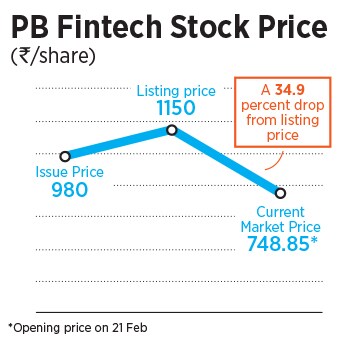

Post-IPO, stocks tank for Policybazaar's parent but the road ahead may not be all bumpy

Prices go down as owners sell shares, but experts say a turnaround is inevitable as markets stabilise

L to R: Alok Bansal and Yashish Dahiya of Policybazaar; Image: Amit Verma

L to R: Alok Bansal and Yashish Dahiya of Policybazaar; Image: Amit Verma

When Yashish Dahiya first met Sanjeev Bikhchandani, the founder and executive vice chairman of Info Edge, in 2008, regarding the setting up of Policybazaar, he said, “I’m willing to bet that you’re paying 60 percent higher for your car insurance than you need to.” Bikhchandani was shocked. He responded saying, “How can there be so much variation?”

Dahiya presented him with quotes from eight insurance companies to support his statement. Bikhchandani says, “Sure enough, I was paying 60 percent more.” Info Edge was one of the early investors in PB Fintech—back then, Policybazaar. Why bet on the startup at a time when no one believed in the model? “The company’s hugely compelling value proposition, high quality team and its first mover advantage,” recalls Bikhchandani.

Dahiya, along with Alok Bansal and Avaneesh Nirjar, launched Policybazaar in July 2008, as an insurance comparison website. They started by focussing on motor insurance and later moved on to health and life insurance when the founders realised those were the real problems the middle class was facing. “Since it was not a ‘top of the mind’ product, that made it conducive for research and purchase online,” says Bansal, co-founder and CFO.

In the first two years, no one believed in Policybazaar’s model, given that most companies had to put in a lot of effort in selling insurance, says Dahiya, co-founder and CEO. He recalls conversations with people in the insurance industry: “You are telling me that customers are going to come to your website to buy insurance? That doesn’t happen. Customers don’t engage with this product, it is an absolutely distribution controlled product.” Few companies entertained Policybazaar back in the day, Dahiya says, “We would introduce them to insurance companies and then they would go physically, and convert them into customers.” It was a lead generation business model for the first three years, where they would spend Re 1, and earn only 5 paise out of it.

Cut to 2011. This was when the sales model—which was their original plan—finally started working. They had started earning Rs 70-80 for every Rs 100 that was being spent. In 2012, the sales model expanded 100x in a year. “This is where the real story of Policybazaar started,” says Dahiya. The team got rid of the lead generation revenue model, and invested heavily in the sales model, which meant profits took a hit in 2012. “Yashish used to tell us that the quality of revenue, and not just the revenue, is very important. We decided to focus on the model, which was right, and not the one that can make us money, so we looked at the long-term benefits instead of short-term,” says Bansal.

The

The