IPO Frenzy: Loss-making Indian tech startups are emulating their US counterparts, but that's not enough

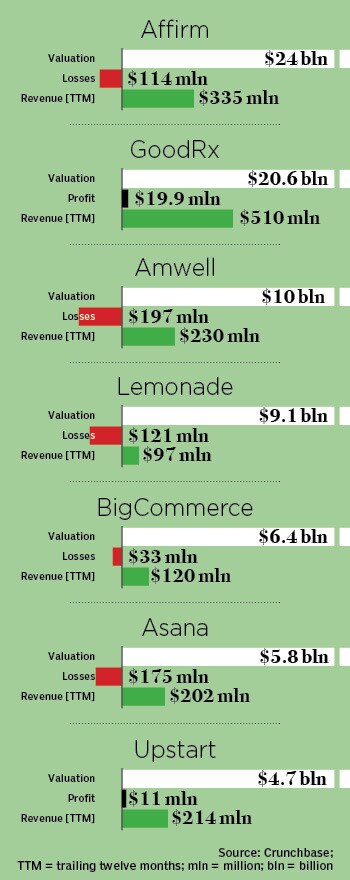

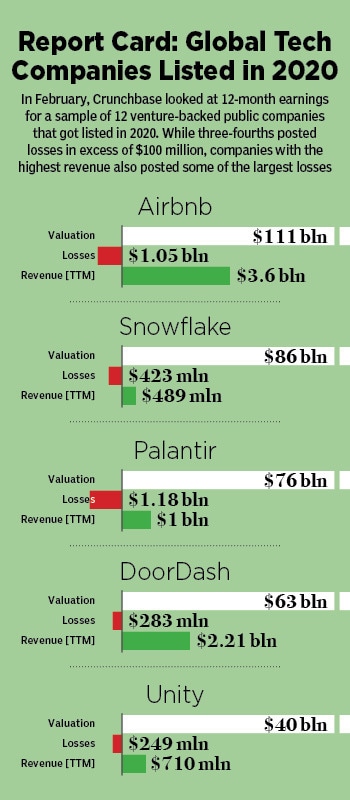

From Zomato to Paytm, loss-making ventures are getting listed by opting for scale over profit in the short-term. Wooing investors on the premise of a promising future, however, needs to be backed an expanding topline and profitability in the long term

From Paytm to Zomato, loss-making ventures are getting listed by opting for scale over profit in the short-term

From Paytm to Zomato, loss-making ventures are getting listed by opting for scale over profit in the short-term

Image: Zomato: Nasir Kachroo/NurPhoto via Getty Images

; Paytm: Shailesh Andrade / Reuters

In 1998, US ecommerce platform Amazon posted losses after a year of going public. Founder Jeffrey Bezos tried to make investors pad up for a long innings. “Because of our emphasis on the long term, we may make decisions and weigh trade-offs differently than some companies,” he underlined in his first annual letter to shareholders after the company got listed in 1997, just two years after starting operations.

Bezos explained the core of his approach. First, the company will keep investing for long-term market leadership rather than short-term profitability considerations or short-term Wall Street reactions. Second, the company will make bold rather than timid investment decisions. “Some of these will pay off, others will not,” Bezos stressed. Profit was not even remotely on the radar of the maverick entrepreneur.

For investors, a handy metric to judge these companies could be looking at the business moat and the growth that the user base can bring in. Does the company have a competitive edge in the space it caters to? Consumer and marketing metrics show how much it costs the company to acquire a user, retain them, and get them to use the service or product repeatedly, points out Nimesh Kampani, president at

For investors, a handy metric to judge these companies could be looking at the business moat and the growth that the user base can bring in. Does the company have a competitive edge in the space it caters to? Consumer and marketing metrics show how much it costs the company to acquire a user, retain them, and get them to use the service or product repeatedly, points out Nimesh Kampani, president at