Once the turnaround man, Ajay Singh may now need an external hand—and capital—to pull SpiceJet out of turbulence

The SpiceJet promoter is not new to dealing with crisis. As the airline grapples with safety incidents, the wily businessman will have to lead from the front for a revival. Experts wonder where the cash will come from to stabilise the airline

Ajay Singh, Principal shareholder, Chairman and Managing Director of SpiceJet

Image: Amit Verma

Ajay Singh, Principal shareholder, Chairman and Managing Director of SpiceJet

Image: Amit Verma

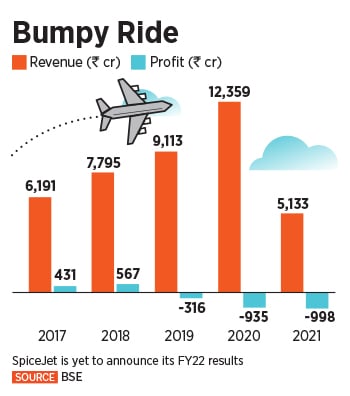

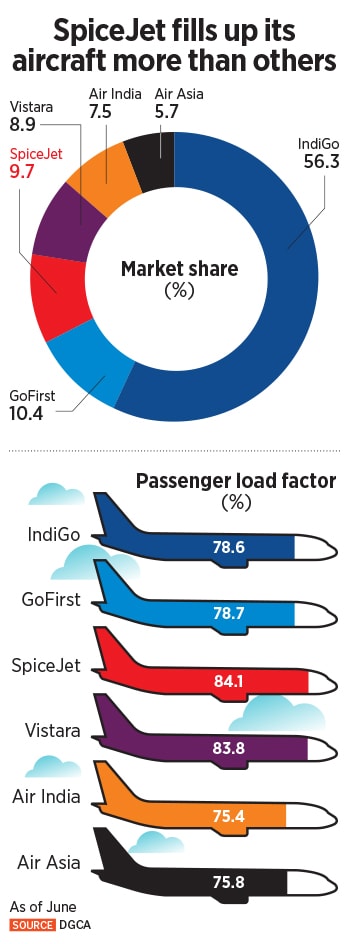

In India’s aviation industry, Ajay Singh has quite a stellar reputation as a turnaround master. After all, in 2014, when SpiceJet, currently India’s third largest airline by market share, was on the verge of shutting down, Singh had bought the airline before making a turnaround in its fortunes. By 2015, a year after he purchased it, SpiceJet was the world’s best-performing airline stock, after it soared some 340 percent.

Singh had also settled dues of some Rs2,200 crore that the airline owed in debts and built SpiceJet into India’s second-largest airline before a series of woes in the past few months pushed it into some serious turbulence. “You have to give him credit,” says Jitender Bhargava, former executive director of Air India. “He prevented an imminent collapse. But the question is—is his aggressive growth strategy responsible for the travails of SpiceJet?”

Today, Singh, the wily businessman, has his back against the wall. A series of misfortunes, including the global ban on Boeing Max aircraft, that SpiceJet owned, and the Covid-19 pandemic meant that SpiceJet has been facing some serious headwinds. Apart from disgruntled employees, including pilots, who allege that their pay hasn’t been revised to pre-pandemic levels, the airline has also had to grapple with some safety incidents in the past few months.

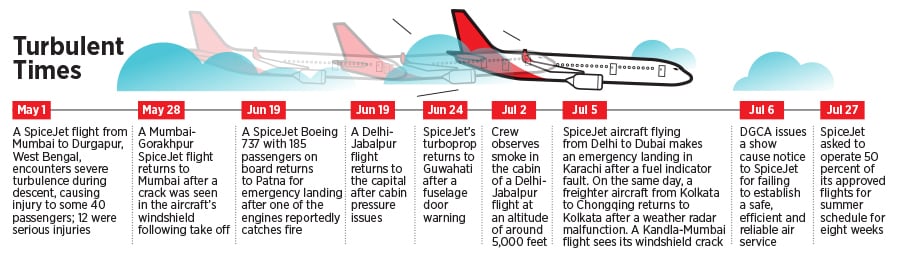

Between May and July, the airline saw nine incidents ranging from smoke in the cabin to the cracking of a windshield and emergency landing in Karachi, prompting India’s aviation regulator to ask the airline to fly at 50 percent of its approved flights for two months.

“SpiceJet finds itself with a fairly fragile balance sheet and this is reflected in delayed payments to suppliers, credit holds and mounting dues,” says Satyendra Pandey, managing partner of aviation advisory firm AT-TV. “This despite significant scaling down of operations. Cargo has been a success story, but how that is leveraged towards restoring the core airline to profitability remains to be seen.” As of 2021, SpiceJet had cash and cash equivalents of some Rs73 crore, while its total debt stands at over Rs9,700 crore.

The airline, however, says that it delayed announcing its results for the last fiscal after a ransomware attack on the company’s IT systems. “Our financial results for Q4 FY22 have been delayed due to reasons beyond the company’s control as a result of the ransomware attack that affected our IT systems, which includes certain data as well,” says a SpiceJet spokesperson. “While we have our financials prepared pre-ransomware attack and now have also retrieved our systems and data, the auditors would require to re-authenticate whether those numbers remain intact from what they have audited, and the audit trails are maintained. This process is normal in such events.”

The airline, however, says that it delayed announcing its results for the last fiscal after a ransomware attack on the company’s IT systems. “Our financial results for Q4 FY22 have been delayed due to reasons beyond the company’s control as a result of the ransomware attack that affected our IT systems, which includes certain data as well,” says a SpiceJet spokesperson. “While we have our financials prepared pre-ransomware attack and now have also retrieved our systems and data, the auditors would require to re-authenticate whether those numbers remain intact from what they have audited, and the audit trails are maintained. This process is normal in such events.”  SpiceJet has denied the allegation. “The investigation report of the said case has been submitted to the regulator. No such findings of an unserviceable weather radar were deduced. The aircraft, in fact, had already operated four sectors prior to the incident on May 1,” a SpiceJet spokesperson tells Forbes India.

SpiceJet has denied the allegation. “The investigation report of the said case has been submitted to the regulator. No such findings of an unserviceable weather radar were deduced. The aircraft, in fact, had already operated four sectors prior to the incident on May 1,” a SpiceJet spokesperson tells Forbes India.