Ola Electric Mobility IPO: A risky proposition or worth the hype?

While some analysts are drawing comfort from the stripped-down valuations of Ola Electric at the IPO stage, volatility stemming from government policy shift and lack of path-to-profitability are some concerns

Bhavish Aggarwal, Co-founder and CEO of Ola Cabs, founder of Ola Electric and OlaKrutrim

Bhavish Aggarwal, Co-founder and CEO of Ola Cabs, founder of Ola Electric and OlaKrutrim

A company may be in a fast growth stage but quick cash burn with mounting losses on the books is certainly not for the faint-hearted. As Ola Electric Mobility is planning to raise a massive Rs 6,146 crore through an initial public offering (IPO), the company’s weak financials, expansions at break-neck speed to grab a bigger pie in the market share of electric vehicles (EVs) two-wheeler business are still big risks for investors, especially retail.

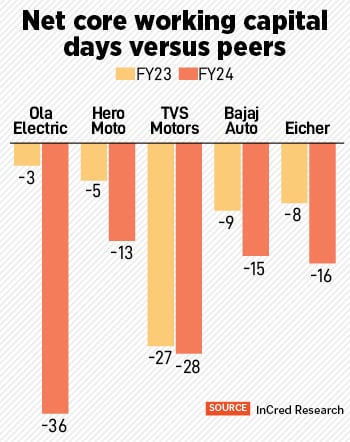

While some analysts are drawing comfort from the stripped down valuations of Ola Electric at the IPO stage, volatility stemming from government policy shift, dependency of raw materials on foreign countries, and lack of path-to-profitability are some of the major concerns.

“Cut in IPO valuation to $4 billion eases the valuation risk at 6.8 times FY24 sales versus global EV peers at 3-8 times of 2023,” says Pramod Amthe, head of equity research (auto), InCred Capital says. For perspective, the current valuation is much lower than what Ola Electric commanded two years back. In January 2022, Ola Electric had raised over $200 million from Tekne Private Ventures, Alpine Opportunity Fund, Edelweiss and others at a valuation of $5 billion.

Amthe adds that quarterly volatility from policy, EV cell plant delay penalty risk and regular private equity share sale will limit stock price gains. “EV cell production success can extend an option value of Rs 7-10 per share,” he says.

Amthe adds that quarterly volatility from policy, EV cell plant delay penalty risk and regular private equity share sale will limit stock price gains. “EV cell production success can extend an option value of Rs 7-10 per share,” he says.In the last few IPOs, most particularly of new age companies, that hit markets recently investors have been cautious about the steep valuations the new issues demanded despite losses or unimpressible profit on the books.

Large new-age technology companies like Nykaa (FSN E-Commerce Ventures), Zomato and Paytm (One97 Communications), which went public in 2021, had performed badly in the secondary markets with severe value erosion for shareholders. For instance, investors in the IPO of One97 Communications lost almost 70 percent of their investment by 1.5 years of the issue. That made investors conscious of valuations of IPO-bound companies and raise questions on their business prospects.

The Softbank-backed Ola Electric expects EV2W sales to reach 41-56 percent penetration by FY28 from 4.5 percent in FY24. Despite being a loss making company, it captured a market share of 40 percent in FY24, and aims to maintain market share led by tech and launches.

Meanwhile, it has already mopped up Rs 2,763 crore as a clutch of anchor investors bid for its share at Rs 76 apiece. Some of the marquee anchor investors include SBI Mutual Fund (MF), HDFC MF, Nippon India MF, Sundaram MF, Bandhan MF, Bharti Axa Life Insurance Company, Kotak Mahindra Life Insurance Company, Government Pension Fund Global, Nomura India Investment Fund, Goldman Sachs (Singapore) Pte Ltd and Fidelity.

Is it worth it?

At the upper price band, Ola Electric company is valued at market cap/sales of 6.6 times with a market cap of Rs 33,522 crore (or Rs 335,220 million) post issue of equity shares. Currently, top global automobile entities are trading between 1-8 times as on market cap/sales. “Therefore, on the valuation front, we believe that the company is richly priced,” Kuber Chauhan, analyst, Anand Rathi Share and Stock Brokers says.

“Therefore, on the valuation front, we believe that the company is richly priced,” Kuber Chauhan, analyst, Anand Rathi Share and Stock Brokers says.Chauhan explains that Ola Electric Mobility being in the fast-growing segment in EV space, it is anticipated to drive substantial growth in the global automotive market. “However, we believe that Ola has significant headroom to grow in coming years led by favourable market conditions, regulatory norms and the higher capacity utilisation of Ola Futurefactory on a yearly basis,” he says.

The company started manufacturing the 4680-form factor cells at the Ola Gigafactory in March this year which is expected allow better control over battery and EV quality, supply, and costs.

“On account of positive EV market outlook, favourable regulatory environment, large quantum of fresh issue in the IPO, announcement of new models along with the upcoming cell manufacturing unit (Gigafactory), we have a positive view for the company from a medium to long-term perspective,” say analysts at BP Equities.

Also listen: Debating Ola Electric's IPO risks

Analysts say Ola Electric is in a favourable position to be the main beneficiary of current trends of adoption of electrical mobility. The company manufactures majority of the core components required to manufacture E2W in-house, including cells at its new and soon to be operable Gigafactory in Tamil Nadu along with support from the government in terms of subsidies and tax benefits. The current trend in the two-wheelers space is towards adoption of electrical mobility and can be mainly attributed to the increasing affordability of EVs, reducing battery prices, improved driving range and a favourable regulatory environment.

