Learnings from a crowded IPO year

The equity and primary markets saw record highs in 2021. While most IPOs fared well, some stumbled. What investor response tells us is that timing an issue is not enough and neither is making losses a deterrent

With the year drawing to a close, there is more action expected to emerge in the first quarter of 2022 in the form of the much-awaited IPO from Life Insurance Corporation

With the year drawing to a close, there is more action expected to emerge in the first quarter of 2022 in the form of the much-awaited IPO from Life Insurance Corporation

Image: Shutterstock

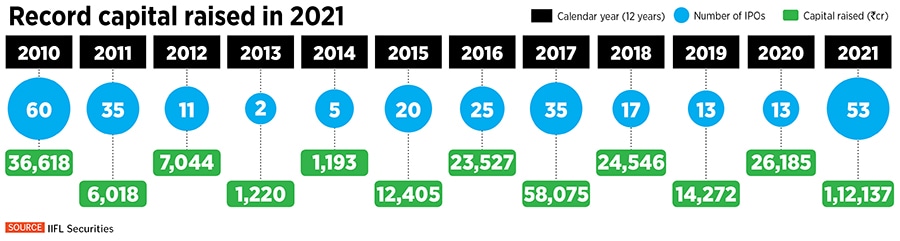

Investors who have pumped in money into listed equities and initial public offerings (IPOs) will look back at 2021 with fondness—they would have seen a 25 percent gain in the Nifty50 and, as per data, a 38 percent return if they had invested in all the IPO offerings. Corporates raised a record amount of capital—in excess of Rs 1 lakh crore in the year (see table) led by the need to boost working capital or expand business operations. For investors, the secondary markets are buoyant on the hopes of the revival of the economy post-pandemic and excess liquidity. It has led to new investors rushing in to open demat accounts (see table) and not lose out on quick listing gains.

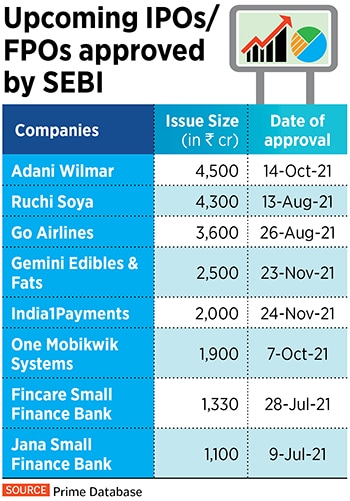

New-age, tech focussed companies such as Zomato, PolicyBazaar, Paytm, Nykaa—applications that people have used every day—became avenues for investments. With the year drawing to a close, there is more action expected to emerge in the first quarter of 2022 in the form of the much-awaited IPO from Life Insurance Corporation. It will also determine trends for other upcoming IPOs. But this year has thrown up some important learnings, for both corporates and investors, which will sustain into the coming year.

New-age, tech focussed companies such as Zomato, PolicyBazaar, Paytm, Nykaa—applications that people have used every day—became avenues for investments. With the year drawing to a close, there is more action expected to emerge in the first quarter of 2022 in the form of the much-awaited IPO from Life Insurance Corporation. It will also determine trends for other upcoming IPOs. But this year has thrown up some important learnings, for both corporates and investors, which will sustain into the coming year.

1. Rationalising the price

There were instances of companies which decided to rationalise the price bands for their issues, probably understanding that investors may not be keen to invest at higher levels. India’s largest private health insurer Star Health, backed by billionaire investor Rakesh Jhunjhunwala, cut the size of its IPO to Rs 6,400 crore from a slated Rs 7,249 crore earlier this month, after it faced an embarrassing investor response. The IPO was priced at Rs 900, but after failing to get fully subscribed, it was forced to extend the time for retail investors to invest and managed to get fully subscribed.The Star Health stock listed today (December 10th) to a weak response from investors—at a six percent discount to the issue price, at Rs 845 at the NSE. Despite Jhunjhunwala’s presence, the issue and the stock has not been able to garner interest. “Star Health did not show a differentiated business model, health insurance companies have been operating in India for decades. The company was unable to show how it would grow in an existing competitive landscape,” says Sandeep Bhardwaj, CEO (retail broking), at IIFL Securities.