the rise in India. These vehicles offer a combination of style, practicality, and a higher seating position, which resonates well with consumers,” says Sharma of Nomura. “SUVs have become a popular choice, even in smaller segments, due to their perceived value and versatility.”

Reclaiming lost ground

Meanwhile, even as it attempts to win back its lost market share, Maruti Suzuki is also largely helped by a partnership with Toyota, which will manufacture the company’s Grand Vitara from its manufacturing plant in Bidadi in Karnataka. In 2019, Toyota and Suzuki announced that the two companies had entered a long-term partnership for promoting collaboration in new fields, including autonomous driving. In India, Toyota had begun badging its vehicles that are built on Maruti Suzuki’s platforms, such as the Brezza and Baleno.

Also read: Ola Electric wants to disrupt India's car industry. Does it have what it takes?

“Maruti Suzuki has primarily focused on the compact and crossover SUV segments, which have gained popularity in India,” adds Sharma of Nomura. “By concentrating on these segments, Maruti has been able to tap into the market demand for smaller, more affordable SUVs that offer a combination of style, practicality, and a higher seating position. This strategic approach has allowed them to cater to a larger customer base and maintain a competitive edge.”

The recent success of the Grand Vitara, launched last year, along with the Brezza, has meant that Maruti Suzuki has been able to win back its lost ground in the mid-size SUV segment, according to Srivastava. “In the Rs 10 lakh to Rs 20 lakh market, our market share is about 25 percent,” Srivastava says.

That’s precisely why the company decided to foray into the above Rs 20 lakh segment, while also hoping for a rub-off on the premiumisation effect on some of the other offerings from the company. “We became very confident because we became the market leaders in the more than Rs 10 lakh category,” Srivastava. “Even though volume at this point in this segment is low, it will also have a good marketing effect. With our entry into this segment, there will be some amount of premiumisation of the brand that will have a positive rub-off effect on the other brands within our umbrella.”

Earlier this year, Maruti Suzuki had set itself a target of 25 percent of the market share in the SUV segment, which stood at a paltry 8.5 percent during the April-June quarter last year. By January-March this year that number rose to 16.4 percent, and the company estimates that its number stands at 22 percent in June this year, with the April-June quarter numbers at 20 percent.

Since 2022, Maruti Suzuki’s launches include the Grand Vitara, Jimny, Fronx, Invicto, and Brezza among others. Of this, the Grand Vitara and Invicto are built in partnership with Toyota. The partnership also includes the Baleno. “One of the main advantages of the partnership is the exchange of technology and expertise between the two companies,” says Sharma of Nomura. “Toyota brings its advanced technology, engineering capabilities, and global experience to the table, while Maruti Suzuki contributes its local market knowledge, manufacturing prowess, and widespread distribution network in India.”

Also read: Tesla Needs India And India Needs Tesla. Now It's All About Making It Work

Today, the Gurugram-headquartered company has bookings of about 3,55,000, largely due to supply constraints due to the semiconductor shortage that had affected automakers globally. With Invicto too, Maruti claims to have already mopped up bookings of over 6,500 since the launch.

Yet, despite all that, Maruti will not be entirely saying goodbye to its lower end offerings, even though vehicle prices in the country are expected to rise as the government pushes to enforce stringent safety norms in vehicles. “There is a large majority for whom the buying criteria basis is cost and price,” says Srivastava. “So we cannot leave that segment because it is very large. At the same time, we have to appeal to the newer type of consumers, which is now becoming larger.”

The Maruti of old is long gone. It’s a whole new game that India’s largest automaker is playing now.