Ola Electric also plans to enter international markets where the EV demand is yet to be fulfilled. The key markets include ASEAN (Association of Southeast Asian Nations), Latin America, and Africa, which are already a thriving market for Indian 2W exporters.

However, the company has other risks too. The company may experience disruptions in supply or an increase in prices of components and raw materials used to manufacture electric vehicles. This may result in an increase in the price of electric vehicles and impact its projected manufacturing and delivery timelines.

However, the company has other risks too. The company may experience disruptions in supply or an increase in prices of components and raw materials used to manufacture electric vehicles. This may result in an increase in the price of electric vehicles and impact its projected manufacturing and delivery timelines.Any reduction or elimination of government incentives or the ineligibility of any of its electric vehicles for such incentives may increase the retail prices of electric vehicles which may possibly adversely affect customer demand for electric vehicles and affect the company’s ability to achieve profitability. Due to the competitive market, it may face downward pricing pressures that may require further price reduction of its EVs. A reduction in pricing may in turn lead to reduced profitability which would adversely impact its business, says analysts.

The company has reported a loss for each of the last three fiscal years. “The company’s heavy investment in R&D may not give a return in the immediate future. Due to high competition, it may face downward pricing pressure. Along with that the company’s employee attrition rate is also too high,” say analysts at Swastika Investmart.

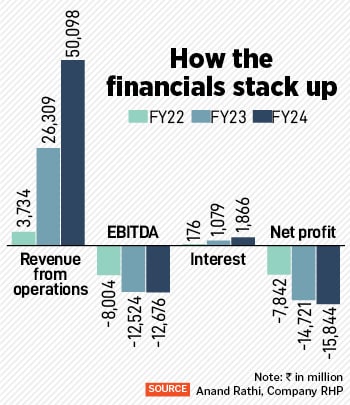

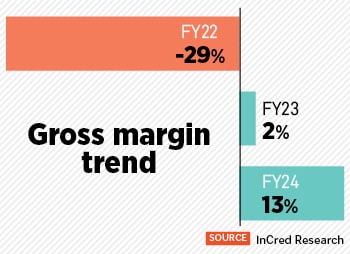

Higher losses: Financials

Ola Electric Mobility has incurred a net loss of Rs 15,844 million in FY24 widening from Rs 14,721 million in the year ago period. In FY22, the net loss was at Rs 7,842 million. However, its revenue from operations was at Rs 50,098 million in FY24, a steep jump from Rs 3,734 million in FY22. Its revenue from operations was at Rs 26,309 million in FY23. Ola Electric has the highest revenue of all Indian incorporated electric 2Ws original equipment manufacturers from E2W sales in fiscal 2023. The company has delivered three products and additionally announced four new products from their first product announcement in August 2021. It started delivery of its first EV model, the Ola S1 Pro, in December 2021. This was followed by the delivery of the Ola S1 in September 2022, Ola S1 Air in August 2023 and the Ola S1 X+ in December 2023 and the Ola S1 X (2 kWh), the Ola S1 X (3 kWh) and the Ola S1 X (4 kWh) in May 2024. On August 15, 2023, the company announced a line-up of motorcycles comprising four models, Diamondhead, Adventure, Roadster and Cruiser. It plans to commence delivery of the motorcycles in the first half of Fiscal 2026.

The company has delivered three products and additionally announced four new products from their first product announcement in August 2021. It started delivery of its first EV model, the Ola S1 Pro, in December 2021. This was followed by the delivery of the Ola S1 in September 2022, Ola S1 Air in August 2023 and the Ola S1 X+ in December 2023 and the Ola S1 X (2 kWh), the Ola S1 X (3 kWh) and the Ola S1 X (4 kWh) in May 2024. On August 15, 2023, the company announced a line-up of motorcycles comprising four models, Diamondhead, Adventure, Roadster and Cruiser. It plans to commence delivery of the motorcycles in the first half of Fiscal 2026.It operates its own direct-to-customer omnichannel distribution network comprising 935 experience centres and 414 service centres (of which 410 service centres are located within experience centres) as of March 31, 2024.

It manufactures EVs and certain core EV components like battery packs, motors, and vehicle frames at the Ola Futurefactory. The company’s business focuses on capturing the opportunity arising out of electrification of mobility in India and they also seek opportunities to export their EVs in select international markets in the future.

Where will the IPO money go?

The company proposes to utilise an estimated amount of Rs 8,000 million from net proceeds towards repayment/prepayment, of the Identified Loans, which are working capital loans, letter of credit and overdraft facilities availed by Ola Electric Technologies (OET).Part of the IPO money amounting to Rs 12,276.41 million will be used for capital expenditure to be incurred by its subsidiary, while Rs 16,000 million will be used for investment into research and product development and Rs 3,500 million for expenditure to be incurred for organic growth initiatives.

Further, the company has availed working capital demand loan of Rs 1,450 million from Yes Bank, Rs 1,500 million from Axis Bank and Rs 4,510 million from Bank of Baroda.

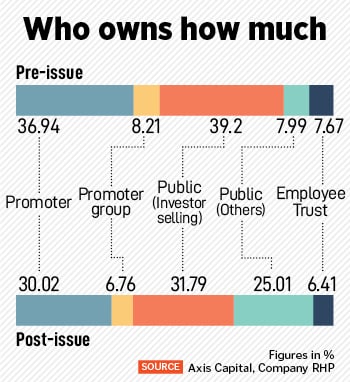

Bhavish Aggarwal, promoter, in aggregate holds 1,361,875,240 equity shares in the company, representing 36.94 percent of Ola Electric Mobility and will participate in the OFS.