Out of the woods: How Small Finance Bank staged a smart recovery

With their feet on the ground and a more diversified lending model, some of these unlisted banks are now getting ready to tap the capital markets

Munish Jain, COO & CFO, Capital Small Finance Bank

Munish Jain, COO & CFO, Capital Small Finance Bank

A year ago, an investor would almost certainly have chosen to go short on small finance banks (SFB). As the pandemic took its toll on borrowers, asset quality had trended south. On the other hand, a rising interest cycle threatened to take their cost of funds north.

This perfect storm had resulted in the market pummelling their stocks. The listed universe (except for AU Small Finance Bank, the largest of its type) traded at or below book value. In effect, the market was valuing these businesses only on the basis of the cash they had today. Simply put, it was unwilling to pay for future profits.

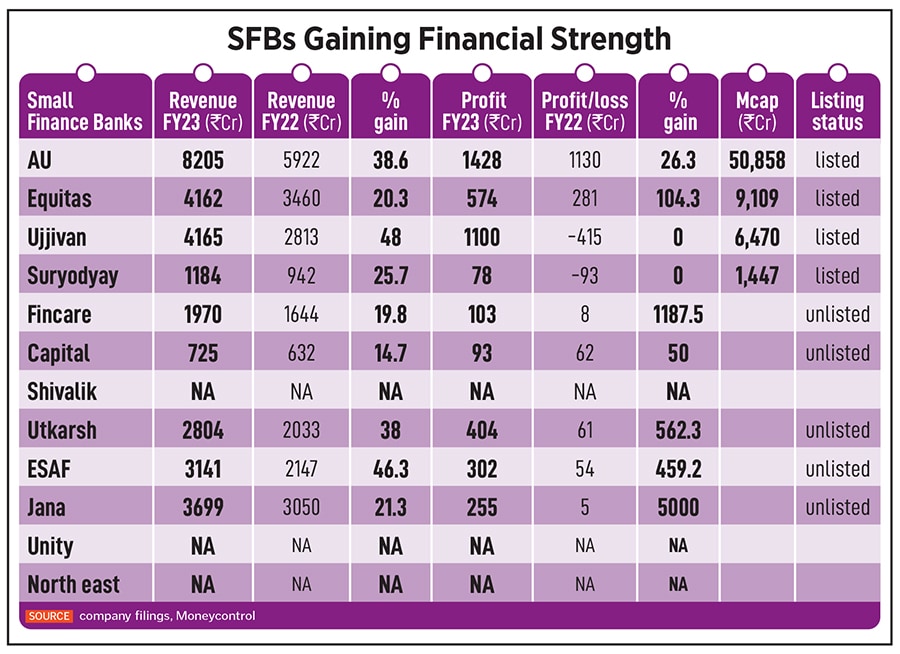

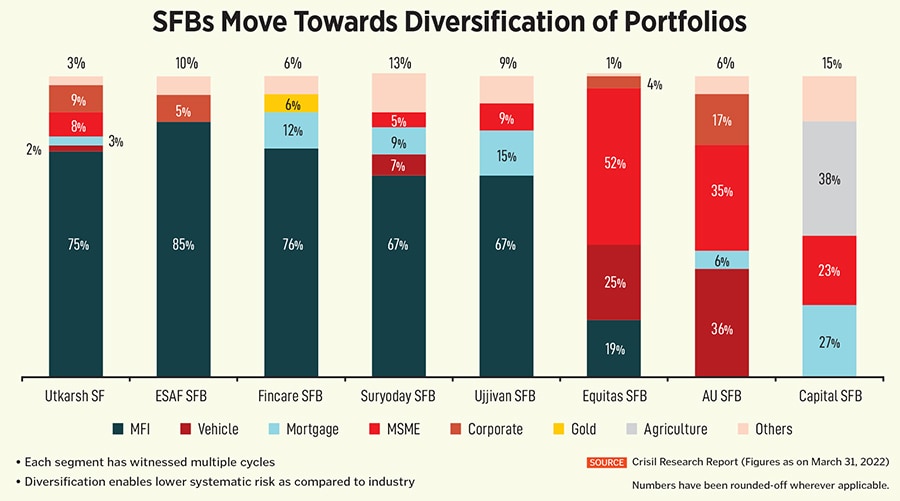

Fast forward to the fiscal gone by and these banks have staged a sharp recovery. “Most of these SFBs still have a reasonably large microfinance portfolio and the key reason for their performance being better is the improvement in the operating dynamics of that sector,” says Krishnan Sitaraman, senior director and chief ratings officer at CRISIL Ratings. Net non-performing assets are down sharply for the sector and profitability has rebounded aided in part by write backs (see chart). An improving business environment could see the banks doing a lot better in FY24. The market has in the last month started pricing in future growth.

Equitas SFB hit a record net profit of Rs190 crore for the quarter ended March 31, as loan disbursements grew by 80 percent in the quarter. The smaller Suryoday SFB swung into a net profit of Rs50.2 crore, against a net loss of Rs63.6 crore in the March-ended quarter, reflecting investor confidence in the bank. Suryoday now trades at Rs139, close to its 52-week intra-day high of Rs140 on May 17. Same for Equitas. At Rs82, it trades at its highest ever price. The stock has doubled in the last year and the market now values it at 2.5 times book value.

Rival Ujjivan SFB has also seen a year-on-year 145 percent jump in net profit to Rs309.5 crore, on revenues of Rs1,364 crore. Banks have also used this opportunity to diversify beyond their core microfinance offering. Personal loans, financial institutional group (FIG) lending and housing reflected the sharpest annual growth. AU SFB (AU and Capital SFB are the only two banks with no microfinance portfolio) beat analysts’ expectations with a 23 percent y-o-y jump in net profit of Rs424.6 crore for the same March-ended quarter.