Meet the players blossoming despite the edtech winter

Platforms offering test preparation, certification and skilling are flourishing in a sector that largely faces slump as students head back to classrooms

With schools now operating through physical classes and their own online material, edtech players, especially in the K-12 segment, are having a hard time attracting new customer base

Illustration: Sameer Pawar

With schools now operating through physical classes and their own online material, edtech players, especially in the K-12 segment, are having a hard time attracting new customer base

Illustration: Sameer Pawar

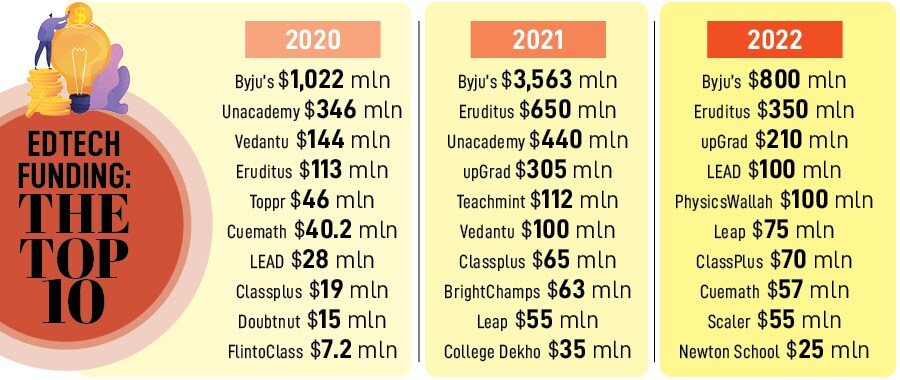

India’s edtech growth has been through a rollercoaster ride since the pandemic first rattled the education ecosystem. With extreme highs and substantial lows, the perception of the sector has been changing among investors, stakeholders, and in the public eye. The platforms that became unicorns and others that garnered profits during the stay-at-home period of the pandemic are today finding it challenging to meet the changing demand.

Byju’s, for instance, announced last week that it’ll be laying off 5 percent of its 50,000 workforce, translating to 2,000-2,500 employees. The behemoth in the K-12 sector reported a loss of Rs 4,588 crore, almost twice its FY21 revenue of Rs 2,428 crore. With this, as per media reports, around 7,000 employees have been laid off in the edtech sector so far this year.

With schools now operating through physical classes and their own online material, edtech players, especially in the K-12 segment, are having a hard time attracting new customer base, and some like Udayy and Lido Learning, SuperLearn, and Crejo.Fun have had to shut shop.

In 2022 alone, WhiteHat Jr. sacked 300 employees, Toppr, owned by Byju’s, fired 350, and more than 1,000 employees resigned collectively. Vedantu let go of 724 workers in three tranches, and Unacademy laid off 1,000 employees. Around 3,000–4,000 employees have received pink slips from edtech businesses in recent months.

Vamsi Krishna, CEO of Vedantu, says layoffs are a response to staying relevant. “These were cyclic layoffs that have been a response to staying on track and aiming for profitability,” he points out. Byju’s and Unacademy declined to respond for the story.