Offline, Online & Vivo: A Game of Quarters

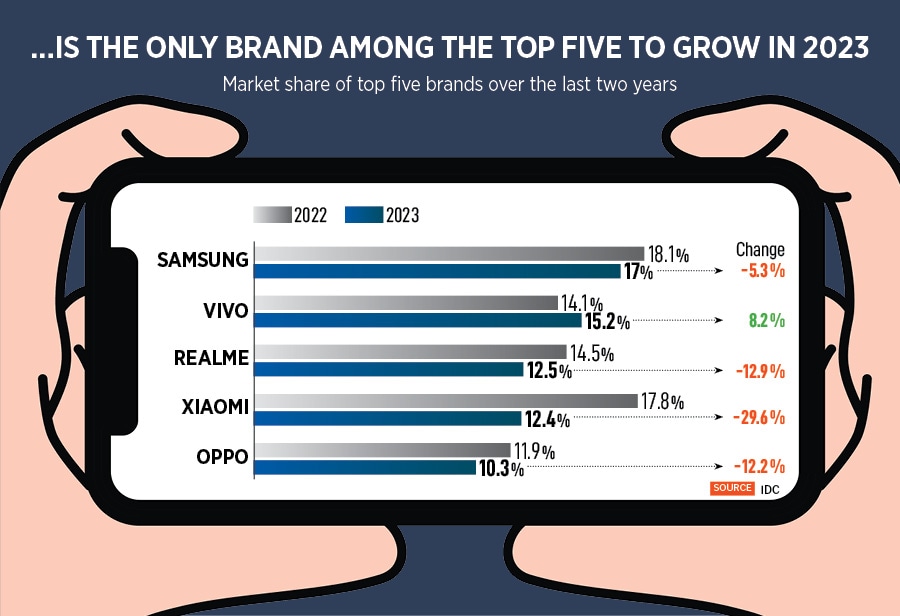

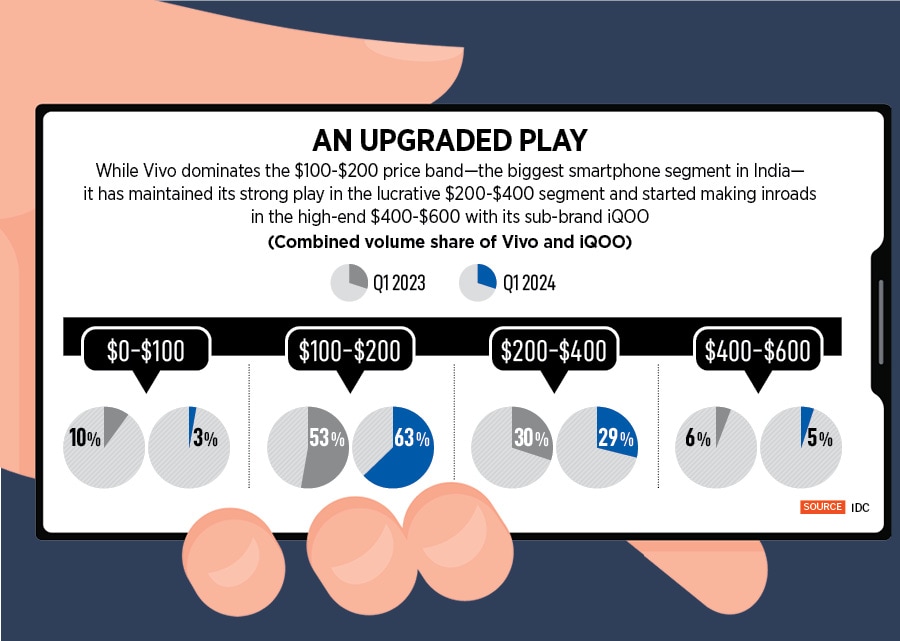

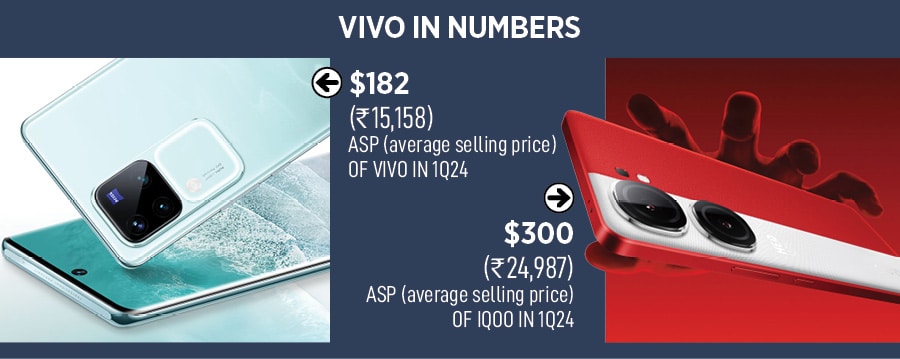

A strong offline presence, a dominant online play, and a smart sub-brand in iQOO, Vivo has yet again pipped Samsung in the quarterly sweepstakes. Can the Chinese phone maker finally wrest the annual throne from the Korean rival?

A Vivo smartphone store in Kolkata.

Image: Debarchan Chatterjee/NurPhoto via Getty Images

A Vivo smartphone store in Kolkata.

Image: Debarchan Chatterjee/NurPhoto via Getty Images

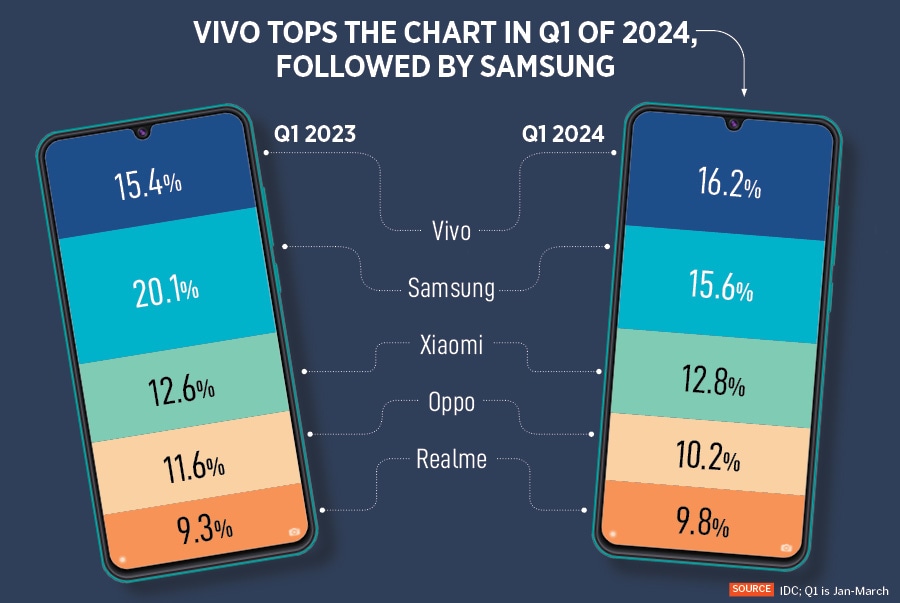

April 2020. It seemed like an April Fool’s prank. “Vivo overtook Samsung for the first time in India,” declared Canalys. In its quarterly smartphone pecking report released in April 2020, the global technology market analyst firm highlighted something that might have been branded absurd a year ago. Vivo, Canalys underlined, grew its shipments by nearly 50 percent, and emerged as the second biggest player in the first quarter of 2020 (January-March). The Chinese smartphone major notched a market share which was a tad below 20 percent. Contrast it to the pecking order which reigned supreme during the first quarter of 2019. Vivo: 12 percent; Samsung: 23 percent. A drastic change in Vivo’s fortune in twelve months baffled the onlookers. “Can the Chinese upstart take on the South Korean giant or is the performance just a flash in the pan,” was the larger question that begged for an answer.

Industry experts, however, were busy answering another interesting question. “Vivo’s victory is bitter-sweet,” Canalys’ analyst Madhumita Chaudhary sounded a word of caution in her post-mortem of the quarterly report that stunned the pundits. The high volume notched by Vivo, she explained, was mainly due to planned stockpiles ahead of the Indian Premier League (IPL). However, with the pandemic playing a spoiler, IPL getting postponed, and a huge inventory in the offline channels getting blocked, Vivo’s blockbuster party was all set to get gate-crashed. “Vivo will struggle to see a quick sell-through when the lockdown lifts,” the analyst noted.