IPO listings disappoint on debut

Market flotations are at an all-time high but the party seems to be fizzling out

Are Initial Public Offers losing their charm? Image - Shutterstock

Are Initial Public Offers losing their charm? Image - Shutterstock

For a certain set of investors, it’s all about the listing-day pop. Bid aggressively, corner a chunk of shares, and sell on the day it becomes accessible to the wider public via the stock market. Repeat this over a myriad bunch of businesses across sectors, and the chances of a 20 to 50 percent gain (on listing day) are in your favour.

That pretty much sums up the initial public offer (IPO) market over the last six months. As the chances of a quick buck have grown, an increasing number of speculators have rushed in. The market is divided among retailers (anyone who bids for shares worth up to Rs 2 lakh), high net-worth individuals (HNIs, anyone who bids for shares of more than Rs 2 lakh) and institutions.

“We have seen that whenever the secondary market does well for a while, the primary market also picks up,” says Sunil Damania, chief investment officer of Marketsmojo.com.

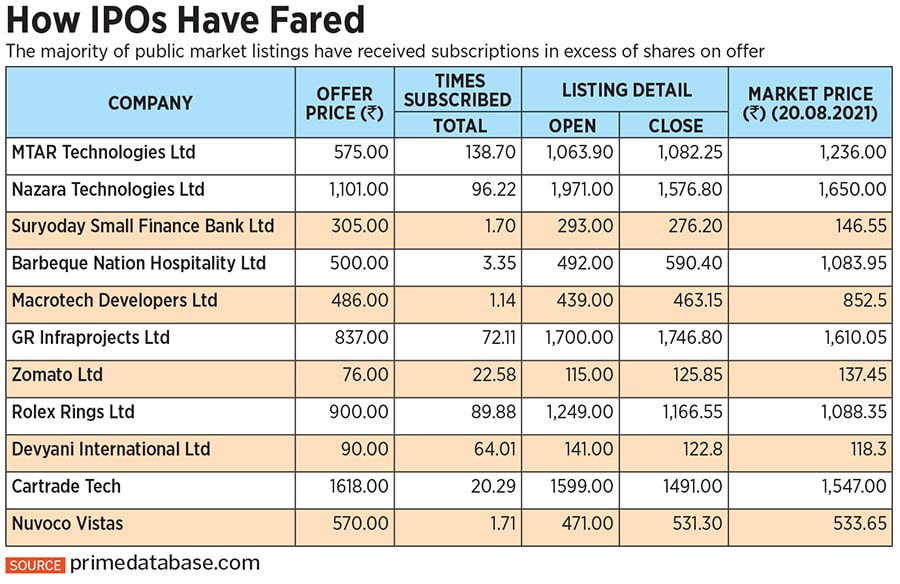

However, there are now some signs that the party is fizzling out. The last four issues listed haven’t had a listing-day pop. Take the recent listing of Cartrade Tech. It listed at Rs 1,599, a 1 percent discount to its offer price. Nuvovo Vistas is also trading at a discount to its offer price, while Aptus and Chemplast Samnar, which opened for trading today, are within their offer price band.

The IPO market frenzy is partly a result of easy liquidity and the fact that financing for IPOs at a rate of 7 to 9 percent is the lowest in a decade. As a result, it’s not surprising to see sought-after issues receiving bids far in excess of the number of shares on offer (see 'How IPOs have fared').